Mortgage brokers will be bound by a Best Interests Duty (BID) obligation as of 1st January 2021. While there are a few silver linings, it’s clear that BID is going to push more work onto brokers and broker groups.

To stay ahead of the game, brokers will need to level up their efficiency and adopt smarter ways of working. In this article, we explore 3 key areas where enhanced productivity will be critical for brokers.

Disclaimer: This article is not intended to be compliance advice. We are instead illustrating how better processes and automation can contribute to efficiency in a compliance-heavy world.

What Will Be The Impact Of BID On Broker Productivity?

Ever-increasing compliance burdens have been a developing trend over the last several years.

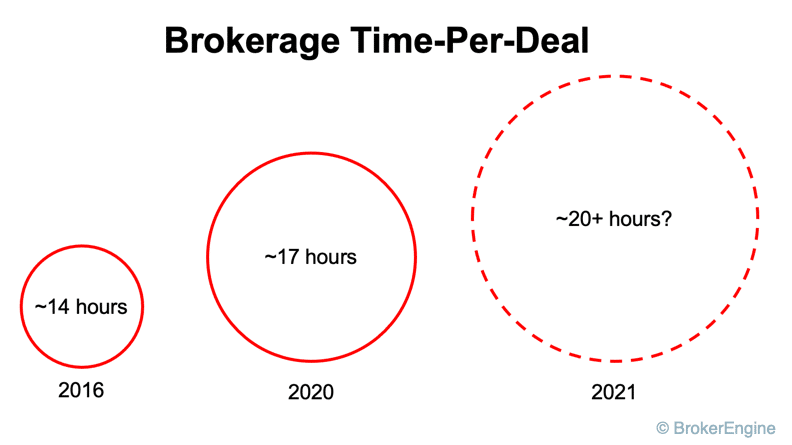

- In 2016, brokerages were spending around 14 person-hours to process an average deal from A to Z.

- With the advent of NCCP requirements, by 2020 delivery time had increased to ~17 hours per deal.

- In 2021, we expect deal delivery time to exceed 20 hours.

Translation: in the 5 years to 2021, broker workload will balloon by 40%+, while revenue per deal remains static.

It sounds bad. And it is, if you don’t evolve. But brokers who make the necessary changes will find they are able to improve service levels while also growing profitability.

Let’s look at 3 ways to do that…

3 Key Areas Where Efficiencies Are Essential Under Best Interests Duty

We’ve identified 3 key moments where BID has the potential to pour sand into the cogs of your process, unless you make the necessary changes.

- Early in the sales/advice process: when collecting information and documents from the borrower before issuing any credit advice.

- Mid-way through the advice process: when building detailed Requirements and Objectives notes to support your credit recommendations.

- Toward the end of the advice process: when presenting Credit Advice to the client.

Let’s dig deeper into each touchpoint and unpack how I’m dealing with each challenge in my practice…

How To Streamline Supporting Information Collection Early In The Sales/Advice Process

In our article on the Ideal Mortgage Broker Sales Process, we explore some of the challenges when engaging with a new client:

- If you ask for very little information up front, then you may find yourself dealing with a lot of unqualified prospects.

- Conversely, if you ask for a very heavy fact find up front before building rapport, you may scare off otherwise good leads.

Within the Best Interests Duty framework, brokers will be required to collect enough information early on in the process to provide appropriate credit advice.

I’m dealing with this requirement with a two-part fact find structure. I start with a Simple Fact Find to aid preliminary information gathering, then switch to a Full Fact Find later in the process once I’ve established that a deal has potential.

Here’s a short video of how the process works:

How To Build Super-Detailed Requirements And Objectives Notes In Minutes

One of the biggest shifts when transitioning from the “Not Unsuitable” test to the “Best Interests Duty” test is the level of detail required for compliance notes to support your reasons for product selection.

It’s likely that compliance departments will want to see a detailed and customised rationale for product selection for each client. A few basic templates won’t cut it.

To achieve this outcome, without spending hours in the process, I use this Compliance Wizard tool within the BrokerEngine software:

How To Present Credit Advice In A Compliant Yet Compelling Way

Even though mortgage brokers are in the ADVICE business, we’re also in the SALES business. Renown business coach Dan Sullivan has a great definition of “selling” that is very relevant for brokers:

“Selling is getting someone intellectually engaged in a future result that is good for them and getting them to emotionally commit to take action to achieve that result.”

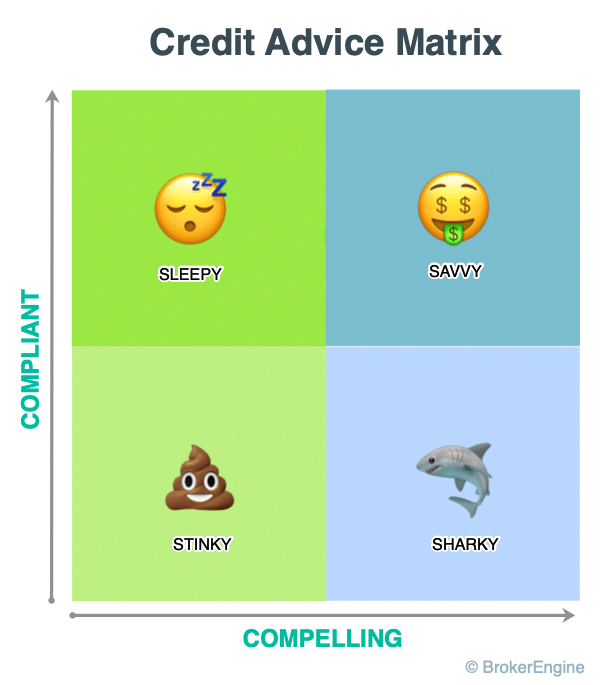

As brokers, we need to tick all the compliance boxes, but ALSO present our recommendations in a way that compels the client to take action. I summarise this challenge in the Credit Advice Matrix below…

- A broker who is WEAK on the Compliance dimension and WEAK on the Compelling dimension has a STINKY strategy – not only will they have skinny kids, but they’ll be “asked to leave” the industry.

- A broker who is WEAK on the Compliance dimension but STRONG on the Compelling dimension has a SHARKY (hey: it’s a word) strategy – they may well be able to get a few clients over the line, but they will ultimately come unstuck once compliance catches up with them.

- A broker who is STRONG on the Compliance dimension but WEAK on the Compelling dimension has a SLEEPY strategy – putting the client to sleep, that is! It’s hard to get a positive result if your advice feels and sounds like dry twigs.

- But the broker who is STRONG on the Compliance dimension and STRONG on the Compelling dimension has a SAVVY strategy – making the client feel confident about the path forward, while still satisfying all compliance requirements.

So the question becomes, how do you create compliant yet compelling Credit Advice presentation documents, without sucking hours out of your day?

I solve this challenge with a document called a Loan Strategy Report™️. (“Version 1.0” of this Report was very effective, but somewhat restricted in terms of design and formatting. Our latest Version 2.0 – just about ready for launch – will allow brokers to create their own templates.)

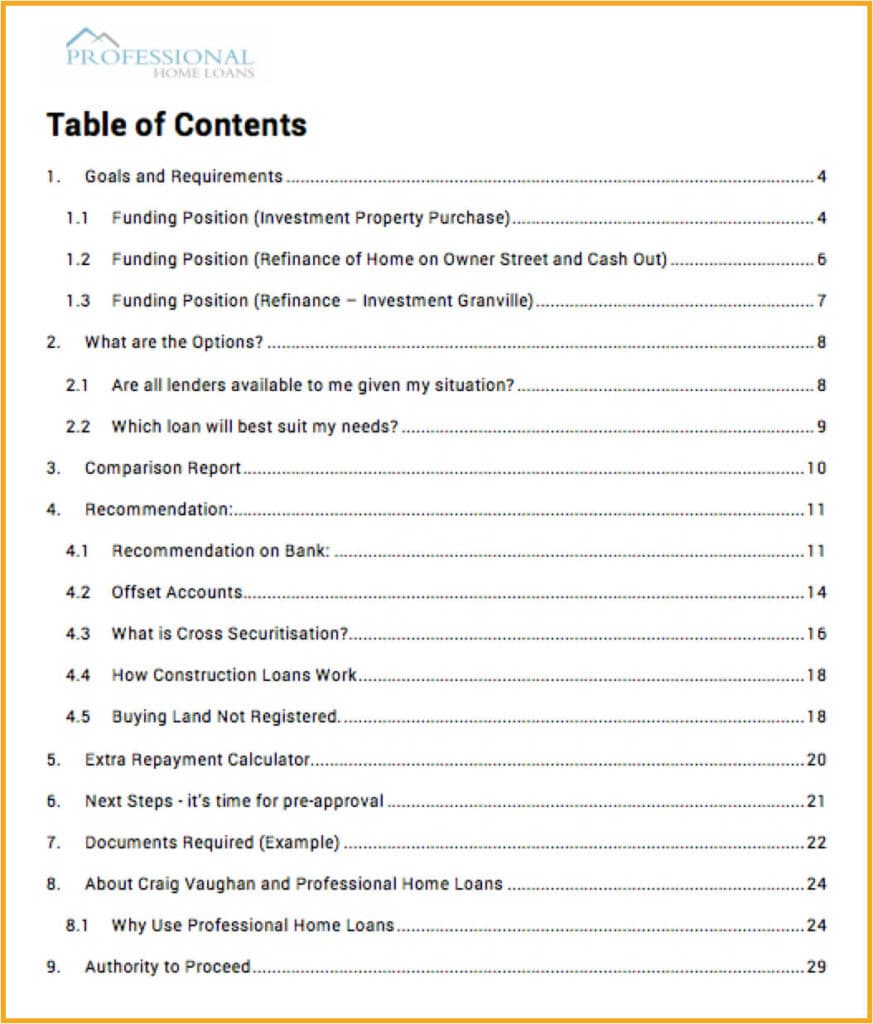

I’ve written about the Loan Strategy Report preparation process before, so check out that article for more detail. But the below Table Of Contents will give you a sense of what the structure can look like.

As you can see, this contains a complete summary of exactly why the product(s) and strategy were selected, in a clear format that makes it easy for clients to say “yes”.

Conclusion and Next Steps

Best Interests Duty does mean more work for brokers. But it also provides the industry with a big opportunity to provide an even more professional service proposition.

We predict that brokers who treat Best Interests Duty as an opportunity to up their game in terms of professionalism and customer experience will attract more clients and grow even faster.

I hope you’ll adopt some of the strategies I’ve outlined in this article. And if you’d like to explore how BrokerEngine can help you THRIVE in the new BID landscape, click here to sign up for our latest demo.