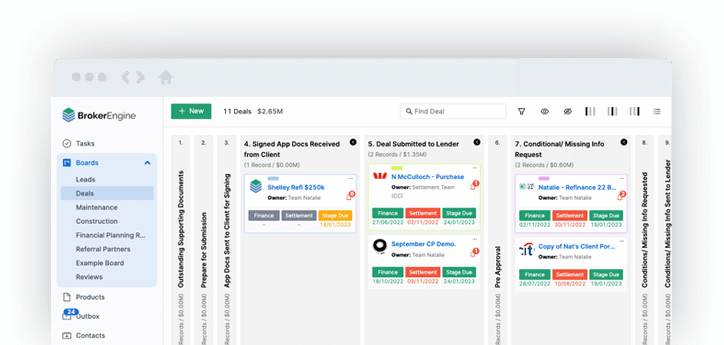

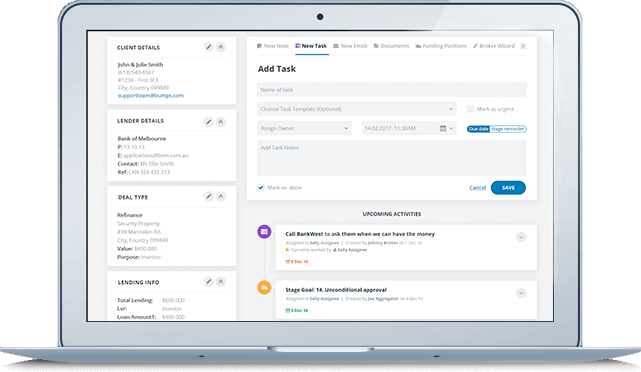

The BrokerEngine Story

Hi, my name’s Craig Vaughan, and I’m a mortgage broker by trade, and the co-founder of BrokerEngine.

I run multiple mortgage broking brands and was nominated in the 2014 Broker of the Year Awards (Top 5) and in 2015 (Top 10). In 2016, I was fortunate enough to receive two nominations – one for Broker of the Year, and one for Broker Group of the Year. All while working 20-25 hours per week and enjoying 2-3 months’ holiday a year.

But it wasn’t always this way…

And in 2016, we were proud to be named one of the top Broker Groups in the country

And in 2016, we were proud to be named one of the top Broker Groups in the country