Although most mortgage brokers have a passion for advising clients and writing new business, many of the very best mortgage brokers in the country rate loan processing as the MOST critical function in their practice. This article explores how getting your back office admin function right (and employing the right loan processing solution or service) helps to drive practice growth.

What is “Loan Processing”?

Loan processing refers to the back office administration function associated with submitting, tracking and settling a residential home loan. The process encompasses:

- Gathering information and documents from the borrower (the client)

- Preparing the loan submission

- Submitting information and data to lender(s)

- Supplying the correct supporting documents to the lender

- Tracking the loan through to unconditional approval and settlement

- Settling the loan and managing the client relationship moving forward

Why Loan Processing Is The MOST Critical Function In Your Mortgage Broking Practice

We recently asked a sample of top-producing mortgage brokers what the most important function in their business is. Perhaps surprisingly, most replied “loan processing”.

Although other functions such as lead generation, sales conversion, referral generation and loan strategy and structure often get most of the attention, loan processing is the unsung engine room of top producing firms.

Here are 3 reasons why your back office administration function is crucial to get right if you want to grow:

- It usually doesn’t take many hours to recommend the best funding solution, but it takes many hours to process the loan. Around 20 hours, in fact. So if you’re not efficient in processing, your time can easily get sucked away from sales, strategy or service.

- The loan submission, approval and settlement process is a BIG part of the client experience, and it’s one that most clients don’t enjoy. There’s a lot of documents, complexity and waiting. There may also be deadlines and stress. So if your loan process isn’t sharp, you run the risk of frustrating and angering clients.

- Loan processing is a function that a broker can employ other team members to do. This frees up the broker to focus on what they do best. In other words, getting this function right offers you LEVERAGE.

The Ideal Mortgage Broker Loan Process

What does the ideal residential home loan process look like? We’ve given a huge amount of thought to this question, and as a result have come up with the following “best practice” loan process.

(That said, many brokers have their own preferences for delivering a great loan approval experience. BrokerEngine software users are able to easily create bespoke loan processing journeys to ensure your desired process is delivered efficiently and effectively, every time.)

Loan Processing Stages

There are 15 loan stages in our default loan process:

| Stage Name | Definition |

| 1. Get Supporting Docs | Supporting documents are being collected from the client |

| 2. Prepare Deal for AIP | Prepare deal for Approval in Principle (Pre-Approval) |

| 3. Sent for AIP | Loan has been sent to lender for Approval in Principle |

| 4. AIP Issued | Approval in Principle has been issued by the lender |

| 5. Prep Deal for Formal | Prepare deal for formal approval (unconditional) |

| 6. Sent for Formal no Val | Deal has been sent for formal approval with no valuation |

| 7. Conditional Approval | Deal has been conditionally approved by the lender |

| 8. Send for Formal with Val | Deal has been sent for formal approval with valuation |

| 9. Formal Approval | Deal has been formally approved (unconditionally) |

| 10. Mortgage Docs Posted | Mortgage documents have been issued by the lender |

| 11. Mortgage Docs Returned | Mortgage documents have been received by the lender |

| 12. Ready to Settle | The loan is ready for settlement |

| 13. Settlement Booked | Settlement has been booked by the lender |

| 14. Settlement | Settlement has occurred |

| 15. Lost/Declined | The deal is not proceeding. The deal is automatically archived after 2 weeks |

Tracking Loan Status

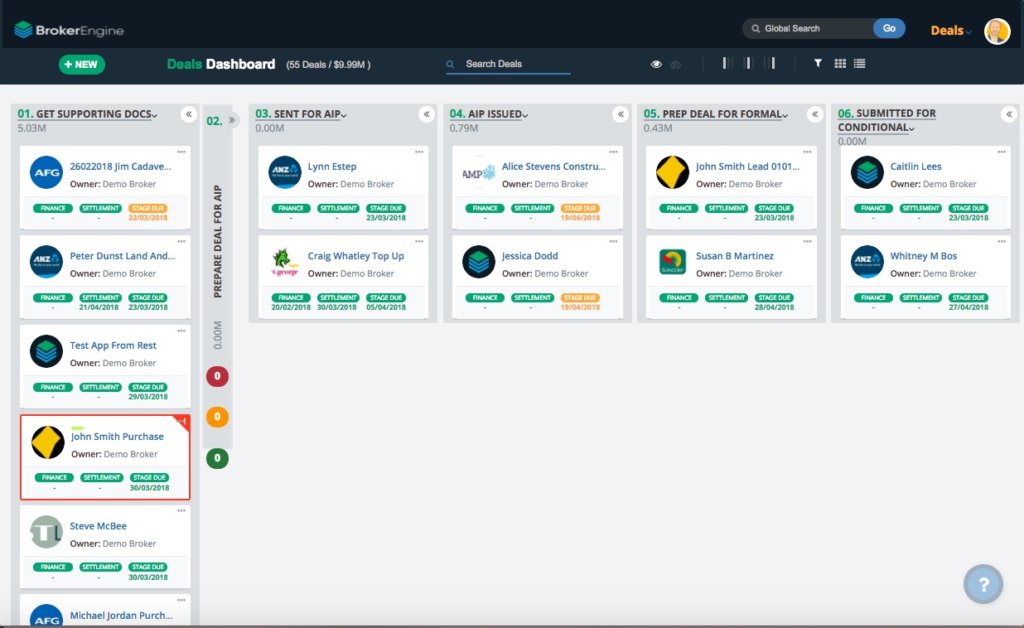

It’s important for a broker and their loan processors to maintain a real-time overview of which stage each loan is at. It has become more common to use a “Kanban-style” dashboard to achieve this. A good dashboard gives you immediate insight into how your pipeline is tracking. Here’s an example taken from BrokerEngine:

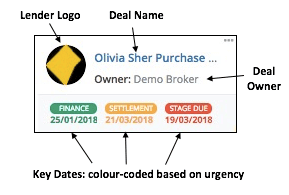

Each card contains key data, which highlight important facets of the deal:

Where the deal is running late or is in danger of missing a deadline, the tile is further highlighted with a red border to draw immediate attention:

Loan Processing Automation

Humans are great at delivering strategy, sales and service. They’re good at solving problems and unsticking (both important qualities in a great loan processor!).

But there are some tasks that computers and software can do faster and cheaper than humans: particularly process-driven, data-intensive or repetitive tasks.

So, in between the loan stages, there are a many tasks that may be augmented by smart software. These include:

- Client fact finding and document collection

- Creation of deal-specific workflows

- Allocating the right task to the right person in the team

- Status updates via email and SMS messages

- Preparation of Loan Proposals and Advice Documents

- Preparation of Lender Submissions

- Preparation and Submission of Discharge Authorities

- Ordering and tracking valuations

- Applying for lender pricing

- Progress updates to Solicitors, Agents and Referral Partners

When you start to look at all the automation possibilities, things start to get very interesting.

Delegation and Teamwork

Mortgage broking is one industry that has proven relatively difficult to systemise.

The main challenge is being able to capture the detail and variability of every deal in an efficient way. Unless you have a good system for delegation, brokers can remain bogged down in explaining, checking and fixing work.

Solving delegation means brokers can get on to their next client conversation. If delegation remains a challenge for you, these articles will help:

- How To Build A Mortgage Brokerage That Runs Without You

- Growing Your Mortgage Broking Team: Who To Hire And When

- The Ultimate Pre-Research Checklist For Delegating Loan Research

Exception Management

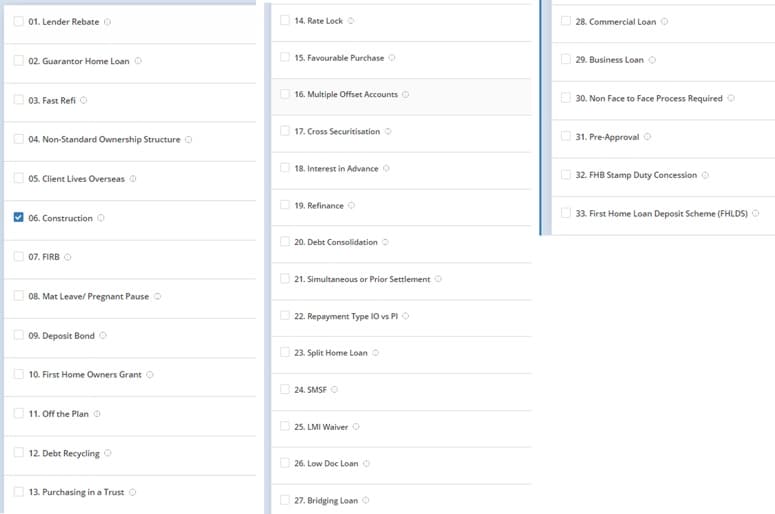

They say that “all home loans are 80% the same… it’s the 20% differences that can kill you.”

In other words, despite the fact that the broad structure of all loan processing tasks may be similar, most loans have a few peculiarities that shift the requirements and open up the potential for mistakes.

These little differences can trip up many a new or experienced loan processor alike. That’s why you need robust processes and workflows for dealing with these exceptions.

We’ve identified 45+ such exceptions that we call “1-Click Workflows”. These include:

| 01. Lender Rebate | Lenders may offer a rebate in the form of a cashback offer post settlement, refund of LMI or fee waiver post-settlement. |

| 02. Guarantor Home Loan | A client may use a guarantor to avoid a deposit requirement or reduce the LMI payable. |

| 03. Fast Refi | Some banks offer “Fast Refi”, which allows the new lender to pay out the incumbent without the outgoing lender being notified. This is so the outgoing lender can’t call in their retention team. |

| 04. Non-Standard Ownership Structure | The borrower may wish to purchase property with a particular share/interest. For example, 50/50 where both parties hold equal shares, or 80/20 where one party legally owns 80% and the other 20%. |

| 05. Client Lives Overseas | The client may purchase property while living overseas. The borrower will need to ensure they are informed of appropriate witnessing requirements etc. |

| 06. Construction | Construction loans entail a specific drawdown structure. |

| 07. FIRB | Some migrants/visa holders may require Foreign Investment Review Board (FIRB) approval. |

| 08. Mat Leave/ Pregnant Pause | For clients who are planning to go on maternity leave or have children in the next 1-3 years |

| 09. Deposit Bond | Some borrowers may require a deposit bond upon unconditional approval if they do not have sufficient funds at that time to pay the deposit or there are tax reasons for not doing so. Therefore a deposit bond will be required. |

| 10. First Home Owners Grant | For borrowers applying for a First Home Owners Grant (FHOG) |

| 11. Off the Plan | When purchasing property “Off The Plan”, there are certain risks that may apply. Brokers may need to advise the client of the risks at appropriate times. |

| 12. Debt Recycling | Debt recycling is a tax strategy that allows a borrower to convert non-deductible debt into deductible debt. |

| 13. Purchasing in a Trust | Some borrowers may be purchasing within a trust structure for tax mitigation or asset protection purposes. |

| 14. Rate Lock | “Rate lock” is a feature that allows a borrower to lock in a fixed interest rate between time of lodgement/approval and settlement date. |

| 15. Favourable Purchase | A favourable purchase is where a client will purchase a property below market value from a related party (e.g. mum and dad). |

| 16. Multiple Offset Accounts | Some lenders allow multiple offset accounts per loan. |

| 17. Cross Securitisation | Cross-securitisation is where a borrower uses multiple properties to secure one or more loans. |

| 18. Interest in Advance | Interest In Advance is where a borrower pre-pays loan interest for the next finance year or years. This brings in further tax deductions this year. |

| 19. Refinance | Refinances have specific sub-processes. |

| 20. Debt Consolidation | Debt consolidation |

| 21. Simultaneous or Prior Settlement | Simultaneous or prior settlement |

| 22. Repayment Type IO vs PI | Repayment type – Interest Only vs Principal and Interest (for Loan Strategy Report preparation purposes) |

| 23. Split Home Loan | Splitting the borrowings between fixed rate and variable rate portiongs (for Loan Strategy Report preparation purposes) |

| 24. SMSF | SMSF residential property loan |

| 25. LMI Waiver | Where LMI is waived under medico or industry specialisation policy, the lender needs to be prompted to apply the waiver. |

Within BrokerEngine, each of these 1-Click Workflows can be added to a specific deal, simply by clicking a checkbox. As a result, the downstream workflow changes to ensure all requirements are met, without mistakes.

Using Loan Checklists To Error-Proof Loan Processing

It is one thing to have processes, systems and procedures to ensure that your loan process is carried out in a standardised way. Ensuring it’s actually done that way is another thing entirely.

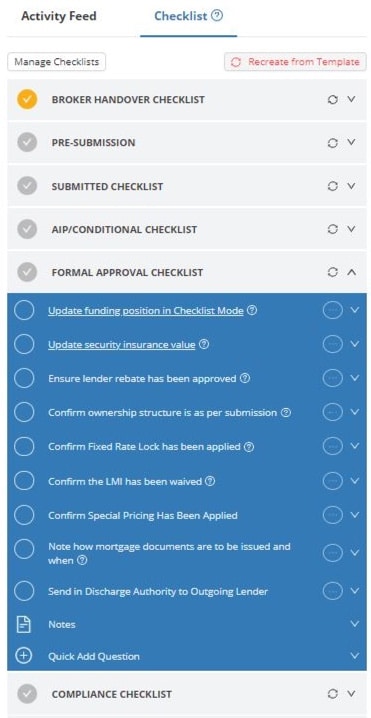

This is where checklists come in. Checklists are a simple yet profoundly effective way of ensuring that processes are executed correctly, every time. (Read The Checklist Manifesto for examples of how checklists have transformed entire industries such as Healthcare).

However, traditional “Static” checklists don’t work for mortgage broking. Checklists need to be DYNAMIC.

Static Checklists are the same for every deal, whereas Dynamic Checklists specifically relate to the deal at hand. With Dynamic Checklists, you have less chance of missing an important detail that can delay or derail your deal and frustrate your client.

These checklists not only ensure that everything is done right, but they also provide an audit trail for each deal in case anything should go wrong. Here’s one example:

By adopting the right loan processing system, you free up time to focus on marketing, client acquisition and client service. These are the activities that ultimately grow the value of your practice.

Mastering The People Side: Who Will Drive Your Loan Process?

This article has explored the ideal loan process structure. The other aspect to get right is to decide who will drive your loan process. For help answering that question, see this article on Loan Processing Options: Do It Yourself, In-House, Outsourced or Offshore?

Cutting 5 to 10 Hours Per Deal Out Of Your Loan Process

When you analyse how most mortgage brokers actually process deals, what you find is that many deals that seem “simple” actually take 20+ hours to complete, from go to whoa.

A lot of time is chewed up on non-value adding tasks such as:

- Researching products or creating loan comparisons with clunky or inefficient tools.

- Gathering client information and documents efficiently

- “Handing over” a deal to support staff and capturing ALL information

- Drafting detailed advice and progress emails to clients manually

- Frequently “checking in” on a deal to see where it’s at

- Escalating off-track deals, or intervening to “save” a situation

- Fielding phone calls from clients to answer questions that could have been answered in advance.

- And more…

When you use BrokerEngine software, these non-value adding tasks can be systematically stamped out from your process.

As a result, many BrokerEngine users report savings of 5 to 10 hours per deal across their team, while offering a more responsive and professional client experience.

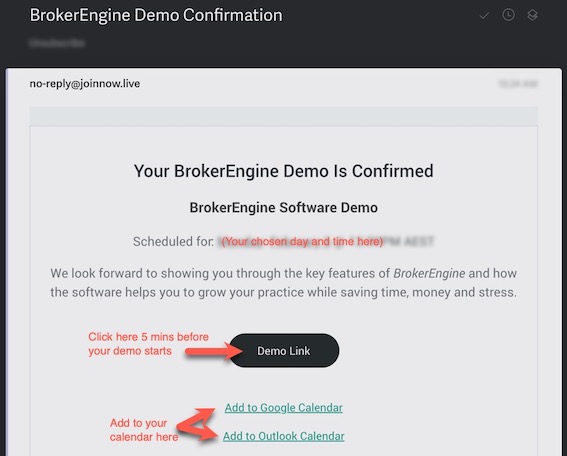

If you’re curious to find out more, register for a Free Demo of BrokerEngine software. We’ll show you how to streamline and automate your workflow, so you can get back to what you do best…

…working more new clients, and creating more outstanding loan solutions.