As a mortgage broker in “growth mode”, you’ll inevitably start to create mid to long-term plans for practice expansion. For example, you’re settling $30M per year now, but in 3 years time you want to be doing $100M.

That’s a great start, but before long you may be reminded of the saying, “No plan survives first contact with the enemy.”

That was certainly the case for me a decade or so ago when I began to get serious about growth.

The plan started out well enough, but at the end of a calendar quarter I’d find that we had lost traction against our goals. I had let a few things slip that I had committed to because I “got busy”. Other team members were slipping too because we weren’t staying on top of our goals…

That’s when I started to look into tools for maintaining traction against goals… keeping myself and the team accountable… and ultimately creating a culture of winning in my practice.

That’s what I’ll share with you today…

Introducing The One-Page Practice Scorecard (OPPS)

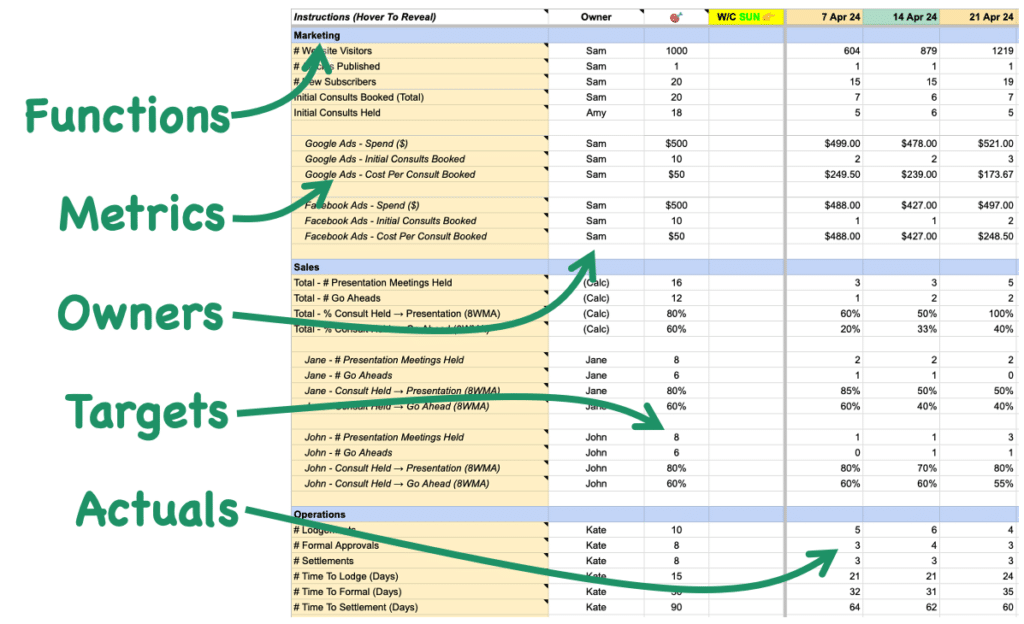

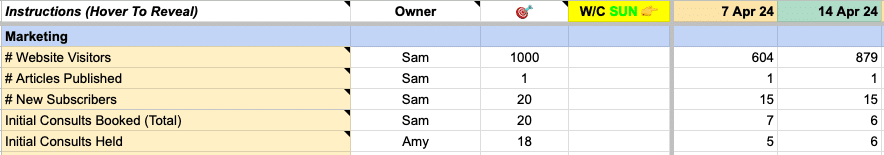

The One-Page Practice Scorecard (OPPS) is a simple spreadsheet for tracking key metrics in your mortgage broking practice so you can stay aligned with your goals.

Here’s how it works and how to use it:

Step 1: Download The One-Page Practice Scorecard (OPPS) Template.

Step 2: Watch a quick explainer on how to use the OPPS.

Step 3: Start using the OPPS in your practice.

The OPPS contains all the key metrics you need to know if your practice is on track, or off track.

If you’re off track, it gives you the real-time data you need to take action now to get back on track, rather than wait until the end of the quarter and discover you didn’t hit your goals.

The charm of the OPPS lies in its simplicity. Here’s how it works:

- Set clear and achievable targets.

- Decide the right metrics to track.

- Assign owners to be accountable for each metric.

- Track and review metrics every week.

- Make data-led decisions to guide actions.

Here’s a quick snapshot:

Let’s take a look at each, one by one.

1. Define your targets

This process assumes that you’ve already set goals. For example:

- Hire X more team members in specific roles

- Scale up lead generation from Y leads to X leads

- Increase sales conversion rate from X% to Y%

- Boost settlement volumes from $X to $Y

Once you’re clear on your goals, the next step is to break your target down into weekly actions and targets.

This way, you can track as you go and quickly discover if you’re off track and need to re-align.

2. Decide the right metrics

Training for a marathon involves a number of different functions working together i.e. training, conditioning, diet, recovery, etc..

The same is true in your practice. Marketing, sales, operations, customer service and finance, each have a role to play in achieving your targets.

Your OPPS ensures each function is keeping up its end of the bargain:

Each function will have 3 to 6 critical metrics that tell you whether things are on track, or not.

Just as your car has a single dashboard oil light that alerts you to any potential issues (i.e. oil level, oil pressure, oil quality, potential leaks, oil filters, oil sensors, etc.), your OPPS tells you where deeper investigation is required.

This is not intended to be an exhaustive list of every data point in your practice.

You’ll likely have a mixture of lead metrics and lag metrics.

- Lead Metric: metrics used to measure ACTIONS that will influence future outcomes (e.g # Articles Published, # Meetings Held, # Lodgements).

- Lag Metric: metrics that track the RESULTS (e.g. $ Settlements).

This will provide a snapshot of ACTIONS and RESULTS to track within your practice.

3. Assign owners (and hold them accountable)

When you’re a solo broker starting out, everything is on your plate. But as your practice grows you need to transition from being a jack-of-all-trades to a leader who delegates effectively.

Assign each line item to a specific team member and make it clear that you expect them to monitor this metric, report on it each week, and brainstorm ways to enhance it.

Sometimes numbers won’t be where they need to be.

It’s not about pointing blame, but rather, identifying that something’s off track, finding out why, and working collaboratively to realign.

This is a simple way to get each team member “owning” their role and being accountable for specific performance measures in your practice.

4. Track and review metrics every week.

I’m a big believer in the importance of annual and quarterly plans. “Scaling Up” by Verne Harnish provides an excellent framework for both.

But as mentioned above, it’s not enough to review goals annually or even quarterly. The OPPS breaks down those big picture goals into weekly targets that can be tracked at the coalface.

The second part of the OPPS process is to use this spreadsheet as the cornerstone of your Weekly Team Meeting.

My weekly team meeting would typically take a maximum of 60 minutes, and would follow the same agenda each time.

Reviewing weekly metrics in our OPPS during this meeting was a simple and time-efficient way to ensure our growth plans were on track.

5. Make data-led decisions to guide actions.

As you start reviewing your OPPS as a team every week, you’ll notice that some of the metrics are on track, and others are off track.

This is entirely normal and is in fact where the value of the OPPS lies.

Metrics that are off track are like an early warning system that will help you to re-align quickly.

For example, if you are not hitting your weekly appointment target, this might give you a signal to ramp up your paid traffic budget… or dig deeper into your appointment confirmation process.

Taking action quickly means you won’t lose traction against your goals.

Now it’s your turn

The OPPS is a simple tool. The key lies in steady and consistent implementation.

I recommend starting with the big picture by explaining to your team where your practice is going over the next 3 years, 1 year and next quarter. Then introducing the OPPS as a method to track progress against your goals.

And remember that the scorecard will quickly lose effectiveness if you don’t review it regularly. That’s where the weekly meeting comes in. As a minimum, you’re reviewing your scorecard as a team 12 times per quarter, ensuring you remain focused on the key numbers.

I encourage you to download the template and give this a go. Let me know how you get on!

As always, if you’re interested in creating a more process-driven practice that is enabled for growth, be sure to check out the latest demo of BrokerEngine software.