The moment when you reveal your loan comparisons and recommended option to a client is the “moment of truth” in your role as a mortgage broker.

This is the moment when you want the client to:

- Understand your advice

- Value your advice

- Proceed with your advice

But sometimes the way brokers present advice gets in the way of these goals. This causes confusion, rework, delays – or, worst of all – losing the client to another bank or broker.

In this article I share concrete strategies to ensure you secure a fast and firm “YES!” for your loan advice. The software I use is BrokerEngine software, although the same principles will apply no matter what tech you use.

Let’s dive in!

5 Hot Principles of Loan Comparisons That Work

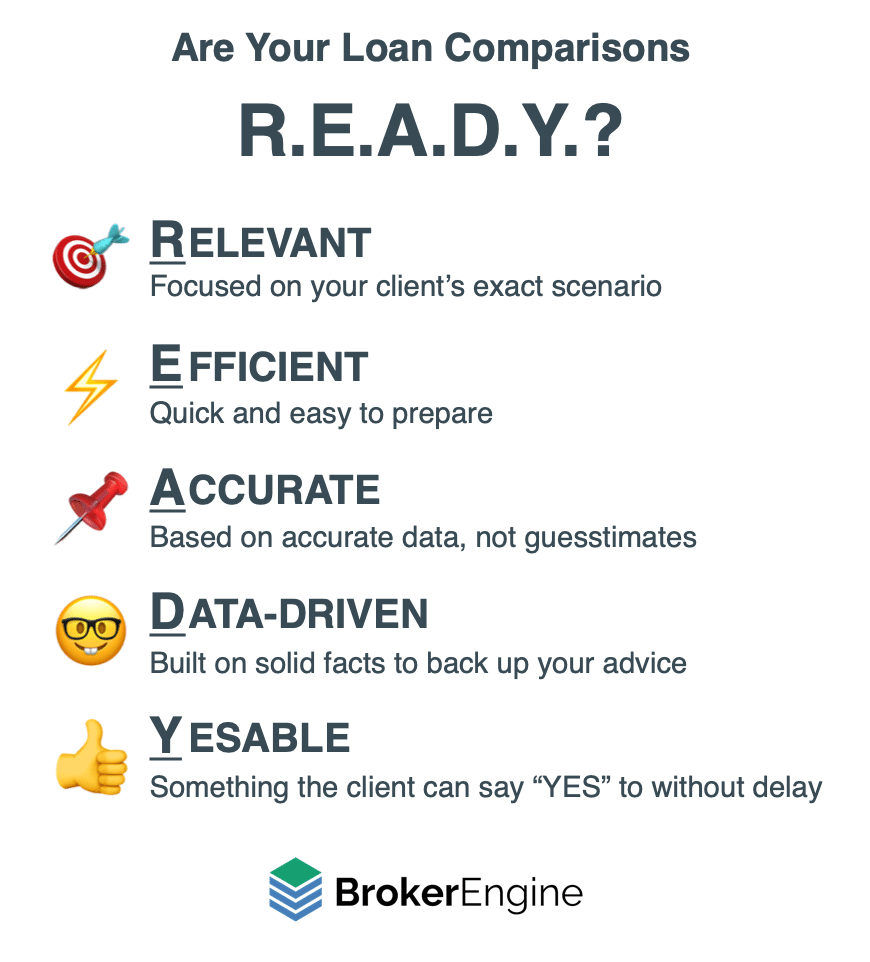

The R.E.A.D.Y. Framework is a useful model to keep in mind when presenting loan options to clients.

The best loan comparisons are:

- Relevant: focused on the exact scenario the client is considering, in terms of borrowings, timeframe, structure etc.

- Efficient: quick and easy for you or your team to prepare so you can respond quickly to opportunities.

- Accurate: based on accurate information, not approximations or guesstimates that will require further clarification before the client can proceed.

- Data-Driven: including all the relevant information that backs up your recommendations.

- Yesable: something the client can say “YES” to immediately, to avoid extended “Think-it-overs”.

Keep these principles in mind as we cover off the strategies below.

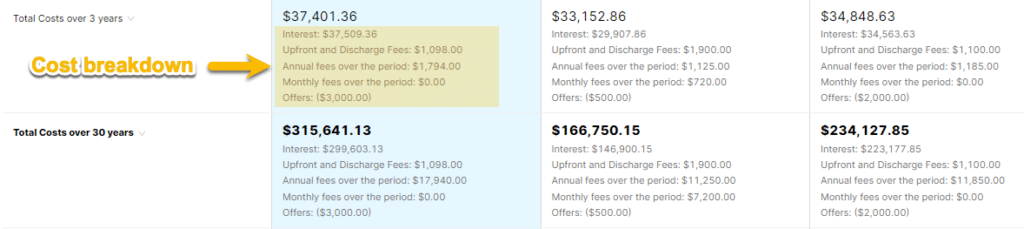

1. Quote Accurate, All-Inclusive Costs Upfront

Traditionally it has not been easy to compare the cost of different loan options after considering all costs and cashbacks, including:

- Interest charges (including reversion rates)

- Assorted fees (Establishment fees, annual fees, monthly fees, one-off fees etc.)

- Existing loan break costs

- Stamp duty

- LMI

- Lender rebates

As a result, it can take a lot of time (and many an Excel spreadsheet!) to work out which option is best for the client.

By rolling up all costs, offers and rebates into total costs that are easily compared, you provide clarity to the client to ensure they can proceed without delay:

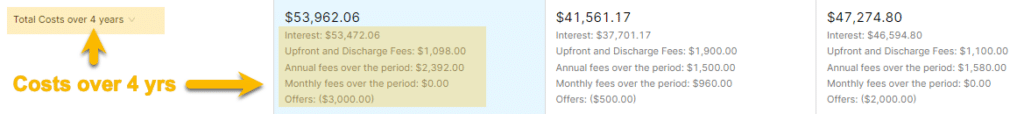

2. Compare Loan Costs Over The Most Relevant Timeframes

The “standard” way to present a home loan comparison is to compare costs over the short term (say 3 years) and long term (say 30 years).

However, these arbitrary timeframes may not mesh with the client’s actual goals.

Practically zero borrowers pay off the same loan over 30 years (but this timeframe may still be a useful reference point for “long term cost”).

A shorter timeframe is often more relevant. Let’s say your client is planning on paying down their Owner Occupied loan as aggressively as possible over the next 4 years, before investing in property.

In this case you might want to switch your reference timeframe to 4 years, to provide relevant context to the client.

3. Eliminate “Noise” And Focus On Client-Specific Value Drivers

Every client is different. Therefore it follows that loan comparison reports shouldn’t be one-size-fits-all, but rather tailored to address specific value drivers for the client.

Here are a couple of examples:

i. Remove or simplify extraneous data

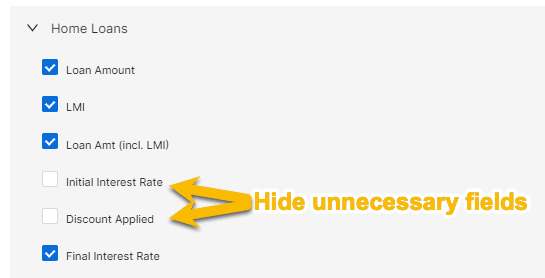

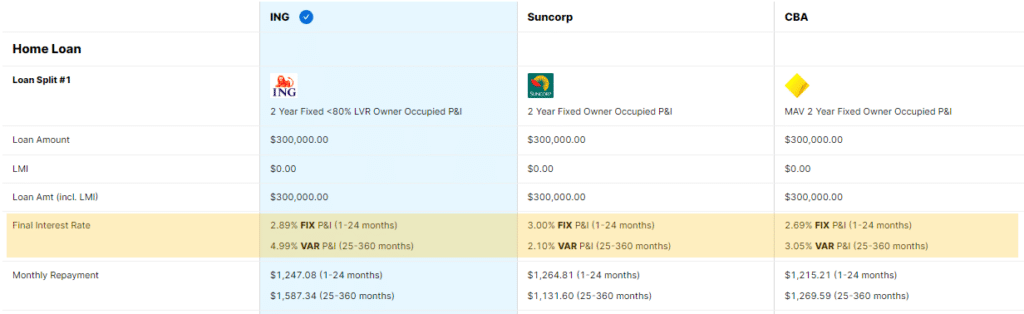

For example, if you don’t want to draw attention to the Initial (i.e. Standard) Rate minus the Discount Applied to arrive at the Final (Net) Interest Rate, you could hide the unnecessary fields to remove clutter…

… and display to the client like so:

This removes visual and cognitive friction than can slow down decision making.

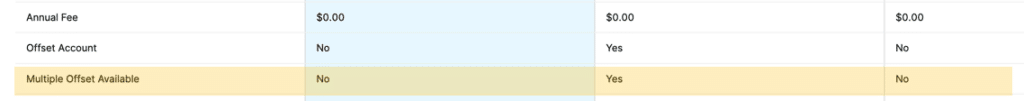

ii. Display the most relevant value drivers

Alternatively, let’s say you have a client interested in multiple offset accounts. You may wish to display this feature – particularly to show why you haven’t gone with a lower cost option with another lender that doesn’t offer this feature.

This presentation method can be particularly effective when you are recommending suitable loan options based on policy rather than rate.

4. Present Recommendations In REAL TIME To Avoid Snags and Delays

One of the most useful pieces of advice from world-renowned negotiations expert Dr Victoria Medvec is:

“Say it, don’t send it.”

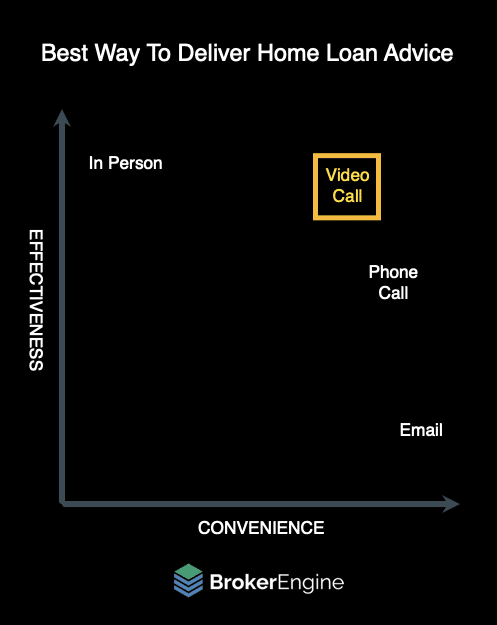

What this means is that it’s far more effective to engage in a synchronous (real-time) discussion with a client regarding your recommendations, as opposed to an asynchronous communication in which you email your comparison and wait for the client to respond.

Real-time discussions enable you to detect hesitation, surface objections, answer questions and mutually agree on next steps. The “email-and-wait” method offers none of these benefits.

What does this mean in practice?

- In-person presentations are most effective (but not always convenient)

- Video Calls are slightly less effective than In-person, but much more convenient to deliver. On balance, Video Calls are our recommended approach.

- Phone Calls are less effective than video calls, but slightly more convenient, because you don’t have to do your hair or be close to an internet connection.

- And Emailing is probably the most convenient, but also the least effective method for closing deals.

Bonus: Building A Loan Comparison In Real Time

To see how I build a loan comparison in real time and apply all the tips in this article, check out the following video:

Conclusion and Next Steps

Given that you’ve gone to all the trouble to source a lead and investigate options on behalf of a client, it makes sense to put your best foot forward when presenting loan comparisons so you can earn the business.

The tips in this article will help ensure clients Understand, Value and, most importantly, Proceed with your great advice!

If you’d like to find out more about how BrokerEngine can help you create effective loan comparisons and write more deals in less time, please register for our latest demo here.