Mortgage document collection and fact-finding can be one of the most tedious part of the loan application process.

As a result, collecting information and documents from clients can feel like pulling teeth. Brokers lose efficiency. Delays are caused. And client experience suffers.

In this article, we explore how to solve the biggest document collection pain points so you can slice up to 5 hours from every deal and improve client experience at the same time.

The Top 10 Mortgage Document Collection Pain Points

It’s useful to note the specific challenges brokers face when requesting information from clients, before explaining how to solve each one. (Click the link to jump straight to the solution).

- Reducing friction from the information collection process so clients don’t procrastinate and they respond quickly and accurately.

- Ensuring the right documents are requested every time, without having to reinvent the wheel.

- Requesting all required information in one place (i.e. Documents, Bank Statements, Client Fact Find) to reduce complexity.

- Tracking document statuses in real time so you can follow up appropriately.

- Following up on missing or incomplete items.

- Validating each document to ensure it’s suitable for submission.

- Managing “Due Now” vs “Due Later” items to avoid last minute surprises for the client.

- Responding to Missing Information Requests (MIRs) and supplementary information requests from the lender.

- Redacting TFNs and renaming files to reduce admin busywork.

- Delegating document collection to an assistant to free up the broker’s time.

How To Solve The Top 10 Document Collection Challenges

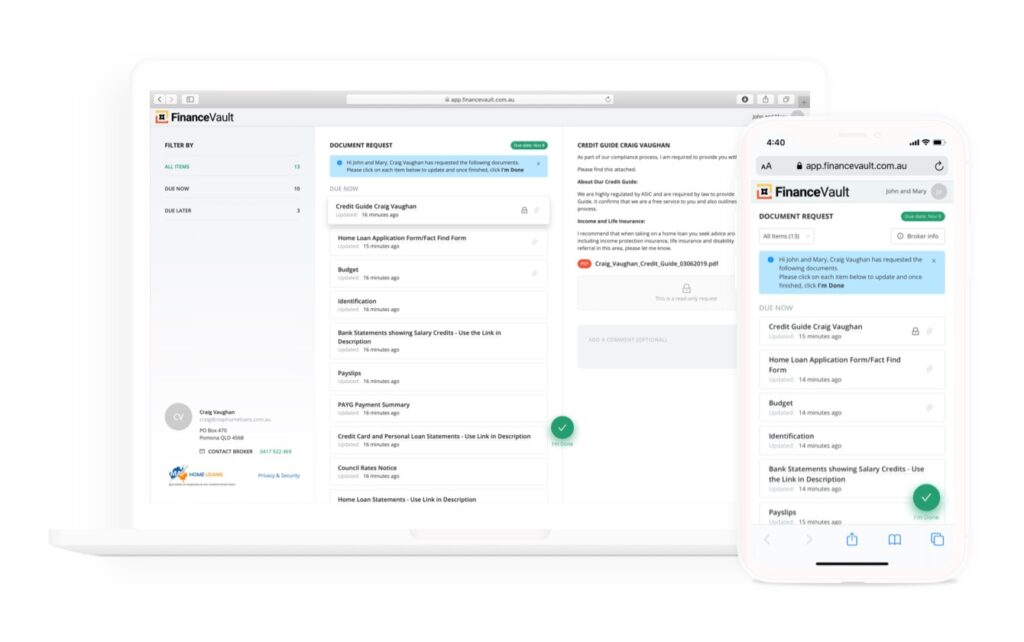

Having faced each of the above challenges first hand, we wanted to design a solution that would address each of these pain points. The resulting document portal is now included in BrokerEngine software. Here’s how it works:

1. Reducing Friction From The Information Collection Process

Digging up bank statements and mortgage documents is an unpleasant task for most borrowers. And when they sense it’s going to be a hassle, they tend to procrastinate. You can improve client response and reduce friction by:

- Ensuring your document collection tool is super-easy to use.Enabling document upload via any device (including mobile camera).

- Specifying only the documents required (and no more).

- Providing useful tips and reference examples to enable clients to respond correctly the first time.

We built our client portal feature FinanceVault with these goals in mind.

2. Ensuring The Right Documents Are Requested Every Time

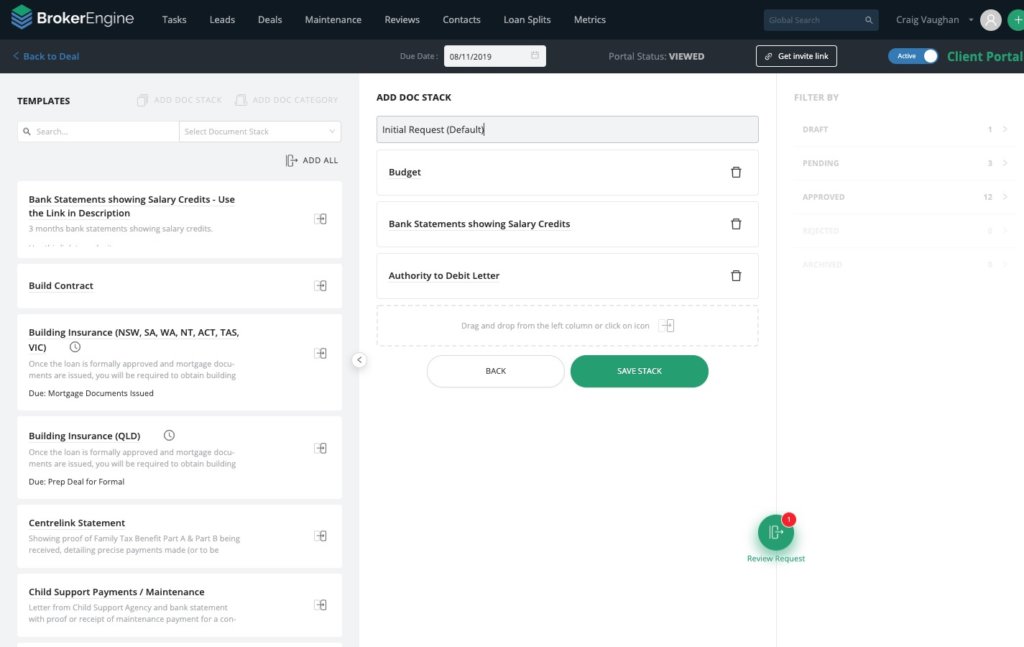

For common mortgage document collection scenarios, it can be useful to create templated sets of documents which we call a “Document Stack”.

This allows brokers to start by choosing a Document Stack, then adding or removing individual documents to suit a particular deal.

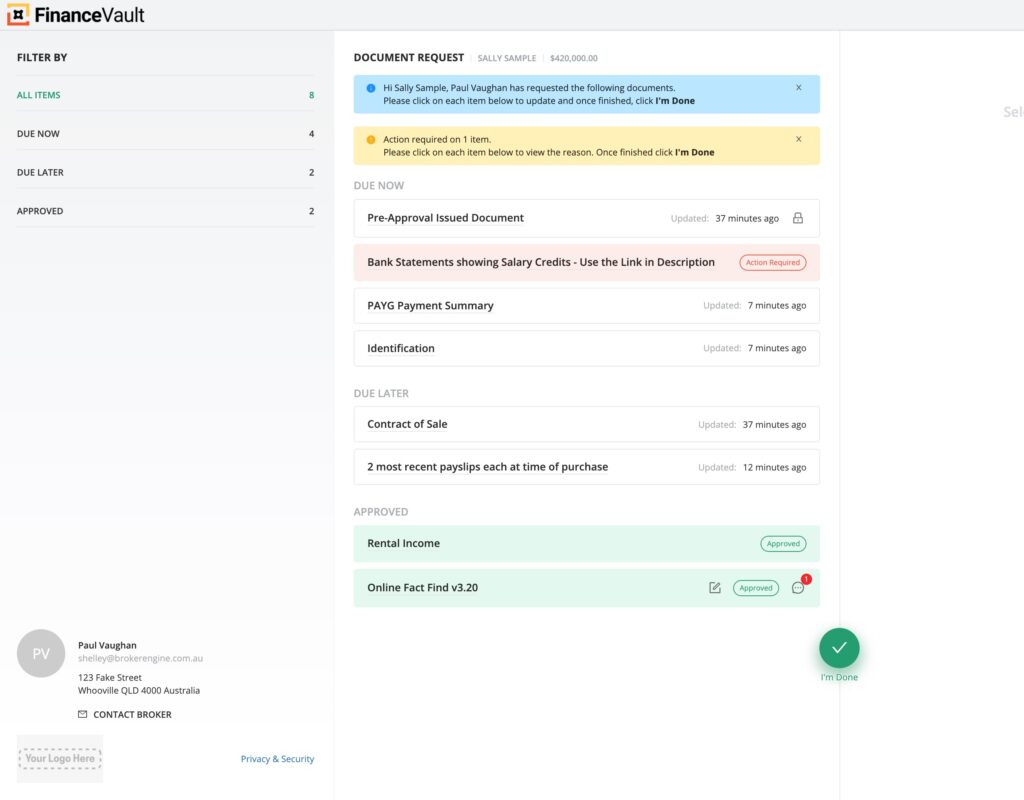

3. Requesting ALL Required Information In One Place

It’s complex and confusing for a client to have to use multiple systems to provide the information you need. For example…

- Using one system for fact find info… (e.g. PDF form)

- Another for bank statements…. (e.g. Online portal)

- Another for documents… (e.g. Email attachments)

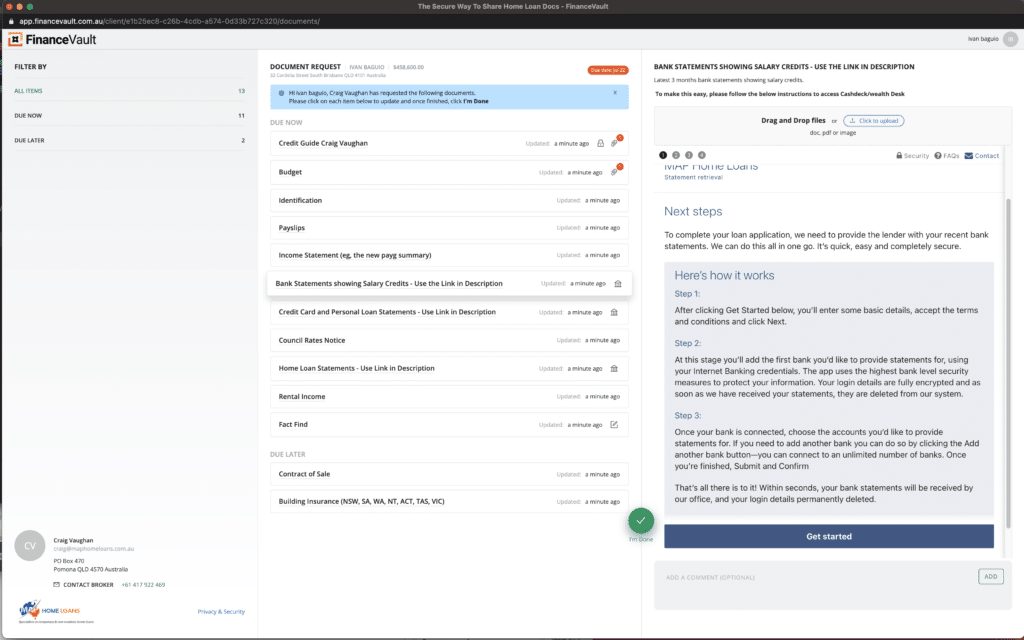

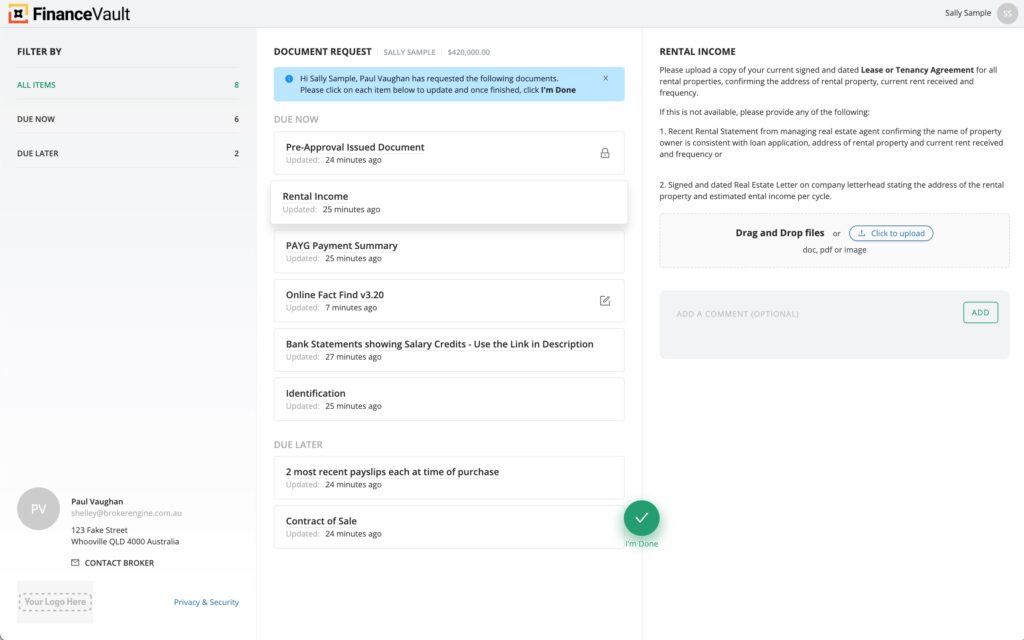

A Unified Client Portal such as FinanceVault allows brokers to consolidate all information requests in the same place. For example:

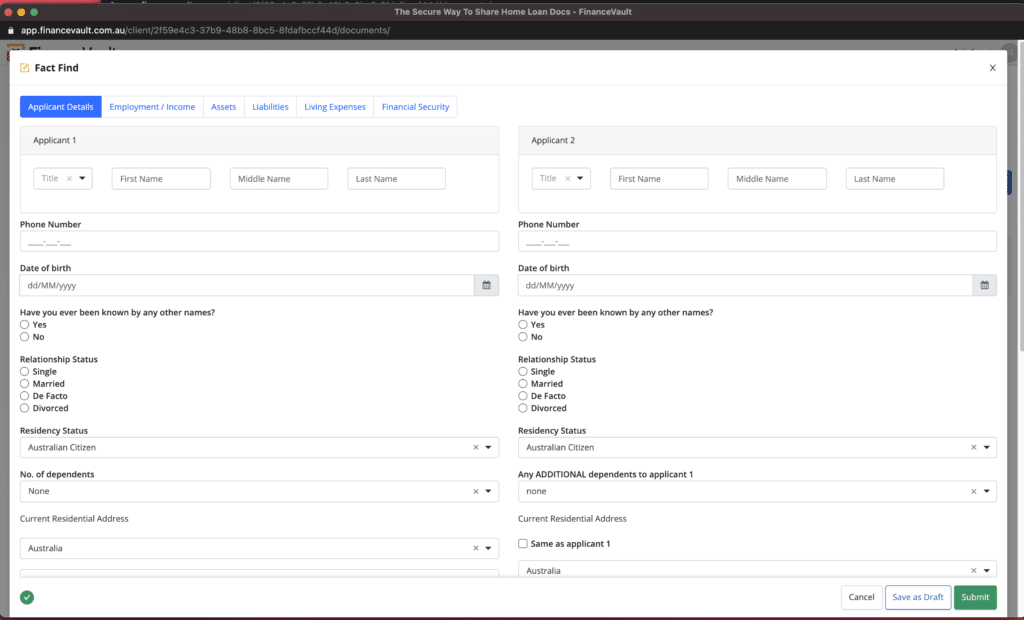

Client Fact Find:

Conditional logic and other “smarts” ensure you can gather all the detail you need, without requesting excessive or irrelevant information.

Bank Statements (via Illion Bank Statements or CashDeck):

A dedicated bank statement collection tool allows you to suck in statements from the borrower’s bank accounts with ease. This is especially useful for clients who have many bank accounts.

Mortgage Document Collection:

Document requests can be uploaded via desktop, laptop, tablet or mobile phone.

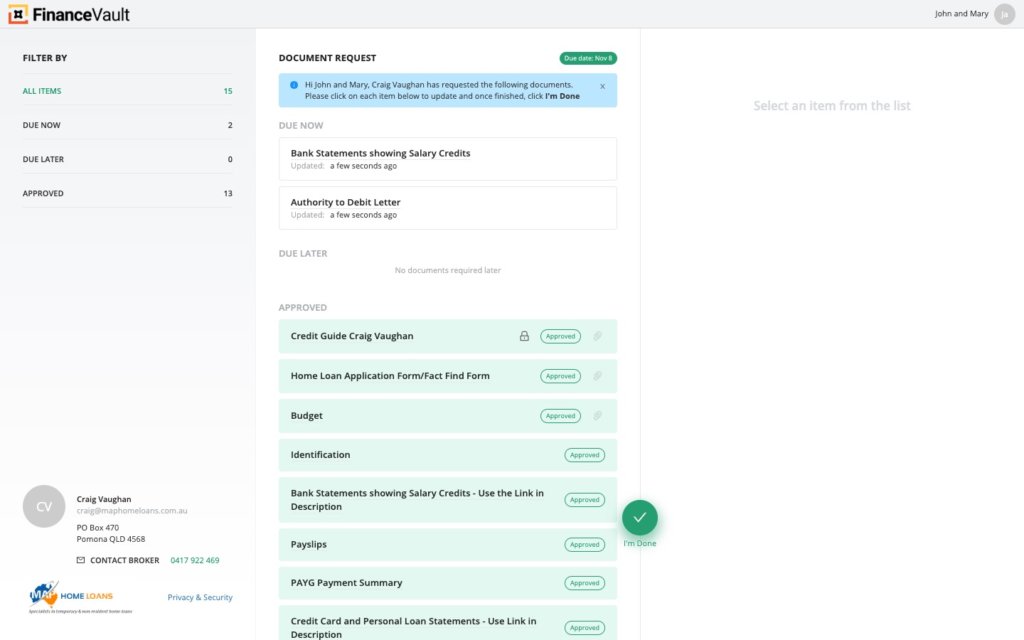

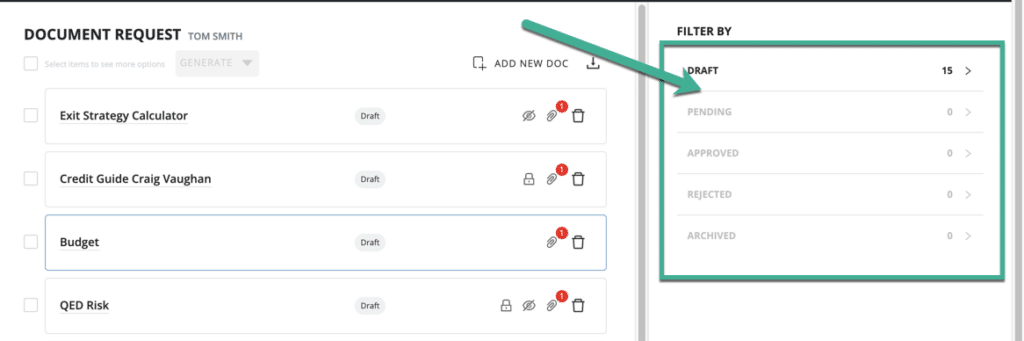

4. Tracking Document Statuses In Real Time

When you request multiple documents, it’s common for the client to drip-feed items in several batches. As a result, it’s easy to lose track of:

- What’s been requested

- What’s been supplied, but needs attention

- What’s been supplied correctly

We use a simple filter to allow brokers and back office staff to pinpoint the items that are outstanding or require attention.

5. Tracking Down Missing Or Incomplete Items

As documents are supplied and approved, brokers can tick them off their list. Reminder emails can be sent to follow up on documents that are pending or require attention.

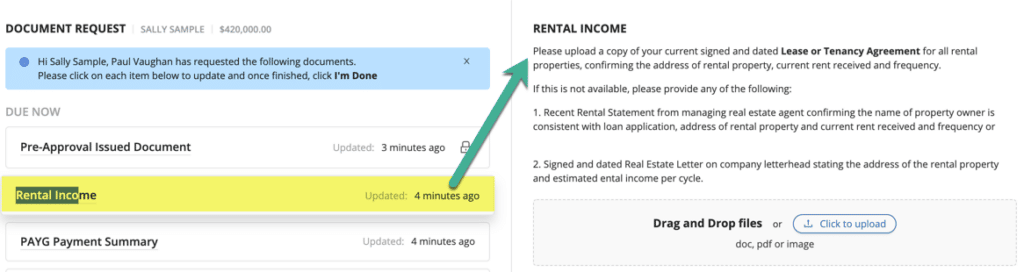

6. Validating Each Document For Submission

A strong document validation process means that submitted documents are accepted by the lender on the first attempt.

One of the easiest ways to ensure a better result is to provide the borrower with very specific instructions or model examples around requirements for each document. This results in fewer iterations and faster submission times.

Where there are errors or omissions, the broker can send a note back to the client with helpful instructions on how to resolve the issue.

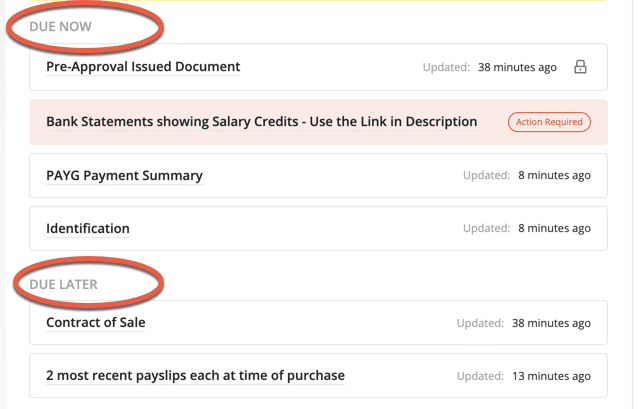

7. Managing “Due Now” vs “Due Later” Items

There are times when some documents are due now and other documents are due later.

Rather than surprising the client with a request at a later date, we flag “Due Later” requests so the client is aware they’re on the horizon.

Examples of “Due Later” documents include:

- Contracts of Sale

- Current Payslips at time of purchase

- FHOG forms (required for land and build contracts)

- Building insurance (required when documents are issued)

- Construction Documents (required for a Letter of Commencement, e.g. Council Approved Plans, Builder’s Insurance etc.)

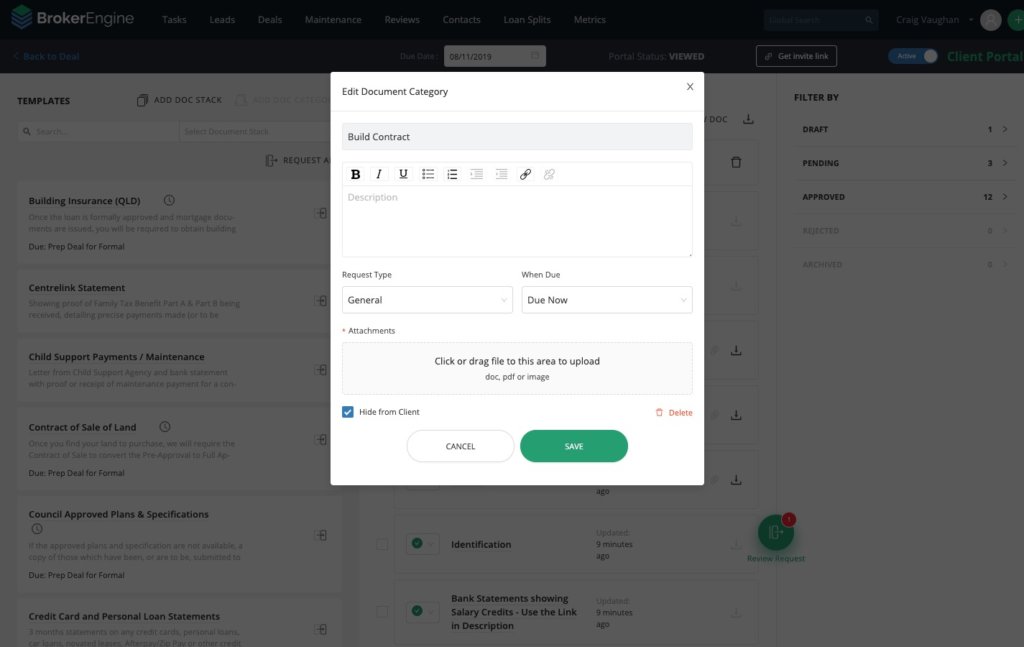

8. Responding To Missing Information Requests (MIRs) From The Lender

It has become very common for lenders to request additional information or documents throughout a deal.

There are at least three categories of additional request, which need to be handled in a slightly different way.

Type 1: Request For Further Documents

Where extra document(s) are required, a supplementary request can be sent to the client. For example:

Type 2: Request For A Response From The Client

The second type of request is for a response from the client (e.g. to explain a charge on their bank statement).

Type 3: Request For A Response From The Broker

The third type of request is a broker-facing request. An example might be a note from the lender reminding you to attach a Servicing Calculator.

Usually this type of request would be hidden from the client, which can be done by uploading the item into the portal and clicking the “Hide From Client” checkbox.

This allows the broker to keep track of all pending items in the one place, without exposing non-client facing information to the client.

9. Redacting TFNs and Renaming Files

There are a number of tedious file management requirements around document collection. These include redacting Tax File Numbers (TFNs) and renaming files for easier filing and retrieval. Doing these automatically frees up time for brokers and team members to focus on higher-level challenges.

10. Delegating Document Collection To Free Up Broker Time

Although collecting information and documents can be a time consuming and tedious process, some brokers find it difficult to “let go” of this function.

That’s because they don’t have a clear system that provides the visibility and structure to allow this function to be delegated.

Brokers are finding they can save several hours per deal by delegating document collection to an assistant, freeing up the broker go to out and write another deal.

Next Steps

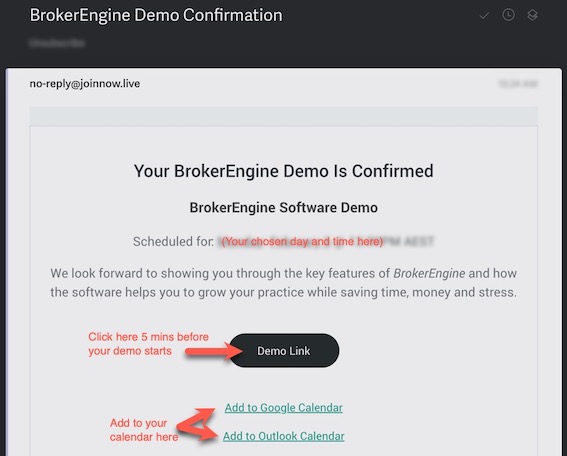

If client information capture and document collection is a pain point for your firm, now may be a good time to put some of these best practices into action.

If you’d like to discover how to solve these challenges and more, register for a free demo of BrokerEngine software (including FinanceVault) now.