Have you ever heard the phrase, “The difference between salad and garbage is timing.”?

Part of the skill of maximising your opportunities as a mortgage broker is communicating with the right client at the right time with the right message.

Even consistent marketing to your prospects and clients won’t do any good if another bank or broker communicates with your client at the key moments when a major decision is most likely.

In this article, we’ll explore 6 categories of data trigger you can use to serve clients more proactively and write more business.

The Method: Change > Implication > Message

Using data triggers to write more business is as simple as following this 3-step Method:

- Notice a recent or upcoming CHANGE

- Consider the IMPLICATIONS of that change to the customer

- Craft the right MESSAGE to create a conversation.

Of course, you also need access to the right real-time data to be able to do this. We use the “Loan Splits” view within BrokerEngine Software to pull this data.

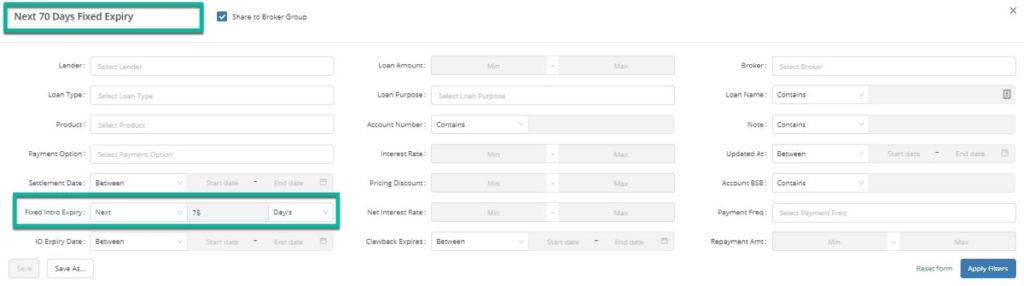

Trigger # 1: Fixed Interest Period Expiry Pending

Trigger #1 is a Fixed Interest Period Expiry Pending. Around 60 days prior to expiry, the lender will often contact the client and attempt to re-fix them. This isn’t always a great outcome for the client:

- As their broker, you don’t get an opportunity to review the market

- You don’t get a chance to put in pricing to get a sharper deal for the client

- In general, you miss out on the opportunity to add value

If a client fixes for 2 years, then the bank re-fixes them for 2 more, then it will be 4 years since you added value as a broker. And with each passing year, the connection between you and the client weakens.

How To Use This Trigger:

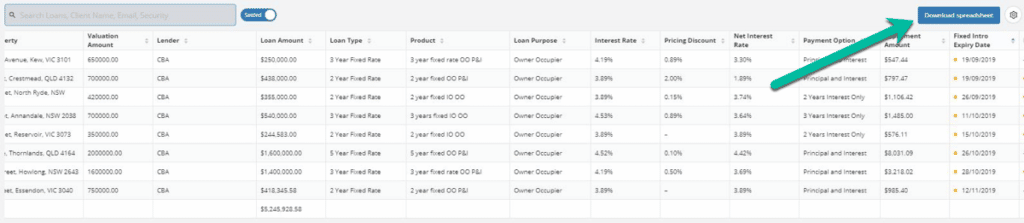

- Set up an alert to be notified 75 days out from a Fixed Interest Expiry date.

- Contact the lender to get the most up to date loan information.

- Reach out to the client with a relevant message. For example: “I can see your fixed interest period is due to expire in a couple of months. What we do in these situations is to do a review of the market to see what the right option is for you moving forward, or at the very least ensure that the bank gives you their most competitive rate.”

Many clients will be impressed with this level of proactivity and be suitably reminded why you’re their broker.

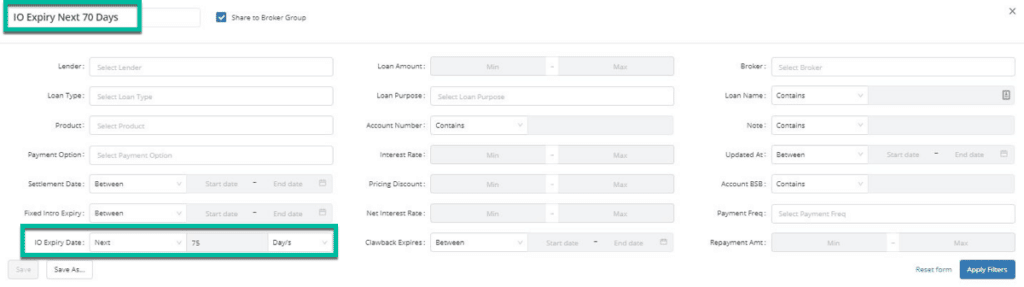

Trigger #2: Interest Only Period Expiry Pending

Trigger #2 is Interest Only Period Expiry Pending. Recently, some lenders have been contacting clients around 70 days prior to IO expiry, so we recommend you set your data triggers for 75 days prior and beat them to the punch.

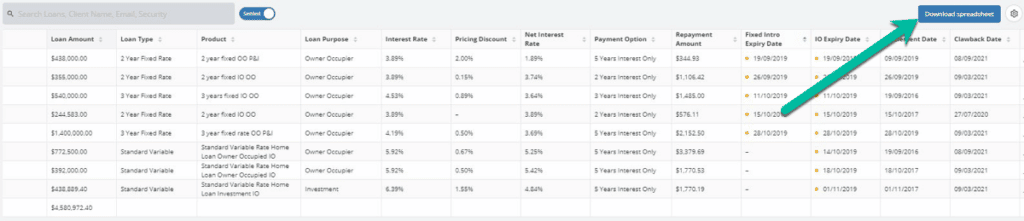

This may be a good time for a refinance discussion to enable the borrower to access another IO period.

How To Use This Trigger:

- Set up an alert to be notified 75 days out from an IO Interest Expiry date.

- Contact the lender to get the most up to date loan information.

- Reach out to the client with a relevant message: “I can see your Interest Only period is due to expire soon. I recommend we review your situation to see what the right option is for you moving forward, including potentially accessing another IO period via another lender.”

Again, you get an opportunity to be there for the client when a crucial decision needs to be made.

Trigger #3: How To Find Refinance Opportunities

Trigger #3 is Unearthing High-Probability Refinance Opportunities.

How To Use This Trigger:

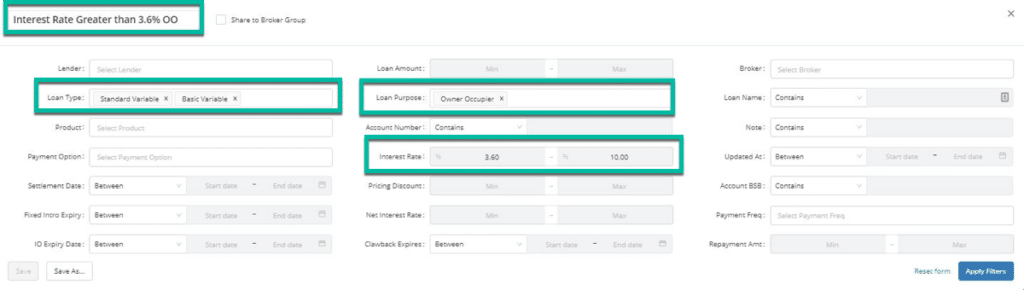

Step 1 is to run a search on your loan splits to shortlist the highest probability clients:

- Show me all clients who are on P&I Owner Occupied Loans…

- …on a variable interest rate…

- …greater than 3.6%.

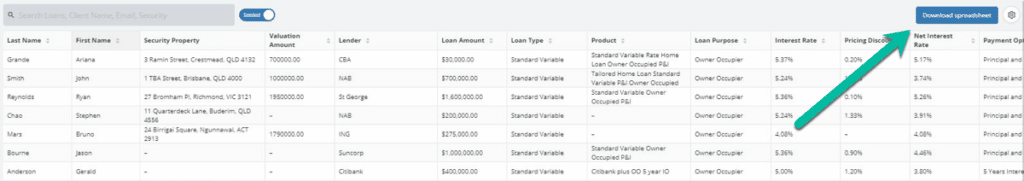

Step 2 is to follow this Loan Review Process to obtain up-to-data data from the lender and order a desktop valuation so you can further refine your target list.

Step 3 is to reach out to the high-probability clients you’ve identified above with an appropriate message in order to set up a conversation.

As a result, you have a way of triggering relevant, high-probability refinance discussions on demand.

If you were to write just one deal a month based on this trigger alone, that’s 12 more deals per year (and 12 even more satisfied clients) that you may not have had otherwise.

Trigger #4: Ensuring Are Getting Best Pricing For Key Lenders

Trigger #4 is to ensure clients are taking advantage of the best pricing for key lenders.

How To Use This Trigger:

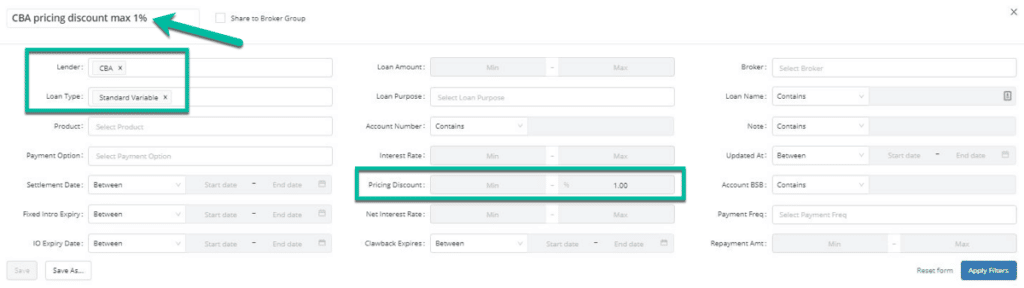

Let’s say you get wind that “Bank X” is pricing heavily because they’re bleeding loans to other lenders.

You would run a search like this:

- Show me all clients who are with “Bank X”…

- …with a discount less than what you’re getting for other clients

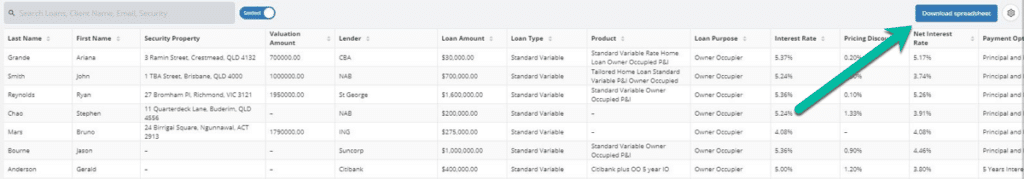

Then one possible action would be to contact the lender and obtain better pricing on behalf of the relevant clients.

This gives you the opportunity to delight your clients with a message like, “Hi Mr and Mrs Client… we just negotiated another 0.3% off your rate with Bank X, which will save you $X,XXX per year in interest.”

This also represents a “moment of truth” which leads very naturally into a referral discussion, with conversation starters like:

- “Who else do you know anyone else with a Bank X loan? Or

- “There are a lot of more competitive offerings out now…. Who else do you know who might appreciate a loan review so we can see if they’re getting a great rate as well?”

Trigger #5: Translate Property Alerts Into Key Conversations

Trigger #5 is to Translate Property Alerts Into Key Conversations.

There are now services available such as CoreLogic Property Monitor which will allow you to be alerted to client properties being listed for sale or rent (among other things).

How To Use This Trigger:

When you’re notified of a transaction trigger, this is a great opportunity to call the client and see what’s changed in their situation.

The likelihood is that you’ll be able to pick up some business. For example:

- Assist with finance for a home upgrade

- Assist with investment finance or a portfolio review

Regardless of the outcome, clients tend to be impressed with a broker who is always on the front foot, rather than waiting for the client to always initiate a conversation.

Trigger #6: Capitalise On Market Changes

Trigger #6 is to Capitalise On Market Changes.

This is somewhat of a “catch-all”, but the method still centres around this core thought process:

Here’s one example of many:

When APRA announced that it was relaxing its guidance to lenders on the residential mortgage assessment rate, this presented an opportunity for some borrowers.

We ran a search for prospects who had applied for a loan in the last 12 months but been rejected on serviceability grounds.

Where the serviceability gap was reasonably narrow, we reached out to the prospects to advise that things had changed and that it may be worth taking another look. As a result, we re-ignited some conversations that resulted in new business.

While this is a “one-off” situation, it’s always worth considering how a lender or market change will affect specific groups of clients. That gives you the chance to communicate in a timely and relevant fashion and leverage your value to the client.

Next Steps

Using Data Triggers is a smart way to serve your clients better.

As your loan book gets larger, it’s not practical to be looking at every loan every week. By using data to trigger high-probability opportunities, you cement a reputation for great service and “automagically” being there for the client at just the right moment.

Take a demo of BrokerEngine software to see how we can help you do this for your clients.