As a mortgage broker, you want to deliver a seamless experience with the right mix of touchpoints.

One way to streamline your workflow is by incorporating SMS messages. SMS messages are quick, easy, and effective. They can help you save time, reduce costs, and improve customer satisfaction.

In this article, we will explore the benefits of SMS messages for mortgage brokers; provide examples of mortgage broking SMS messages, and offer tips on how to use SMS messages in an effective and compliant manner.

What are the benefits of SMS messages?

SMS messages have many benefits for mortgage brokers, including:

- High open rates: SMS messages have a 98% open rate, ensuring your message is see and important emails (such as document requests) don’t get missed.

- Instant delivery: SMS messages are delivered instantly, making them ideal for time-sensitive information.

- Cost-effective: SMS messages can cost as low as 5c inc. GST.

- User-friendly: SMS messages are easy to read and respond to

- Versatile: SMS messages can be used for a variety of purposes, from appointment reminders to workflow updates – what’s not to like?

SMS messaging setup and costs

Building SMS messaging into your workflows used to involve using multiple apps and connectors. At BrokerEngine, we loved the idea of SMS workflows so much that we built a direct integration with touchSMS, a low-cost, business grade Australian SMS provider.

The integration between touchSMS and BrokerEngine doesn’t require any 3rd party tools such as Zapier. Just:

- Create a touchSMS account and load up some credits

- Copy the API key from touchSMS and plug it into the Integrations section in BrokerEngine

- Configure your desired settings

- Add SMS messages into your automated workflows and you’re good to go!

Here’s a 3-minute video that walks through how to set up your own SMS workflow:

Example mortgage broker SMS messages

You can choose to use text messages within your mortgage broker workflows a little, or a lot.

The advantage of building text messages into your BrokerEngine workflows is that they go out automatically to clients every time, without you having to do anything extra.

Here are some examples that make sense for many brokers:

Appointment Booking Confirmation

Hi [Client], your Loan Strategy appointment with [Broker] is confirmed for [Date] at [Time]. Please let us know if you need to reschedule. Thanks!

Appointment Booking Reminder

Hi [Client], just a friendly reminder that you have an appointment with [Broker] tomorrow at [Time]. Please let us know if you need to reschedule.

Invitation to Supply Required Documents

Hi [Client], we require some documents to proceed with your loan application. Please check your email (including spam/junk) for details of our secure document portal, FinanceVault. Many thanks, [Broker]

Loan Submitted Advice

Hi [Client], confirming your loan application has been submitted to [Lender]. We will keep you updated throughout the process. Many thanks, [Broker]

Loan Pre-Approved Advice

Hi [Client], congratulations! Your loan application has been pre-approved. Please check your email for further details. Thanks! [Broker]

Loan Approved Advice

Hi [Client], great news! Your loan application has been formally approved. Please refer to your email for further details. Thanks, [Broker]

Loan Settlement Advice

Hi [Client], your loan has just settled. Congratulations! Please check your email for further details. Thanks, [Broker]

Other SMS Use Cases

SMS messages are very versatile – here are some more ideas:

Testimonial Request (after Formal Approval)

Hi [Client], we hope you're enjoying the service so far. Would you consider leaving a short review to help spread the word about [Brand]? Please click this link to leave a review: [Link]

Testimonial Request (after Settlement)

Hi [Client], it has been a pleasure working with you. Would you consider leaving a short review to help spread the word about [Brand]? Please click this link to leave a review: [Link]

Loan Review Text Message

Hi [Client], we’re about to commence a review of your lending to ensure everything is still competitive. Please email [Email] or call [Phone] with any specific requests or concerns. We’ll be in touch within 7 days with further info. Thanks, [Broker]

Other Important SMS Sending Tips

There are a few other important considerations when it comes to SMS messaging.

SMS Compliance

Please review resources such as the Spam Act 2003 in Australia and consult with legal representatives as needed to confirm you are acting in a compliant manner.

When using SMS messages, it’s important to ensure you are complying with relevant regulations, such as the Spam Act 2003 in Australia. This includes obtaining consent before sending SMS messages, providing opt-out options where required, and keeping records of consent.

If you are updating a client on the progress or process of a deal, the Act suggests that you can assume “implied consent” to send updates via SMS.

However, if you bulk send SMS messages to prospects, you are most likely to require specific express consent, and provide opt-out options.

Message Tone

When sending SMS messages as part of your workflows, we recommend adopting a professional yet friendly tone that sounds like you sent each message individually. It doesn’t need to sound overly formal and certainly not like “market-ese”.

Beware Unsavoury Hours

It’s recommended that you only send SMS messages within waking hours. Depending on the nature of your business and your client base, you may or may not wish to send messages during weekends.

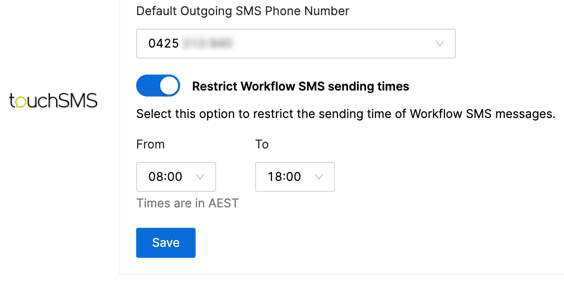

BrokerEngine users can use the following setting to restrict when messages are sent. Messages will be queued until your sending window opens up, to avoid waking up an important client at 2am with a testimonial request!

Conclusion and Next Steps

SMS messaging is a useful tool for updating clients while ensuring your deals keep moving forward.

The right SMS strategy can create the impression you’re the most proactive, “on to it” broker around. Only you know it’s all automated in the background. 🤫

If you’d like to start adding SMS automations and other advanced workflows to your practice, register for the latest demo of BrokerEngine software here.