In a previous article on the ideal mortgage broker loan process, we explored the best loan processing workflow for mortgage brokers. Now in this post, we take a look at the loan processing services and options available today – and how to choose between Do It Yourself, In-house, Outsourced or Offshore solutions.

Do It Yourself Loan Processing

Some brokers – especially those writing smaller volumes e.g. sub $2M/month – choose to do their own loan processing.

The advantage of the DIY approach is that it’s “free” (but only when you discount the value of your time. But the disadvantage is that you lose operating leverage.

When is it a good idea to process your own deals?

My view is that new brokers should process their own deals for the first 6 months / 50 deals. This ensures you understand the process and requirements. My experience has been that brokers who have never done loan processing don’t understand the nuances of the function and why it’s so important to get right.

Although many brokers start out processing their own deals, this is not a good way to grow your practice. The opportunity cost is extremely high. Loan processing can be time consuming, and by doing it yourself, you’re not developing new business or advising clients.

Once you know how the process works, our advice is to get a loan processor leverage your practice.

In-House Loan Administration

With in-house loan administration, the broker hires one or more part-time or full-time loan processors to work in the same office (or via a virtual or remote office arrangement).

The benefits of this is that a good loan administrator is worth their weight in gold. They not only provide huge value to a mortgage broker, but over time can be cross-trained in other functions such as:

- Lead management

- Marketing coordination

- Sales process coordination

- Parabroking

Loan processing can also a path to become a broker.

The potential sticking point is that it takes time to become proficient. And many of the best loan admin officers are already gainfully employed.

(The idea behind the BrokerEngine software is that it gives loan processors a set of “train tracks” that make everything quicker and more efficient, so you can hire and train even new entrants to the field.)

Outsourced Loan Processing Services

The alternative to an in-house processing team is to engage an outsourced loan processing service.

There are many providers available, onshore and offshore These companies perform all your loan processing tasks so you as the broker can stay focused on serving clients and driving new business.

Just like any industry, there are a range of prices and service levels. The keys to success when engaging an outsourcing firm are:

- Expectations: understand exactly what will be provided and in what way.

- Scope: what stage(s) of the process with your outsourcing firm handle? Will they be client-facing or “behind-the-scenes”?

- Communication: how will your outsourcing partner communicate with clients? Will they be limited to email, or will they also call clients? Will they communicate with clients directly, or route communications via the broker?

- Collaboration: how will you brief your outsourcing firm? How will you stay “on the same page” throughout the deal?

Getting clear on these questions is an important foundation to a working relationship. In our experience, it’s usually mis-communication around these areas that lead to problems.

Onshore vs Offshore Back Office Support?

Thanks to the internet and globalisation, more and more outsourced loan processing firms are located offshore, often in lower-cost countries such as the Philippines, India, Nepal or Eastern Europe.

(The benefit of the Asian timezones is that there is usually significant overlap with the Australian business day to enable rapid collaboration.)

Pros and Cons of Offshore Loan Processing Services

The potential upsides to an offshore loan processing service provider include lower costs, and an often well-educated and process-driven workforce.

The potential downsides are less familiarity with the Australian business culture; language barriers; and “the tyranny of distance”.

That being said, there are some very impressive success stories of Australian brokers working with offshore teams. In fact, in my own broker group, I employ a team of 5 loan processors in Manila, Philippines.

“Communication is key when you’re working with any remote team. I provide my team with a set of “train tracks” in the BrokerEngine software. All the features, delegation tools and checklists ensure the job is done right every time. This gives me peace of mind, and also helps my team know they’re doing the right thing, too.”

Per-Deal or Dedicated Staffing?

Whether you choose to process your deals onshore or offshore, there are two broad models to outsourcing: per-deal or dedicated staffing.

Per-deal: like the name says, with Per-Deal loan processing services, you pay per deal processed. This is great for brokers writing lower (or variable) volume, because you have a variable cost structure. The downside may be that there are many different people working on your deals, so ensuring consistency is absolutely critical. As your volume increases, a per-deal billing model may end up costing more than a dedicated staffing model.

Dedicated staffing: this model is like engaging a remote full-time employee. You are responsible for training and some aspects of management. The potential upside is that you can build better teamwork by working consistently with the same person over time. Especially for brokers writing consistent volumes (e.g. 8+ deals per month), this solution will tend to be more cost effective.

A “good” dedicated staff member running the BrokerEngine software can process 20+ deals per month, leaving ample time for handling other work such as:

- loan variations

- pricing requests

- progress payments

- database management

- marketing coordination

(A GREAT processor can do closer to 40+ deals per month.)

Your Loan Process: From 14 Hours To 4 Hours Per Deal

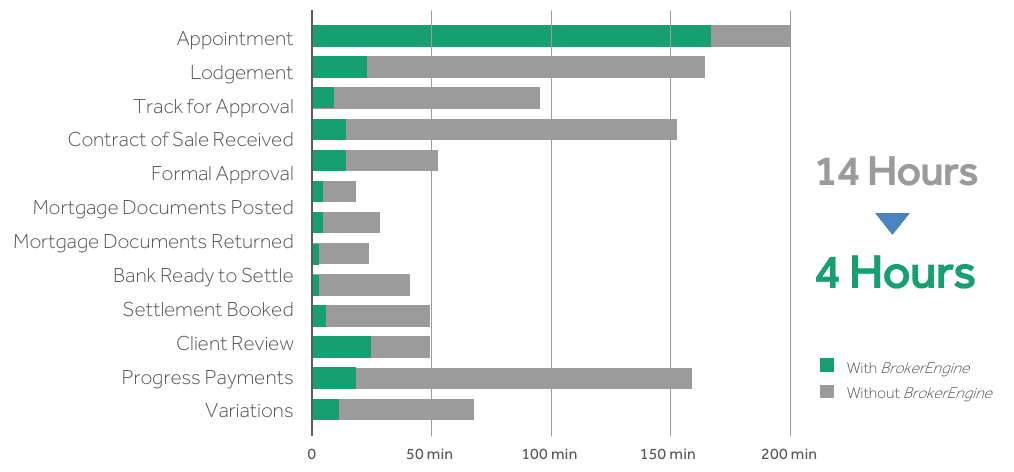

We asked our users how long it takes to process each loan “the old way” (i.e. before BrokerEngine), and the consensus was that each loan requires 14 hours of work. This includes meeting with the client, through to settlement and post-settlement care.

When you use BrokerEngine, this time is reduced to 4 hours. Here’s the data behind those figures:

Mortgage broking is too competitive to waste up to 10 hours per deal. And if you want to grow, then ensuring you have the right back office support is critical.

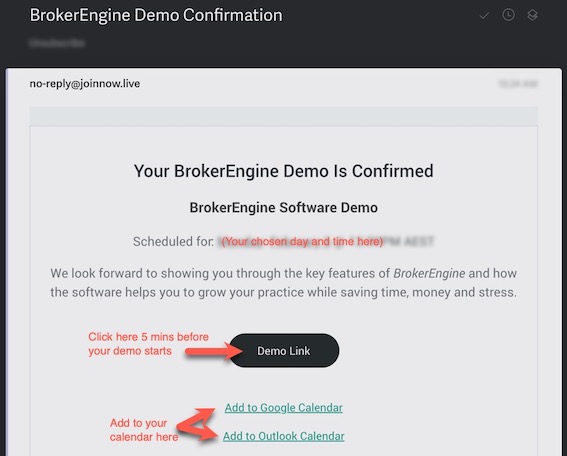

If you’d like to know more, contact us for a Free Demo of BrokerEngine. We’ll show you streamline and automate your workflow, so you can get back to what you do best…

…sitting in front of more new clients, and delivering amazing loan solutions.