For many mortgage brokers, there’s no question more tricky or frustrating to deal with than, “What’s your lowest rate?”.

The implication is that you have to give them a number, and if that number doesn’t match up to the number in their head, they move on.

It’s easy to dismiss these borrowers as “tyre kickers”.

But often there are legitimate reasons why a prospect is asking about the lowest rate.

In this article, we’ll look at the full process I use to deal with this question and win the winnable business.

Unpacking The “Lowest Rate” Question

The “lowest rate” question is really a specific scenario within the overall mortgage broker sales process.

There are a small number of borrowers who are only concerned with interest rate. But my experience is that these prospects are rare.

There may be good reasons why a prospect asks the “lowest rate” question. For example:

- They don’t know what else to ask

- They want a great deal (of course they do!)

- They want to feel like a “savvy borrower”

- They saw an ad for a low rate and like the sound of it

- They are a genuine price shopper looking for the lowest interest rate and are prepared to invest time and energy to find it, to the exclusion of all other factors, regardless of what happens in the future.

Only option (5) above is what I would consider a “price shopper” or “tyre kicker”.

So we need to go through a process to determine what kind of borrower we’re dealing with; how (or if) we can help; and if we actually want to do business with them.

The Ideal Mortgage Broker Sales Process

How To Convert Shy Prospects Into Lifelong Clients, Step-By-Step

The High Level Process

High level, here’s my process for dealing with the “lowest rate” question:

- Reframe the question

- Uncover the prospect’s true needs

- Present a better overall solution

- Win the business!

Let’s drill down further….

1. Reframe The Question

It doesn’t help to simply answer the question with a number, if you can avoid it.

The problem is that the prospect is asking the wrong question. Any answer to the wrong question is the wrong answer.

So here’s how I deal with the question in a couple of common scenarios:

Answering The Question PRIOR To An Initial Interview

You may get this question up-front, prior to holding an initial interview (especially with online leads).

Here are 3 potential responses among many:

- “To give you answer to that, I’d need to explore your situation in a bit more depth. Then I can find the loan products that have the lowest rate that you also qualify for and meet your overall goals…

- “I’m happy to quote you some low interest rates, but if they won’t approve your application, what would be the point of that? What we usually do is to ask a few more questions about your situation so we can recommend the loan products that have the lowest rate that you also qualify for and meet your overall goals…”

- Here’s one I like from Rod Stelling of Tradies Finance: It’s not the rate of interest that’s important. It’s the amount of interest that you pay. Otherwise the banks would only sell cheap rate loans. I will teach you how to pay less interest regardless of the rate. You just need the “right” loan.

As you can see, there’s no smoke and mirrors here.

If I (or my sales co-ordinator) are dealing with a hardcore, interest-rate-only price shopper, then we’ll let the lead go rather than try to convince them otherwise.

However, my experience is that most borrowers are open to the best overall solution, not just a one word answer.

Answering The Question DURING An Initial Interview

During an initial interview, at least half of borrowers will tell me that “the lowest interest rate” is very important to them.

Interest rate IS an important factor.

But as you know, there are lots of other factors that weigh in too.

So if a prospect says they want the lowest rate in an interview, I simply agree with the statement…

Of course… Of course you do.

… and move on with the needs analysis.

2. Uncover The Prospect’s True Needs

It’s almost always true that broader needs will surface, which will lead to a more holistic loan recommendation.

After all, it’s very rare that a borrower:

- Doesn’t have any serviceability issues

- Doesn’t have any policy issues (e.g. lack of genuine savings, waiving LMI, employment type, living expenses, visa status, probation period, salary currency etc.)

- Doesn’t want an offset account to park extra cash

- Doesn’t want to invest, now or in the future

- Isn’t looking to repay the debt quickly

- Doesn’t have any structuring requirements (e.g. avoiding cross-securitisation)

By conducting an in-depth needs analysis, I get what I need to make a compelling case to the client.

3. Present a Better Overall Solution

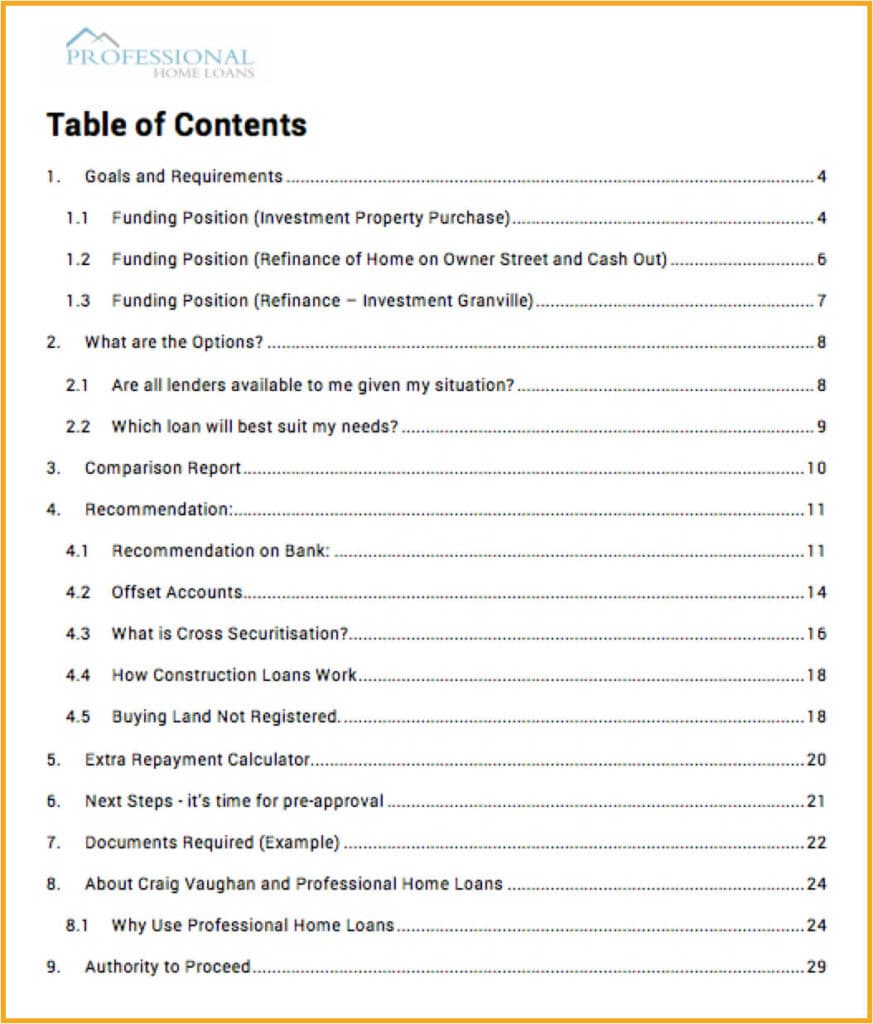

I present my loan recommendations using our Loan Strategy Report document (generated out of BrokerEngine software).

Here’s one example of how it’s structured:

The specific sections of the LSR that relate to solving the “lowest rate” conundrum are:

- A recap of needs and objectives – reminding the prospect that they have broader issues and concerns that will not be satisfied by a “lowest rate” product

- Product options – a table showing some of the shortlisted options that I compared.

- Policy comparison – a section demonstrating the product(s) where the borrower is likely to meet policy.

- Highlighted solution – aka my product recommendation, based on the borrower’s overall situation.

4. Win The Business!

By the time I get to present a Loan Strategy Report, 95% of prospects will proceed with my loan recommendation.

This is simply because I’ve taken the time to really understand their situation and present a solution that meets their objectives.

As Dean Jackson says, “The most powerful sales technique is appealing to self-interest, because there’s no defence against it.”

In Conclusion

By running a standardised process like this, you tend to get consistent results.

There’s no need to be afraid of the “lowest rate” question.

Sure, you don’t win them all, but with this approach, you’ll find you can win the winnable business – and meet some great clients in the process!