For many mortgage brokers, income stream diversification is a bit like your mum telling you to eat your broccoli.

You’re often told, “it’ll be good for you” (and perhaps it will be)… but maybe you just don’t like broccoli.

In this article we’ll look at the pros and cons of income stream diversification. We’ll also cover best practices for cross-selling to existing clients.

The Case For Diversification: For And Against

Between 2010 and 2016, I dabbled with cross-selling related products and services to my clients. (Mainly as a referrer to other parties).

To be honest, my results weren’t substantial enough to justify de-focusing from my core home loan business.

I felt I was adding the most value to clients with residential mortgages. Also, my “dollars per hour” earnings for loan writing were much higher than anything else.

These days, the market, technology and client expectations have evolved. I’ve re-visited diversification as a part of my overall growth strategy.

Even so, it’s not right for every broker – so let’s look at some of the pros and cons of introducing new revenue streams into your practice:

|

For |

Against |

|---|---|

|

|

|

|

|

|

|

|

| |

| |

|

Bottom line: adding new revenue streams can benefit you, providing the downsides are addressed.

There is no popup with a slug "online-workshop" in the theme settingsWhich New Revenue Streams?

There are several categories of new revenue streams beyond residential mortgage loan commissions that you can introduce. Broadly, these are:

- New loan product categories

- Referring related products and services to third parties

- Direct provision of additional services within your firm

Let’s look at each one in turn:

New Loan Product Categories

Many brokers start with residential mortgages (for example), then add other loan types, such as:

- Commercial lending

- Business loans

- Asset finance

- Car loans

- Personal loans

For the right practice, new loan offerings are an opportunity to provide the same client with more solutions. New products can also attract new clients.

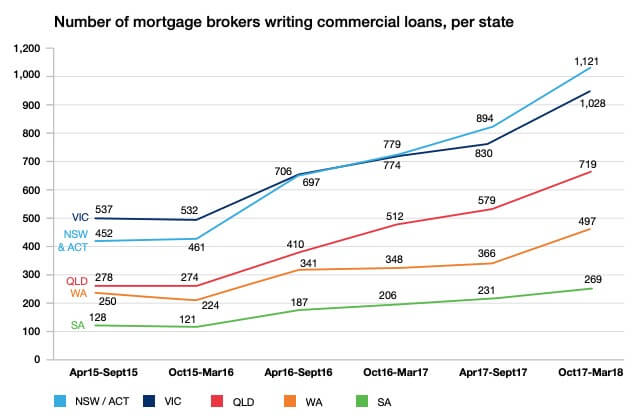

While data on every type of loan is difficult to find, the MFAA reports that around 22% of mortgage brokers are now also writing commercial loans.

Referring Related Products and Services

The next opportunity is to connect your clients with providers of related products and services.

This option is attractive because it doesn’t require you to master new product categories or develop the infrastructure in-house.

Here, we’ve divided the broad opportunities into three categories:

Greasing The Wheels: Making Life Easier

- These are services that make the client’s life easier during a loan transaction.

- Home Connect (setting up utilities in the client’s new home) is a useful value-add for the client, with a potential income stream of around $100 for each client that avails themselves of the service.

- On occasion, clients will need introductions to conveyancers or accountants. While these referrals may not necessarily entail financial compensation, they serve the client while also opening up the potential for reciprocal referrals.

Significant Purchases: Adding Value To The Client Experience

- Clients may have a need for more significant services such as Financial Planning, Life Insurance, Estate Planning, Property Investment Advice or Property Management.

- Often, the client is going to buy anyway. For example, if they want to buy an investment property, they may well seek advice. It’s far better that that advice comes from a trusted professional in your network than a “random” option. I’ve been referring some clients to Smart Property, who offer my clients a complementary property strategy service, which may also lead to a property purchase down the track.

- Tight systems and processes are required to make these introductions. A “casual suggestion” doesn’t usually work. You need scripts, templates and processes to really cement the introduction.

- The items on this list may also involve a referral commision back to you for successful referrals.

The Extra Mile: Going Above And Beyond

- Some mortgage broking firms go “the extra mile”. They cross-sell a broader range of services associated with a house move, such as cleaning and removalist services.

- In my own practice, this feels too far removed from the core loan transaction – so I don’t offer them myself.

- However, if you get very good at co-ordinating the whole home-buying experience, these may be potential add-ons.

Expert Opinion: How Do You DIVERSIFY Without DE-FOCUSING?

BrokerEngine co-founder Will Swayne has assisted scores of successful mortgage brokers with lead generation, marketing and sales process over the last 15 years. He answers the question, “How do you Diversify Without De-Focusing?”:

“Being perceived as a specialist usually allows you to hold a more focused marketing conversation with prospects. The result is a stronger pipeline of new prospects who understand and want what you do.

As you add more services, the risk is that you start to look like more of a “financial supermarket” and less of a specialist in a specific area.

This can hurt your ability to attract clients for your core offerings.

The solution is offering to MARKET only your core offerings, but CROSS-SELL your other options to clients who are already on-board.

This way, you don’t defocus your client efforts, while still delivering the benefits of diversification.”

Cross-Selling Tips and Strategies: Making Referrals Successful

Many mortgage brokers (myself included) have had an experience like this:

- They dabble with introducing additional products or services.

- Despite a number of attempts, the referrals don’t seem to “take”.

- So, they go back to offering “home loans only”

One possibility is that they’re genuinely better off being a single-service provider.

Another is that they were going about the process of referring clients all wrong.

When I started, I was indeed not referring in the right way.

What I’ve since discovered is that successful cross-selling is a combination of MINDSET, PROCESSES, TOOLS and SCRIPTS.

Cross-Selling Mindset

This presentation by US marketing guru Jay Abraham explains “The Strategy Of Pre-Eminence”, a belief that it is your moral obligation to provide every client with the very best solution possible:

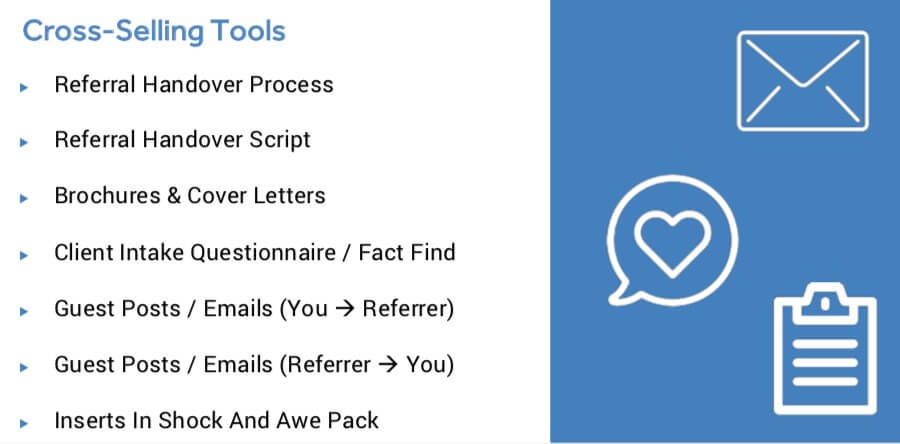

Cross Selling Processes, Tools & Scripts

To cross-sell successfully, you need the right processes, tools and scripts.

These enable you to deliver the right message to the right prospect at the right time in the right way.

Here’s a brief overview of some of the options:

- Referral Handover Process – a standardised process for handing over a referral from you to an allied professional (for example, a financial planner). If you fumble the handover, the referral usually comes to nothing.

Below is one simple framework (keep in mind you need the systems and processes in place to actually ensure this happens):

- Referral handover scripts – this means the exact words you say to a prospect when introducing another service.

Some brokers feel awkward introducing a third party.

And if you feel awkward, you probably come across as awkward to the client.

So it’s important to be able to confidently introduce a service and propose the next steps. Practicing and rehearsing actual scripts is the best way to gain confidence. - Brochures and cover letters – marketing collateral covering the range of services you offer can come in handy.

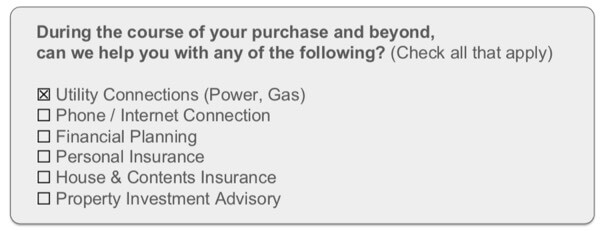

- Client intake questionnaire / fact find – this is one place where it’s easy to ask about other needs that you may be able to satisfy. Here’s one suggested question to include:

- Guest posts and emails – where you create content for your referral partners’ websites and/or email lists – and they do the same for you. This is a very powerful way to reach new clients.

- Include inserts in your Shock and Awe Pack – your Shock and Awe Pack is a package of materials you send to new prospects. Adding appropriate information about some of your related offerings may be a good idea.

In Conclusion

The business case for cross-selling and income diversification is stronger than ever before.

Clients expect a more comprehensive service and brokers are looking to build a tighter relationship with clients.

Providing you have the right processes in place, diversified income streams are a solid opportunity.

I hope you’ll try some of these tips and let us know how you get on.