Many mortgage brokers tend to put a lot of emphasis on lead generation and sales conversion, while downplaying the importance of lead management.

Good lead management means making the most of every sales lead and ensuring that opportunities never “slip through the cracks”.

In this article we review data-driven lead management best practices and also provide you with mortgage broker-specific automation examples for implementing bulletproof lead management in your practice.

Let’s get started!

What Is Lead Management?

Lead management is the process of connecting lead generation to sales. It involves techniques such as lead response, persistence, qualification, and nurturing to improve the value of leads in the sales process.

3 Data-Driven Lead Management Best Practices

With trillions being spent on marketing and lead generation every year, a lot of research effort has gone into establishing how to maximise the value of that marketing.

This lead management infographic from

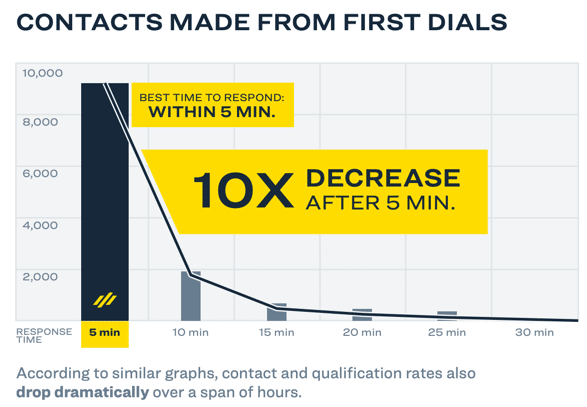

#1. Respond To Leads Within 5 MINUTES if Possible

Research shows that a sub-5 minute response to inbound leads is your best bet for contacting a prospect on the first attempt.

If you wait 10 minutes, your chances of contact on the first attempt decrease by 10 TIMES.

ACTION STEPS FOR MORTGAGE BROKERS:

- Where possible, empower your Client Service Manager or other “first responder” to jump on new leads as a matter of urgency.

- If you are responsible for responding to leads directly, it’s not always possible to drop what you’re doing and call a lead. But when you are available, a rapid response is most effective.

Example Lead Management Automation Workflow

Here’s a sample lead management workflow to help facilitate a fast response and ensure leads don’t slip through the cracks:

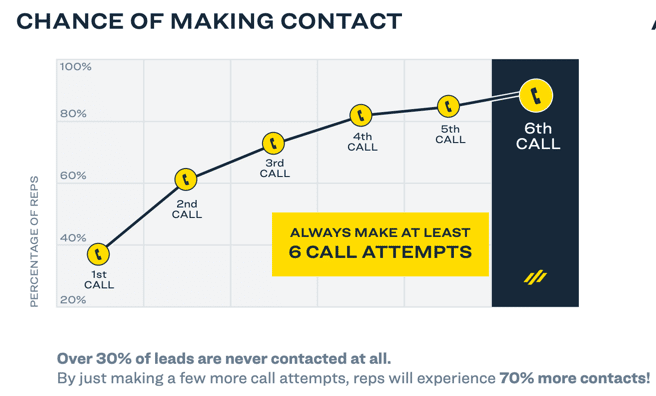

#2. Be Persistent With Lead Followup (6 Calls / 12 Touches Is Optimal)

Research also shows that most companies give up on leads too soon.

It turns out that 6 phone calls is the optimal number of attempts if you want to maximise your contact rate (without getting into diminishing returns).

- A mix of phone calls / emails / text messages works best.

- Keep track of lead followup in a trusted workflow system such as BrokerEngine.

- Follow up at the best time of day where possible (see next section).

#3. Attempt Lead Followup At The Optimal Time Of Day and Day of Week

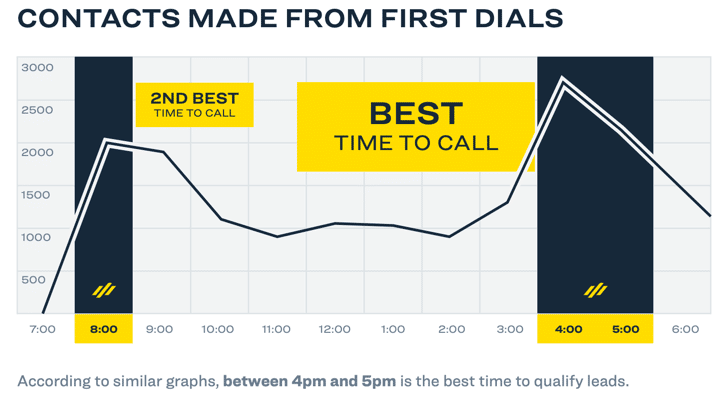

The research also reveals that some times of day are better than others for making contact.

The golden time is 4pm to 5pm (although this may be more suited to a B2B audience). If you’re dealing with consumers, you may also see good results at 8am to 9am, and also just after work, around 5pm to 5.30pm.

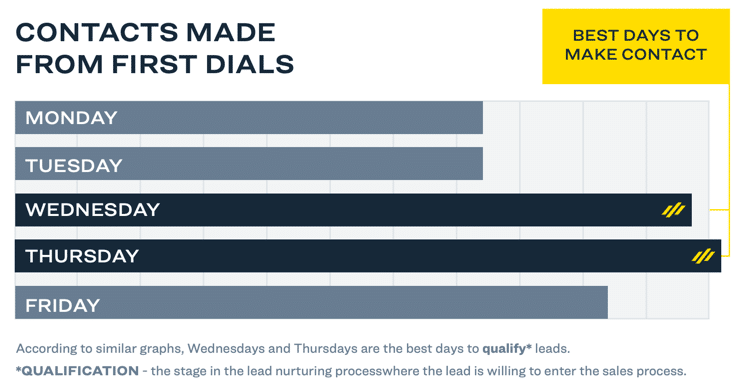

While we’re discussing optimal contact times, some days of the week are better than others. Wednesday and Thursday should definitely be top of your list for callbacks:

Most Companies Are Weak In Lead Management!

Research proves that many companies are weak in the area of lead management. This provides you with an easy opportunity to differentiate yourself.

Just look at these industry norms:

- Speed of Response: The average phone response time is 44 hours. The optimal phone response time is 5 minutes.

- Persistency of Response: The average number of “touches” is 4.5 touches. The optimal number of touches across phone/email/SMS is 12 touches.

- Phone Response: 30% of leads are not responded to at all! The optimal approach is to….actually respond 🙃.

Conclusion and Next Steps

We get it: lead management isn’t the most exciting aspect of marketing and new business generation.

However, it is one area in which it is easy to systemise and deploy best practices.

Not every lead will be contactable, and not every prospect will do business with you, but it’s your job to get the best results from a given batch of leads.

Hopefully this article has given you some quick wins you can put into practice this week. And if you could do with a more robust system to streamline and automate lead management in your practice, we invite you to check out the latest demo of BrokerEngine software.