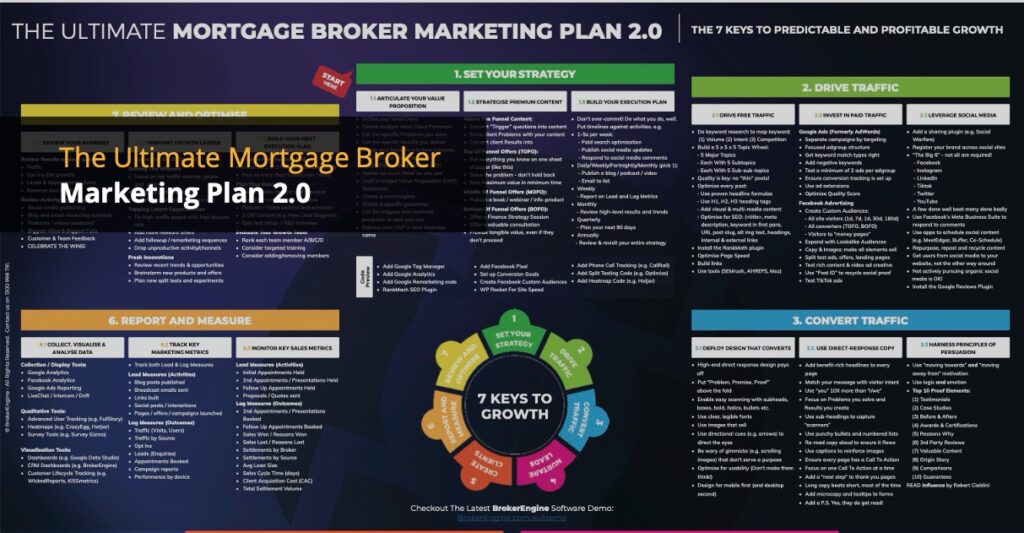

If you’re serious about mortgage broker marketing, then you need a marketing plan that is comprehensive, proven and practical: this is that plan. Click below and “Save as…” to download your own copy (no email address required), and read on to learn more about how to use this plan to grow your practice:

This is the marketing plan I’ve been using to help some of Australia’s most successful mortgage broking firms plan, track, execute and scale their marketing over the last 15+ years.

New In Version 2.0: I’ve updated the graphic based on what’s working right now. The fundamentals have not changed (they rarely do). Here’s what’s changed:

- Added/emphasised strategies and channels that are more effective than they used to be.

- Removed or deprioritised tactics that fall on the wrong side of the effort/reward equation.

- Updated our tool/software recommendations based on best features and value for money.

So let’s skip the small talk and dive right in…

~~~~~

1. Set Your Mortgage Broker Marketing Strategy

A marketing strategy is simply a framework and plan to get the marketing job done.

I believe the job of marketing is RESULTS, measured in the form of:

- Sales Leads

- Appointments

- Sales

- Lodgements

- Settlements

- Client Referrals

- Trail Commission Growth

- Client Retention and Repeat Business

And here are THREE sub-categories of marketing strategy you need to get in place:

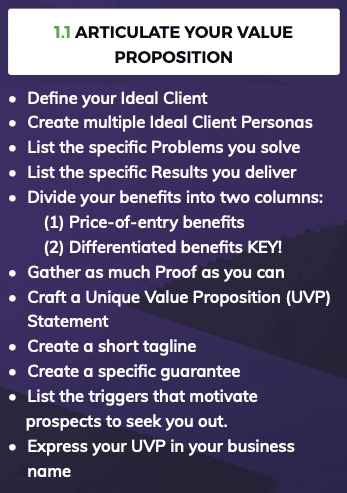

1.1 Articulate Your Value Proposition

Articulating your Unique Value Proposition or (UVP) is to summarise succinctly how you are different and more desirable than any other broker in the eyes of your target prospect.

The key words are: “YOUR target prospect”. If you know WHO you can help the most, you can tailor your communications and processes around helping that prospect more effectively than other brokers.

For more info, check out the Unique Value Proposition Formulation Method I use to create UVPs that work.

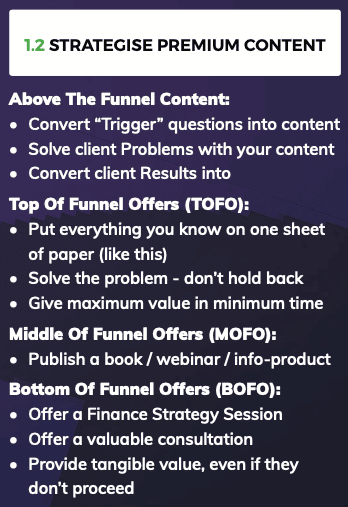

1.2 Strategise Premium Content

Premium Content is your most valuable marketing content that you use to progress potential clients through your mortgage broker marketing funnel. This includes:

- Top Of Funnel Offers (TOFOs): problem-solving content that is valuable enough for prospects to hand over their email address in exchange for access.

- Middle Of Funnel Offers (MOFOs): content suitable for “marketing-qualified leads”, that creates a bridge between the prospect’s situation, and how you can assist them.

- Bottom Of Funnel Offers (BOFOs): content and offers designed to get prospects to put up their hand and engage with you in a buying conversation.

Once your premium content and offers are locked down, you can focus your traffic generation efforts on pumping prospects into the top of your funnel.

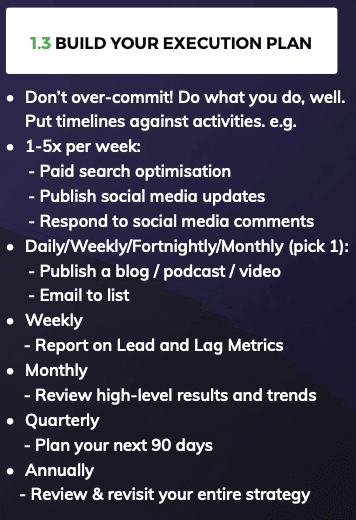

1.3 Build Your Marketing Execution Plan

Your Marketing Execution Plan is your 90-day schedule of marketing activities designed to create the results you desire.

There is a “natural rhythm” for many of the activities:

- 1 to 5x per week: tactical activities such as paid search management or social media publishing.

- Weekly/Fortnightly/Monthly (Pick 1): publish valuable new content and tell your email list about it.

- Weekly: review Lead Metrics (i.e. Activities) and Lag Metrics (i.e. Results) for the week prior.

- Monthly: review high level results and trends.

- Quarterly: plan your next 90 days.

- Annually: review and revisit your entire marketing strategy.

It’s not expected that you’ll do everything here yourself. You will usually use a mix of in-house and external / agency resources to get your marketing done.

2. Drive Traffic

So you have the bones of your marketing strategy in place – well done.

Now all you need is traffic — and lots of it — to pour into the top of your marketing funnel.

Online traffic generation for mortgage brokers is relatively competitive. This is because it works!

Many mortgage broking firms are active online, and many are after the exact same ideal prospects that you are.

All of this drives up competition for traffic.

The good news is that most mortgage brokers aren’t executing this marketing plan 🙂

So let’s look at the three main pillars of traffic generation and how to execute them correctly:

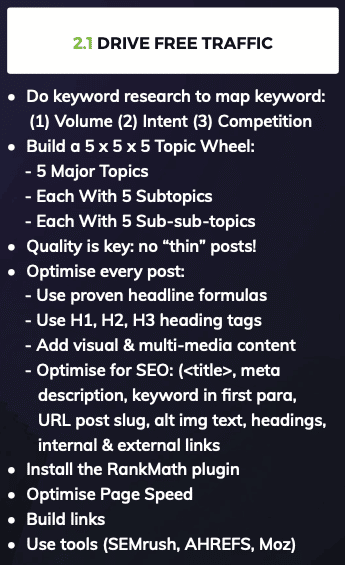

2.1 Driving “Free” Organic Traffic

Everyone wants to be “Number 1 On Google”. The question is, how do you get to number 1 on Google?

This is a VERY big topic, but the short answer is to create quality content that matches the search intent of prospects who are looking for answers on what you offer.

Step 1 is to use a keyword research tool such as SEMrush, AHREFS or Moz to understand the keyword marketplace and get an understanding of keyword volume, user intent and competition.

Step 2 is to create high quality content that provides insight and answers into the keyword queries you find.

Step 3 is to optimise every post from an on-page SEO perspective. If you use WordPress, a plugin such as Yoast SEO or Rank Math will come in handy.

Step 4 is to build backlinks to your content.

Step 5 is to email your list to tell them about your new content, so it does “double duty” as both fodder for search engines, and nurturing content for your email list.

Is SEO easy? Nope.

But to help you get traction, we published a mortgage broker SEO case study here about the exact strategy one broker used to generate 397 new client enquiries in 12 months via SEO.

Content-driven SEO is relatively difficult, technical and time consuming to get right. But the long-term benefits are worth it.

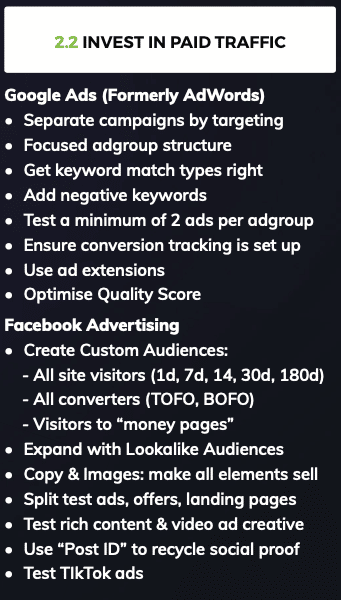

2.2 Invest in Paid Traffic

If SEO is like owning your own home, then investing in paid traffic is like renting.

With SEO, you get to “own” the results of the traffic you generate. But with paid traffic, you only get the benefit as long as you keep paying.

That may not sound like a great deal, but buying paid traffic can be both profitable and scalable when done right.

For mortgage brokers, the most effective paid traffic platforms are Google Ads (formerly AdWords) and Facebook Ads.

It is very difficult to run a profitable paid ads campaign as a generalist broker because you are competing head to head against banks, lenders and large broker groups who can afford to throw lots of money at their advertising campaigns.

You are most likely to succeed if you have a compelling UVP in a niche market.

Some brokers have even managed to build large audiences on Tiktok. This takes a little more creativity, but it has the potential for you to build trust and establish a kind of celebrity for followers.

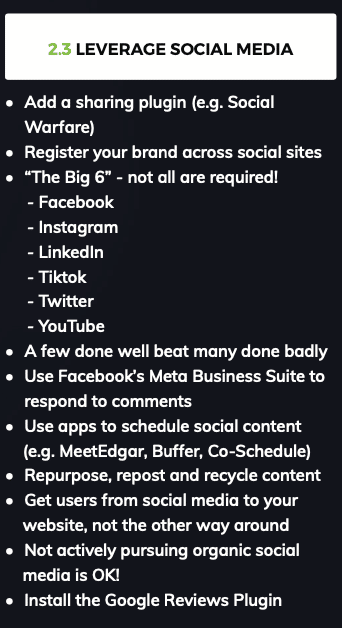

2.3 Leverage Social Media

Notice the suggestion is to LEVERAGE social media. What we mean by this is to use social media as an amplification tool to spread your marketing message far and wide.

Our experience has been that social media marketing done in isolation — i.e. in the absence of a solid marketing funnel and other content — is a complete waste of time.

3. Convert Traffic

Traffic generation receives most of the glory when it comes to online or digital marketing strategies.

But traffic without conversion is just a cost. In fact, traffic is always a cost until it converts. Then, it transforms into an investment.

There are three key pillars in your quest to convert traffic into opt-ins, leads and enquiries:

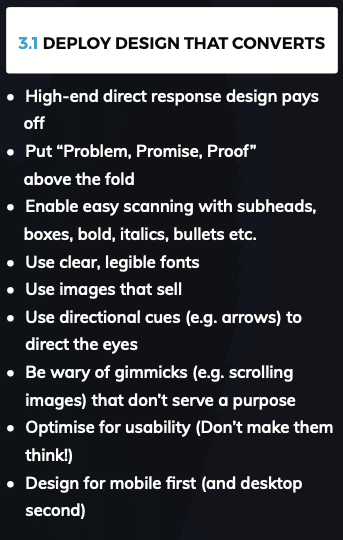

3.1 Deploy Design That Converts

“Direct response” graphic design pays off. In other words, it has the potential to convert browsers into sales opportunities and then clients.

Key principles of graphic design are:

- Optimise the space “above the fold” of your website (i.e. on the first screen that the user sees when they visit your website).

- Specifically, you want your “Problem, Promise, Proof” messages to be sitting above the fold (refer to this article).

- Make your content easy to read by using headings, sub-headings, bullets, numbered points, legible fonts etc.

- Design for every device – but especially mobile! Check your site on mobile to confirm it works as expected.

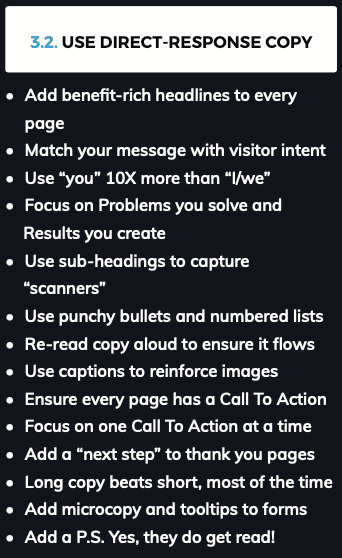

3.2 Use Direct Response Sales Copy

Direct response sales copy is marketing copywriting that asks for action. It asks prospects to opt-in to your email list, make and enquiry, or give you their business.

Some of the key principles of direct-response copywriting include:

- Using benefit-rich headlines and sub-headlines.

- Remain 100% focused on the desires of the prospect and the problem you’re solving.

- Explain how your method of solving the problem is faster, easier, cheaper, more effective than other alternatives.

- Ensure every page has a Call To Action (i.e. an instruction to take the next step).

- Make everything simple. Don’t make the prospect think.

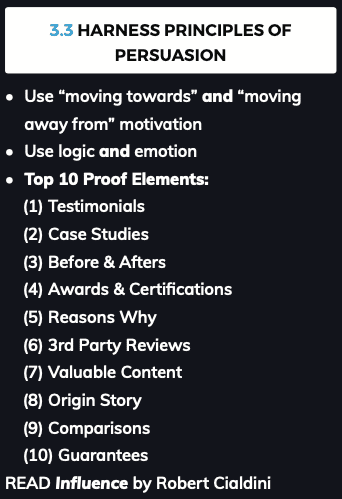

3.3 Harness Principles of Persuasion

Wrapped around your design and copywriting should be time-tested principles of psychological persuasion.

One of the best primers in this field is Robert Cialdini’s Influence: The Psychology Of Persuasion.

Another important pillar of persuasion is to employ marketing proof elements to reinforce your marketing message.

The “Top 10 Proof Elements” are provided in the image above. If you want to dive deep, this Infographic featuring 42 Marketing Proof Elements should be your next stop.

4. Nurture Leads

There is usually a BIG gap between the number of people you’ve come into contact with (or are on your email list) — and the number of people whom you count as clients.

Closing that gap between prospects and clients is one of the biggest marketing opportunities for mortgage brokers.

And that’s where lead nurturing comes in.

Lead nurturing is the intentional process of engaging with prospects at every stage of the buyer’s journey with relevant content designed to progress the prospect to the point where they become a paying customer or client.

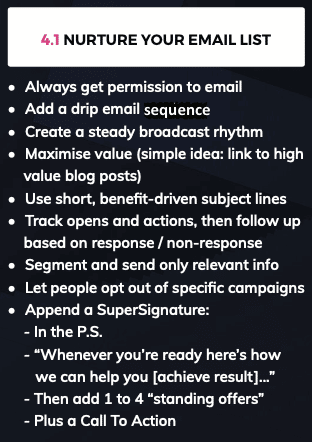

4.1 Nurture Your Email List

Email marketing is, hands down, the most effective lead nurturing tool for mortgage brokers.

Relevant contact with your prospects via email is one of the best ways to become “top of mind”.

One simple method is to simply publish blog content on a regular basis (see above), and then email your list, directing them to your blog.

That way, you’re always bringing value to your interactions with potential clients.

Focusing on value is great, but you also need a mechanism for people to respond to you when they’re ready for your help.

One of the best ways I’ve seen to tie in your marketing message in an unobtrusive way is Dean Jackson’s Super Signature Strategy.

You simply append your Super Signature to every email and watch the leads roll in over time.

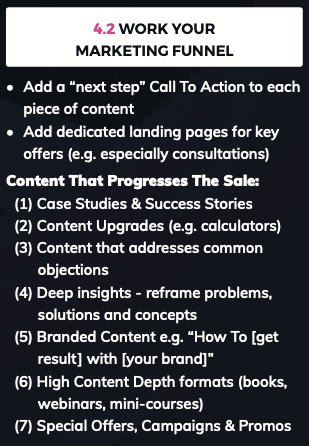

4.2 Work Your Marketing Funnel

There is a risk with lead nurturing of simply “educating the prospect to death” with more and more content.

Yes, mortgage broking clients need education, knowledge and insights, but ultimately they need the best loans and lending structure for their situation.

And certain types of content is better than others at creating a bridge between knowledge and action – outlined in the image above.

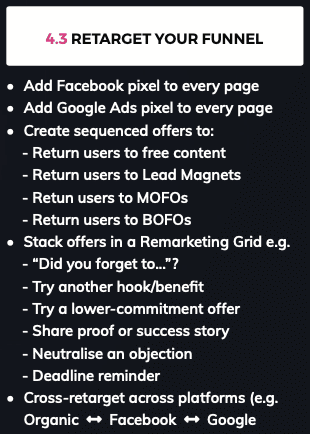

4.3 Retarget Your Funnel

You’ve probably experienced advertising that appears to “follow you around” the internet. This is known as ad retargeting (also called remarketing).

The two major retargeting platforms are Google Ads and Facebook Ads.

By adding the relevant retargeting pixel to your website, you can create relevant offers to bring prospects back to the next step in the buyer’s journey.

5. Create Clients

So you got a lead (maybe by following one of these awesome mortgage broker lead generation ideas).

The hardest part has been done. Now you need to transform that lead into a profitable client using the right lead management and sales conversion strategies.

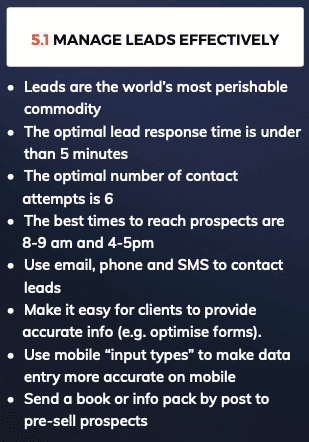

5.1 Manage Leads Effectively

It’s always useful to remember that leads are the world’s most perishable commodity.

In this age of instant online answers, if a prospect makes an enquiry with 3 mortgage brokers simultaneously, the one who calls the prospect back first will be in pole position to get the business.

If you don’t get a response from new leads, following up diligently (at least 6 times) will maximise your chance of booking the appointment.

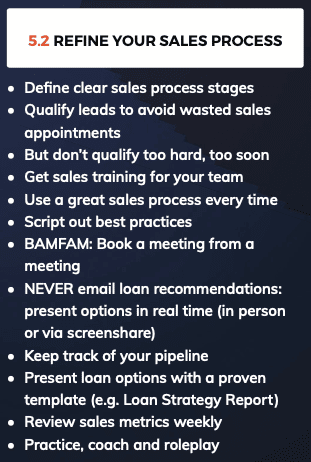

5.2 Refine Your Sales Process

Making sure you have an efficient, effective and standardised sales process is one of the keys to maximising the value you can provide in the marketplace.

Many mortgage brokers tend to “wing it” when it comes to sales.

They get good results with warm leads, or with a very agreeable prospect, but find it harder to close more challenging deals.

Not every lead is closeable and not every deal is doable, but with a strong sales process, you can maximise your sales results from a given batch of leads.

In addition to the “soft skills” component of selling, you also need the right mortgage broker CRM software to keep track of your pipeline and ensure deals are progressing.

The Ideal Mortgage Broker Sales Process

How To Convert Shy Prospects Into Lifelong Clients, Step-By-Step

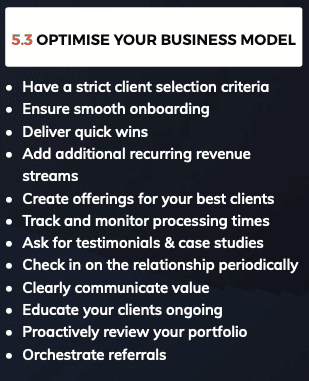

5.3 Optimise Your Business Model

Optimising your mortgage broker business model is all about ensuring a smooth client experience.

After all, marketing and lead generation requires a significant investment of time and money. So you may as well get the best possible Return On Investment.

Some of the key factors to get right are to:

- Ensure your loan processing systems are smooth and client-friendly.

- Not rely on loan commissions alone. Instead, consider adding additional income streams into your client journey.

- Gather feedback and testimonials on an ongoing basis.

- Proactively review every client’s situation on an ongoing basis (not just when they ask).

- Orchestrate client referrals (not just expecting them to happen).

6. Report and Measure

What gets measured gets managed. So the question has to be asked: how are you currently measuring your marketing, sales and growth activity?

Are you able to get the data you need when you need it? More importantly, are you able to USE your sales and marketing data to drive better results?

Here are the disciplines you need to master in order to turn your metrics into results:

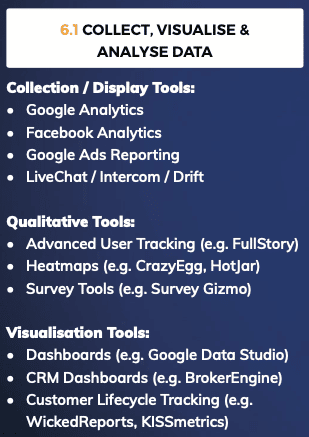

6.1 Collect, Visualise & Analyse Data

The first step is to have the right data collection tools in place.

There are lots of nuances, but the core principles are to have data collection tools that track:

- Your website activity (e.g. Google Analytics, heatmaps)

- Paid advertising

- Live chats and other pre-sales interactions

- Sales activity

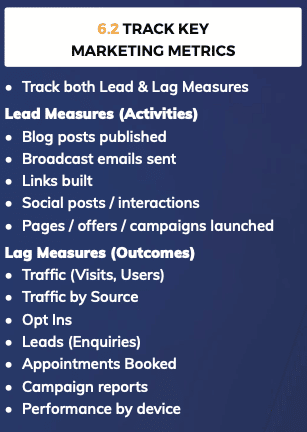

6.2 Track Key Marketing Metrics

Most mortgage brokers only keep track of marketing Lag Measures.

Lag Measures are things that you measure once they’ve already happened. Examples include website traffic; leads generated; and appointments booked.

These are important, but it’s also critical to report on Lead Measures.

These are the ACTIVITIES that influence and predict the lag measure results. Examples of lead measures include: number of blog posts published; number of emails sent; number of campaigns launched.

If you execute your Lead Measures (activities) consistently, the Lag Measures (results) will follow.

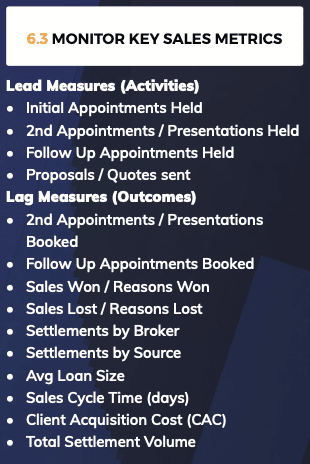

6.3 Monitor Key Sales Metrics

Marketing is everything that happens up until a lead is generated. And Sales is what happens after the lead is generated.

Lead Measures here are ACTIVITY: appointments held, recommendations made, loan proposals generated etc.

And the Lag Measures are RESULTS: especially the number of deals won, the average loan size, and average settlement volume per month.

7. Review and Optimise

Too much “doing”, in the absence of reviewing and re-aligning, causes wasted effort and mis-allocation of resources.

At least quarterly, but preferably monthly, we recommend that brokers review their marketing, sales and growth activity to ensure your growth path is on track.

7.1 Review Your Numbers

First up is to review the key numbers against goals. This is all the fun stuff like:

- Traffic

- Email Opt-ins

- Leads, Enquiries and Appointments

- Sales, Revenue, Profit and Cash

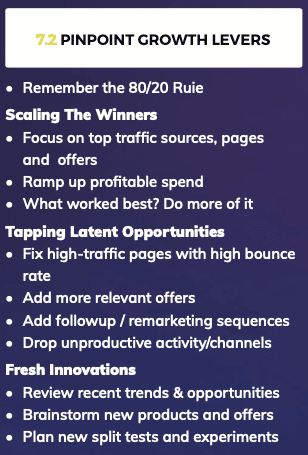

7.2 Pinpoint Growth Levers

Now that you know what your results are and what worked, it’s time to pinpoint the growth levers that are going to propel you forward.

You can’t do everything. Instead, focus on the big 80/20 levers that are going to drive the most results.

Scale the winners, cut the losers, and innovate new ideas to test over the next quarter.

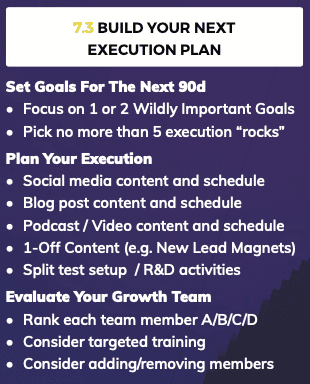

7.3 Build Your Next Marketing Execution Plan

Finally, it’s time to build your next quarterly execution plan.

The key here is FOCUS. Concentrate on just 1 or 2 goals you want to make happen. These are called Wildly Important Goals (or WIGs).

(Studies show that when companies focus on just 1 or 2 things, they tend to achieve them. But when they have many goals, they tend to diffuse their energies and miss most if not all their targets.)

Next, choose no more than 5 execution “Rocks”. Rocks are chunky initiatives (e.g. “Publish 2 articles per month on our blog”).

Pick up to 5 and do them well. Don’t add too many Rocks, for the same reason as not picking too many Goals.

Finally, put together your content and marketing plan for the next 90 days, then repeat the process all over again…

What Are The Next Steps?

Congratulations – you made it!

Now you might be wondering what do do next.

I do hope you’ll download a copy of the marketing plan above, print it out, stick it on your wall, and start using this to grow your practice.