Mortgage brokers consistently rate client referrals as one of their favourite sources of new business, and it’s not hard to see why:

- When a client refers you, that’s the best compliment of all

- Client referrals are practically zero cost

- Referred clients are usually the easiest and the fastest to close

The question then becomes: how do you drive more mortgage referrals?

It’s much more than just popping an “I appreciate your referrals” footer in your email signature.

You need to actually “bake in” referral generation into your business processes. Here are the referral strategies and approach I used to become a referral only practice in 3 years:

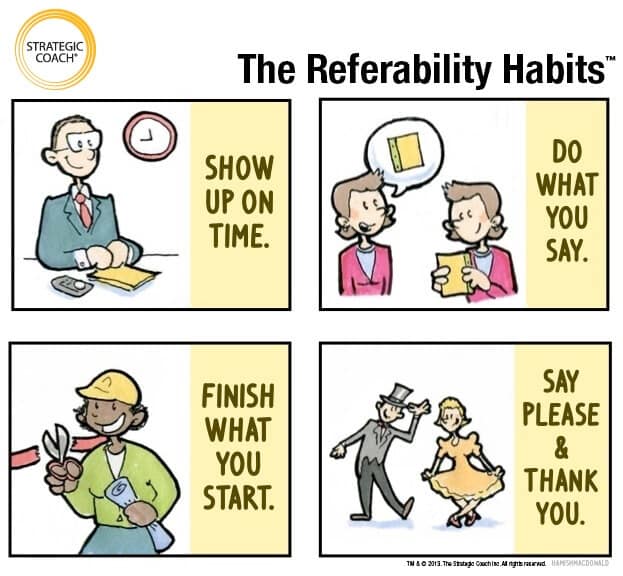

The 4 Referability Habits

The 4 Referability Habits is a framework from Dan Sullivan of Strategic Coach. They are a set of habits that make you easy to refer.

These basic courtesies might seem obvious, but it’s surprising how often busy brokers skip them. In so doing, they jeopardise relationships and lose referral opportunities in the process.

Let’s unpack each habit in more depth and explore how they relate to mortgage broking practices in particular.

Habit #1: Show Up On Time

Sounds simple (and it is), but it’s important to ensure you’re on time to client meetings and appointments.

Showing up on time suggests you’re reliable.

Quick story: a friend of mine was interviewing accountants. One accountant seemed to have the best technical skills, but he showed up late to all three appointments. My friend thought, “If he always arrives late, what chance does he have of filing my tax returns on time?” My friend decided to go with another firm.

The same principle applies to mortgage brokers. People only refer people whom they think are reliable and who won’t let them down.

Habit #2: Do What You Say

The second habit is to do what you say. To do this, you need standardised processes. You need to keep clients informed. And you need to keep unexpected surprises to a minimum.

Think of a Toyota factory. Every car that rolls off the production line is more-or-less identical to the last: built on time, to spec and to budget. The people at the factory aren’t suddenly surprised by a pink fluffy unicorn rolling off the production line when they were expecting a Prius.

That’s what your processes have to be like. If you want to drill into the detail, here are two articles on the mortgage broker sales process and ideal loan processing workflows.

This habit is probably the most important of the four. Providing a great client experience is critical to people referring you. The referrer needs to feel confident they’re sending their friend to a “safe choice”.

Habit #3: Finish What You Start

The third habit is to finish what you start.

So if you say you’ll apply for pre-approval, make sure it’s done promptly and thoroughly. If you say you’ll review your client’s position annually and keep them up to date with the latest offerings, make sure you follow through.

The moment you leave a client hanging, they’ll start to lose trust in you.

Habit #4: Say Please & Thank You

The fourth and final habit is to say please and thank you.

This is the part that most people think of as “referral marketing”.

Saying please means to to ask for the referral at strategic times — keeping in mind that if you haven’t executed the first three habits properly, your request may fall on deaf ears.

Some ways to do this include:

- When a client is unconditionally approved

- Just after a loan settles

- Yep, in your email signature

- During / after Loan Reviews

- In your regular client newsletter

The last point warrants more explanation. For many years I’ve published a bi-monthly print newsletter for my clients and referral sources.

Among other things, my newsletter both asks for referrals from clients AND thanks clients who gave me referrals. Thanking clients in this way:

- Publicly acknowledges people who referred, and

- Signals to OTHER clients that, “this is a broker who is referred often”, giving them tacit permission to do so too.

While we’re on the subject of “thank yous”, you may have wondered how you should thank referrers.

- Should you send a gift?

- And if so, should you send a gift for the referral, or for a successful outcome?

Here’s how I do it:

When I receive a referral from a client, a reminder is triggered from within BrokerEngine to send a referral thank you gift.

The one I like best is a pair of movie tickets, because it’s easy to mail, and is appreciated by most people.

I send a gift to thank the client for the referral, regardless of loan outcome of the referred party.

The referrer isn’t in control of the loan outcome, and I want to encourage them to keep sending their friends my way. If I play the averages, it won’t be long before I close a deal anyway.

Compared with the cost of, say, digital lead generation, “thank you gifts” are a very modest investment indeed.

Tracking and Rewarding TOP Referrers

Like most other things in business, referral behaviour tends to follow the 80/20 rule.

80% of your referrals will come from 20% of your clients. Your distribution may be even more skewed. It wouldn’t be unusual for 90% of referral activity to come from just 10% of clients.

So it makes sense to do something extra for your Power Referrers. You really don’t want to lose them as a client! And you want to recognise them and encourage them to keep referring.

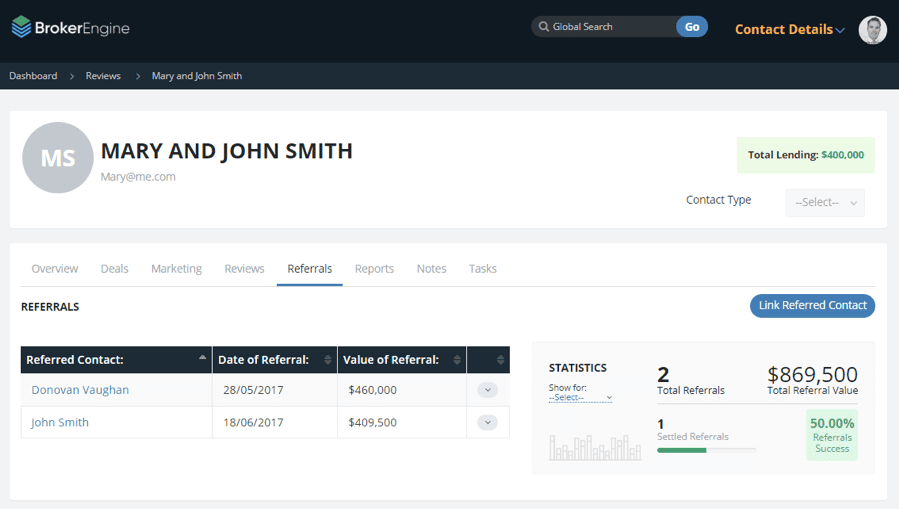

Step 1 is to understand who your Power Referrers are. Within BrokerEngine, we provide a Referral Activity Report within each contact record. This shows how many referrals the client generated, who was referred, and the loan outcomes.

Step 2 is to refer to this information in your interactions and conversations with clients. For example, just before doing an annual review with a client, I’ll scan their referral activity. That way I can refer to their friend(s) in conversation and get another opportunity to thank the client. In doing so, the client is reminded of how good it feels to refer a friend to a good provider.

Step 3 is to periodically do something extra special for top referrers. It’s not unusual for your top 10 referrers to supply half your client referrals during a given year. I recommend doing something special for them. For example, sending them a generous Christmas hamper, thanking them again and recognising them as a top referrer.

Apart from the fact that it feels good to say a sincere “thank you”, it doesn’t hurt to reinforce the behaviours you want to see continue.

In Conclusion: Making Client Referrals Systematic

The main thing is to make referral marketing systematic within your practice so that it happens every time.

That’s why we baked in the appropriate referral generation steps into the workflows within BrokerEngine to ensure they “just happen”. (You can take a demo of the software here, if you haven’t already).

The rest is up to you. When you provide a great client experience and follow the 4 Referability Habits, the business will follow.

The ULTIMATE Mortgage Broker Marketing Plan

How To Create, Execute and Optimise A Marketing Plan That Gets RESULTS.