Mortgage broking firms that combine the ideal mix of people, processes and technology are achieving faster, better and more predictable results with outsourcing.

As little as five years ago, the way many mortgage broking firms went about outsourcing to hubs like the Philippines might be best described as getting someone at a desk and hoping for the best.

We now know this isn’t enough. (This was one of many outsourcing mistakes I learnt the hard way!)

Mortgage brokers who are achieving the best outcomes with remote and offshore teams have learned to combine people, processes and technology effectively. Here are some of their best practices:

People strategies

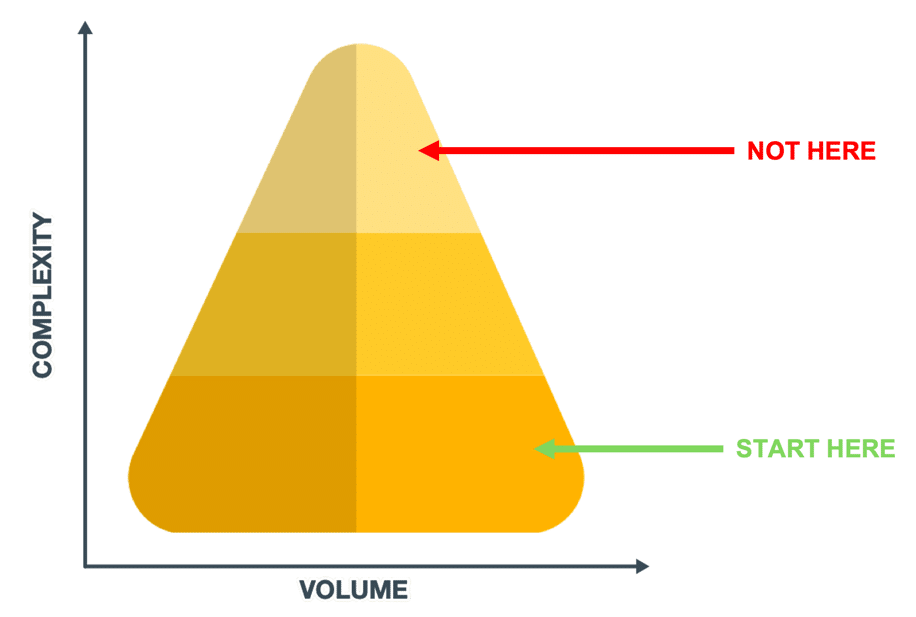

Hiring for quick leverage

While brokers may like the idea of hiring very experienced and bulletproof ‘unicorns’, the fastest traction comes from outsourcing less complex, higher-volume, process-driven tasks such as data entry, document collection and loan tracking.

Screening for success

Potential candidates can be screened with psychological evaluations and aptitude tests to dramatically increase your chance of finding a perfect fit. Caitlin Stuart from outsourcing firm Affordable Staff says:

“Screening tests are one of many tools we use to ensure team members are well-suited to the industry and the firm they’ll be working with.”

Supervision and training

Hiring is only the first step — staff sharpen their skills faster with on-site supervision from managers and trainers who are familiar with the mortgage broking industry.

Process secrets

Standardised workflows

This is essential to communicate requirements, create efficiencies and deliver outcomes every time.

Unless a broker has a quick and accurate way to hand over work, any potential efficiencies get swallowed up in explaining, clarifying and fixing. Workflows enable a team to focus on value- adding tasks.

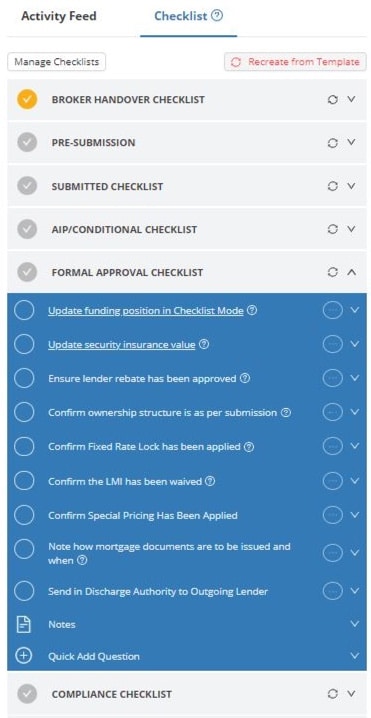

Quality assurance

Deal-specific checklists should be matched to every client file to ensure requirements aren’t missed and quality is maintained.

Continuous improvement

Building processes is never a ‘one and done’ exercise — all team members should be empowered to tweak and improve processes regularly.

Technology leverage

Specialised workflow platforms

While aggregator software tends to focus on lodgement and compliance, workflow platforms such as BrokerEngine are designed to enable efficient collaboration and teamwork.

Communication tools

Video conferencing, team messaging and knowledge capture tools help keep your team on the same page. (Here’s a list of our 43+ Favourite Mortgage Broker Productivity Tools.)

Train for excellence

It’s common to accumulate powerful tools and software that you’re only using to a fraction of their potential. Training to help your team maximise the value of your tools is just as important as signing up to the tool itself.

Next steps

The good news for brokers looking to support in-house team members with offshore staff is that you no longer have to reinvent the wheel. There are now well-established best practices that you can plug into to make your outsourcing journey a successful one.

By adopting these nine best practices, your chances of success go way up. Depending on where you are now, you may wish to consider these next steps…

- If you’re weighing up different loan processing options, read Loan Processing Options: Do It Yourself, In-House, Outsourced or Offshore?

- If you’re interested in outsourced loan processing and want a recommendation, feel free to contact us and we’ll be happy to point you in the right direction.

- If you’re already outsourcing (or considering it) and want to dramatically streamline delegation and workflow, book a free demo of BrokerEngine software today.