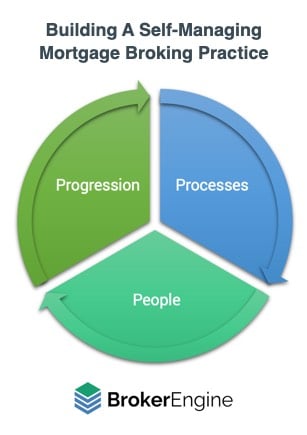

At BrokerEngine, we define a self-managing practice as a mortgage brokerage that manages itself to greater growth. It’s a practice that can run smoothly and effectively — and even grow — when the principal broker isn’t there.

While not every broker aspires to a self-managing operation, many would like their practice to be less dependent on their personal efforts. Once you achieve that, the end result is more money, fewer hours and more extended holidays.

Table of Contents

Processes > People > Progression

We’ve seen a lot of mortgage brokers strive to achieve more freedom and autonomy in their practices. And we’ve noticed that success or failure usually hinges on getting three things right: Processes, People and Progression:

- PROCESSES: to really step back and let go, you need very detailed processes that define exactly how everything is done in your practice.

- PEOPLE: you need the right people in the right roles, with the right training and autonomy to do their jobs to a consistently high standard.

- PROGRESSION: this is the element that sometimes gets missed. Your systems are not static. They need to evolve with the changing market and improve over time, or else they will grow stale.

With this high-level framework in mind, let’s drill down deeper into 6 principles for building a brokerage that ultimately runs without you.

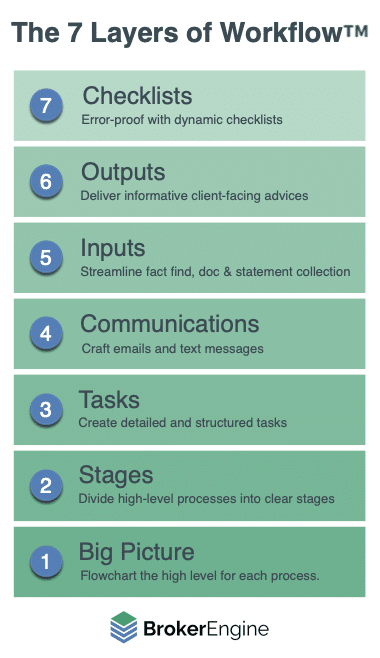

1. The 7 Layers Of Workflow™

Building deep processes involves much more than compiling a “Standard Operating Procedures” Manual. Multiple layers of systems are required, which we call the The 7 Layers Of Workflow™.

- Layer 1: Big Picture – High-level flowcharts that give your team context of how major processes work (e.g. lead management, sales, loan processing, maintenance and reviews).

- Layer 2: Stages – Distinct steps in each major process. For residential home loans for instance, this might include: “Get Supporting Docs”, “Prepare Deal For AIP”, “AIP Issued”, etc..

- Layer 3: Tasks – Specific actions to be completed at each Stage. Because mortgage brokers are constantly executing variations on the same broad theme, most Tasks can be templated to a high level of detail.

- Layer 4: Communications – Client-facing emails and/or SMS, voicemail broadcasts or phone scripts to be sent at each stage – ideally populated automatically using merge fields.

- Layer 5: Information In – Streamlining how you get information into your practice i.e. Client Fact Find, Bank Statement and Document Collection. (Hint: Email and PDF or Word Doc attachments are blunt instruments for collecting data, bank statements and documents.)

- Layer 6: Information Out – Client-facing Advice Documents over and above regular emails and text messages. Structured Advice Documents reinforce expertise, professionalism and efficiency in one tidy package.

- Layer 7: Checklists – Checklists are crucial. You can create the best systems in the world, but if your team don’t follow them, balls will get dropped. (And if you can’t verify they have been followed, it’s hard to “let go”.)

BrokerEngine software uses Dynamic Checklists™️ that only display relevant items for a given deal (and hide the ones that are not), making them quicker and easier to use. This means your team are more likely to actually use them.

2. Fireproofing vs Firefighting

Even if you map out your processes and workflows well, you may find you’re inundated with client emails and phone calls on a regular basis that prevent you from getting much done.

Fireproofing means building a process that means your clients will never call unless urgent. You do this by:

- Baking quality into your process (e.g. by briefing your loan processor in detail) so that fixes and rework aren’t required downstream

- Anticipating client questions before they are asked

- Eliminating surprises (e.g. tell the client that document X will be required at stage Y)

- Reducing errors or mistakes that cause delays

- Always advising clients what to expect so they don’t have to ask

- Delivering on promised timeframes (or proactively advising when you can’t)

- When mistakes do occur, fixing the system so they don’t happen again.

3. Systemise What DOESN’T Make Money

Most mortgage brokers are motivated to systemise the exciting and profitable things that make money (such as Deal Processing Workflows).

But it’s equally important to systemise the things that DON’T make money, such as:

- Variations

- Switches

- Progress Payments

That’s because these maintenance items cost you time and carry a high opportunity cost. Time spent doing these things prevents you (or one of your brokers) from writing your next deal.

4. Move Quickly, Touch Lightly

Does “Systemising Your Practice” sometimes feel like a “big lift” that distracts you from your business for 3 months or more?

The problem with the “Big Lift” approach is that it not only distracts you from your business for months at a time, but it is too heavy and unwieldy to keep updated in real time.

Processes that aren’t updated fail the Progression test. Maintaining processes should be so quick and easy that it can happen in real time, by:

- Recording a quick Loom video and adding it into a task or checklist

- Dropping in a quick email template

- Saving a BID note template for future reference

- Adding a checklist item (with or without display conditions)

It’s astounding how quickly these 5 minute systems interventions compound over time into an almost bulletproof Process.

5. Build For Redundancy

Many brokers invest in recruitment and training in order to get a team humming along with great efficiency and enthusiasm.

This works great… until it doesn’t. If one team member leaves, a lot of the knowledge can go out the door with them. Gaps in the process are quickly exposed.

That’s why I make it habit to always think, “If one team member leaves, how will the next team member know what to do?”.

This means creating robust Processes including:

- Loom videos

- Clear task descriptions

- “Too much detail”

The idea is to build your Processes right once, instead of “paying many times” by training each new hire from scratch forever.

6. Empower Your TEAM To Evolve Your Systems

A practice where the Principal is the sole “systems guru” is a practice where the principal can’t really let go.

So the final tip is to build a practice where there is a Culture of Systems. This is where team members are empowered and rewarded for:

- Creating documentation

- Recording a quick video

- Adding extra detail to a task

- Branching a general workflow into several specific workflows

In my practice, I’ve often found that errors and oversights are the fuel for creating more robust processes in future.

I don’t mind mistakes happening once, but I aim to ensure they don’t happen twice.

This final principle is all about building in Progression to ensure your practice is always getting better and better and never stagnating.

Conclusion and Next Steps

Many mortgage brokers love what they do and the impact they make… but that doesn’t mean they wouldn’t like to earn more, work less and make an even BIGGER impact. Who wouldn’t?

In this article we’ve covered 6 proven principles for building a practice that runs without you. It certainly doesn’t happen overnight, but by chipping away a little at a time, you’ll gradually build a practice that YOU control, and not one that controls you.

Would you like all your mortgage broking processes BUILT FOR YOU…for a tiny fraction of the cost of doing it yourself?

If building a practice that runs without you appeals, the tips in this article will certainly help.

While I have no doubt that if you put your mind to it, you’ll get there in the end, keep in mind that there may be 1,000+ hours of work involved to do it properly.

Those are 1,000 hours that you could use to either (A) write more deals (B) focus on growth or (C) enjoy more time on hobbies, family and friends.

The far cheaper and easier alternative is to just jump on board as a BrokerEngine user. When you sign up, we’ll give you all the foundational processes you need, done for you on day 1. From there, you can customise them even further if you wish.

With your processes locked down, you can focus on doing more of what you enjoy. To explore further, check out the latest BrokerEngine demo here.

Why reinvent the wheel when it’s already been done for you?