Unfortunately, a lot of great credit advice is never translated into action. Especially when brokers are forced to focus on compliance so much that their compelling credit strategy fades into the background.

And it doesn’t help matters when most credit proposal templates are about as appetising as dry twigs with a side of sandpaper.

This article explains a complete methodology for creating client-facing proposals and advice documents that are both compliant AND compelling – so you can spur more clients into action and grow your loan book faster and easier.

Don’t let your great credit advice fall into THE GAP to die. Follow the loan proposal method in this article instead…

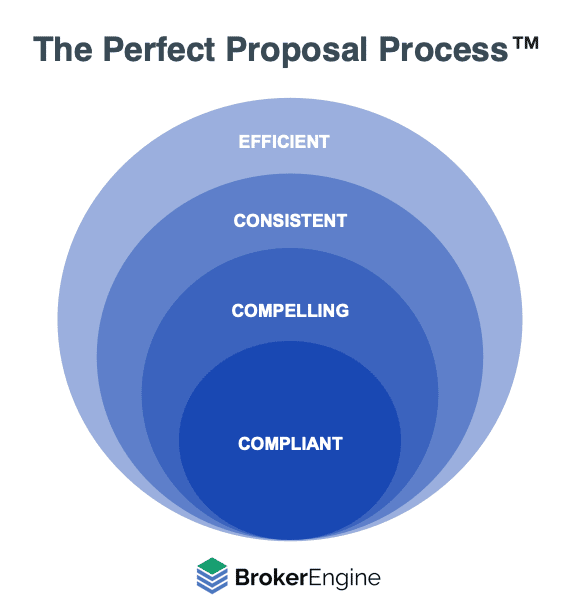

Introducing The Perfect Proposal Process™

The key to taking a client from advice to action is adopting a mortgage proposal process that is:

- Compliant: meets Best Interests Duty (BID) obligations and provides the client with a solid record of advice that minimises future queries and concerns.

- Compelling: gives the client the information they need to confidently move forward with your advice, without any “think-it-overs”.

- Consistent: delivers high adoption rates every time, for every broker (not just 1 or 2 star performers).

- Efficient: is time-efficient to generate, without cutting corners.

With these success criteria in mind, let’s look at the proposal format we’ve come up with…

The Ideal Mortgage Broker Proposal Template

We’re going to unpack a proposal structure that we have refined over many years. Brokers who use this format (in tandem with a solid overall sales process) report proposal-to-deal conversion rates of 95%+.

We recommend presenting your Proposal to the client in real-time (via Zoom or in-person), so you can address any questions on the spot. This is FAR MORE EFFECTIVE than emailing recommendations and following up.

Although this Proposal format can be automatically generated by BrokerEngine software (with customisations), this template is very effective, regardless of how you create it.

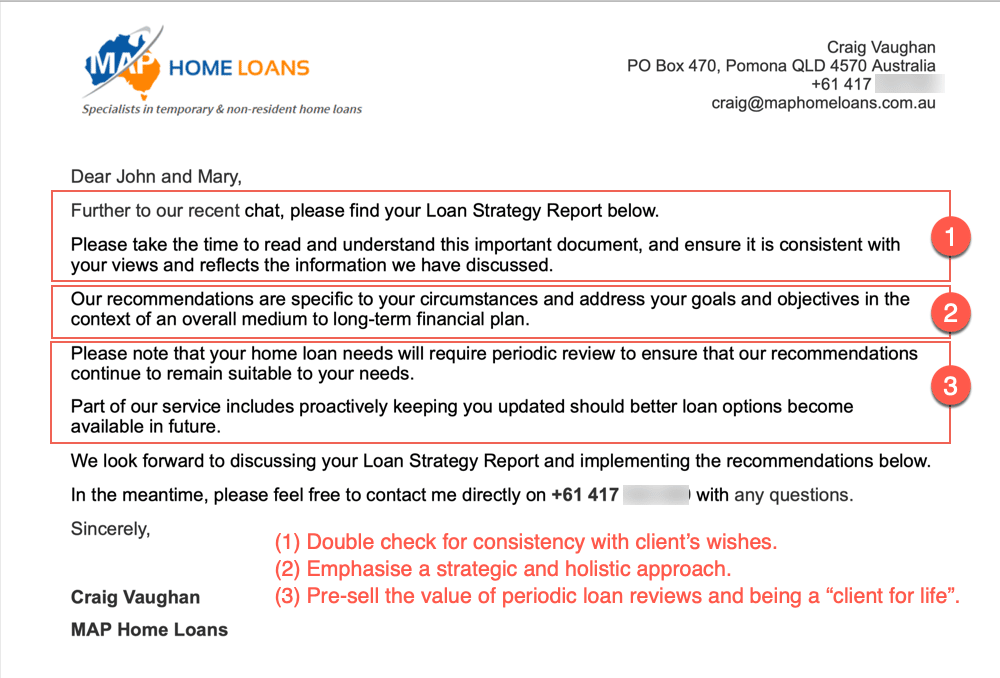

Preamble: Cover Letter

A friendly cover letter introduces your Proposal and:

- Confirms that this document is consistent with the client’s wishes

- Emphasises your strategic and holistic approach

- Pre-sells the value of your proactive loan reviews and “client for life” philosophy

Here’s a starting point to adapt as needed:

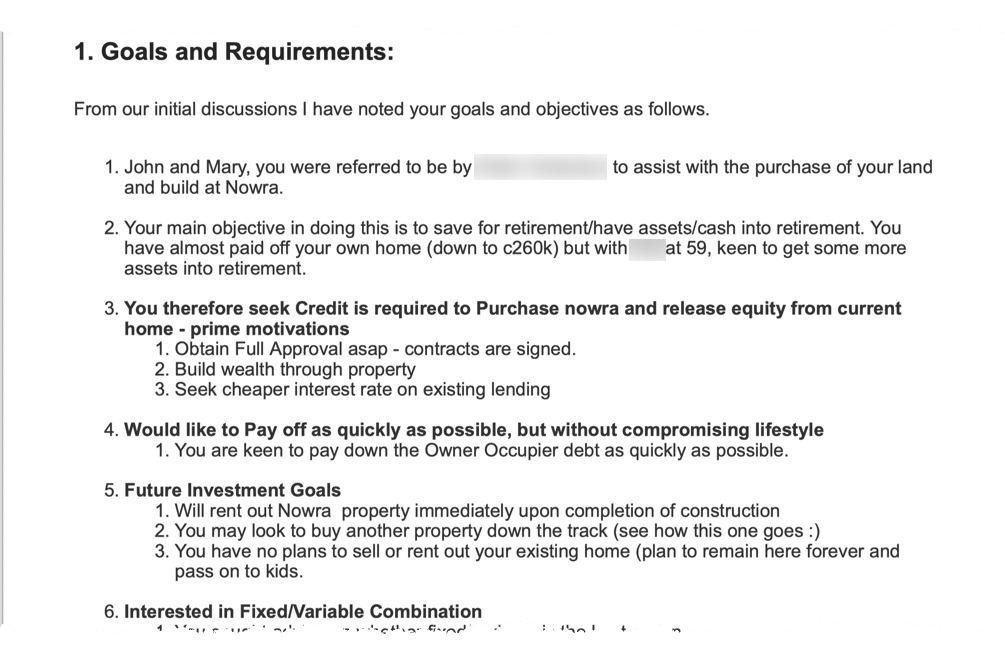

Part 1: Goals & Objectives

Accurately capturing your client’s requirements is critical for compliance.

It’s also a valuable part of the sales process. That’s because demonstrating that you have understood the client’s problems and goals will get you most of the way to providing a great solution. Here’s an example:

For BrokerEngine users, this text would be automatically pre-populated into your Proposal based on data previously entered into our Interview Guide tool. That means this section can be very detailed, without taking any extra time to generate.

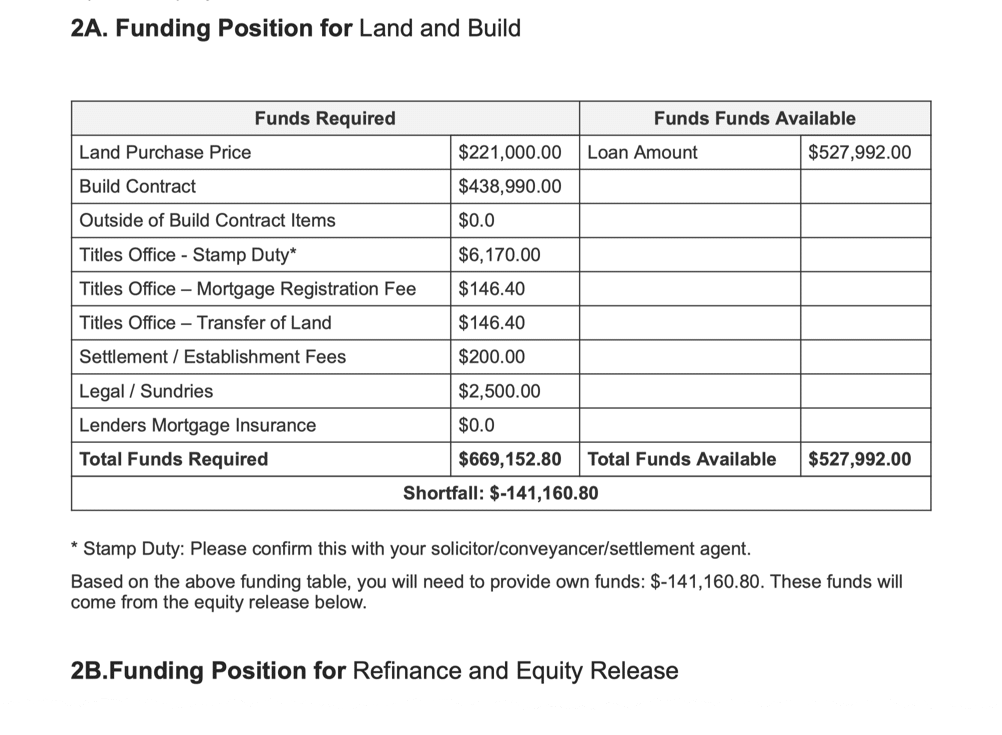

Part 2: Funding Position(s)

When presenting loan advice, clarity is key. A Funding Position table allows you to outline the funds required to execute your strategy. Here’s an example (again, automatically pre-populated):

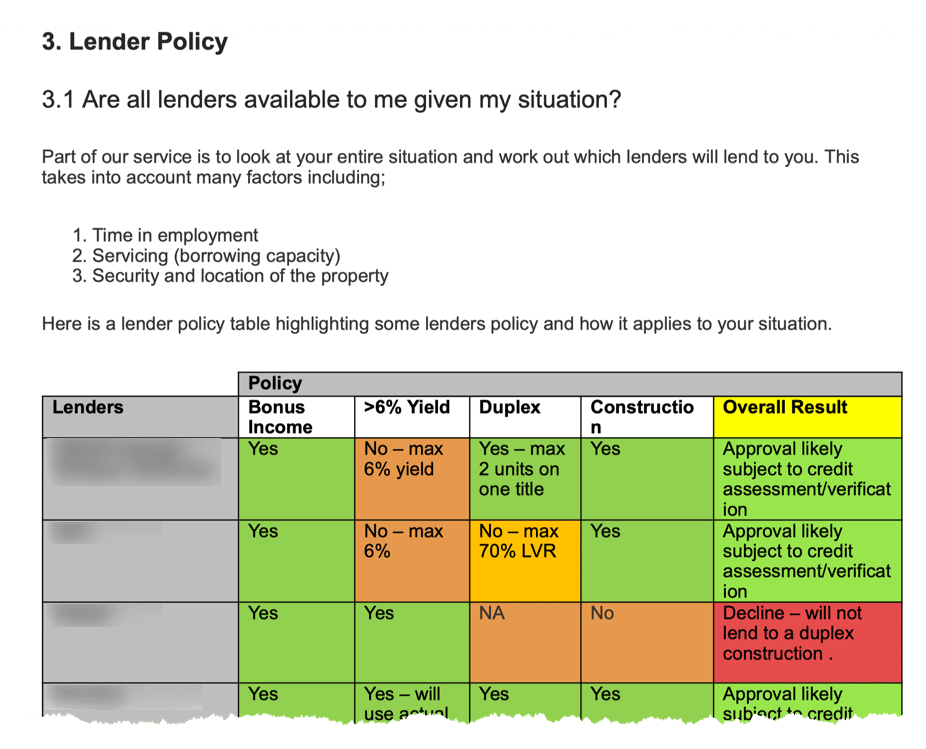

Part 3: Lender Policy Matrix

The previous sections confirm WHAT the client is looking to do. Now in Part 3, you present a shortlist of potential options as a Policy Matrix (including options the prospect may have brought to you).

The purpose of this section is to take the prospect behind the curtain and show them some of the options you have considered and also why they may/may not qualify for certain lenders.

(One useful application of this approach is to show that even though XYZ Bank has a low interest rate, the client doesn’t qualify due to policy.)

Refer to the example below (In BrokerEngine, we use our advanced template manager to streamline the various policy scenarios.)

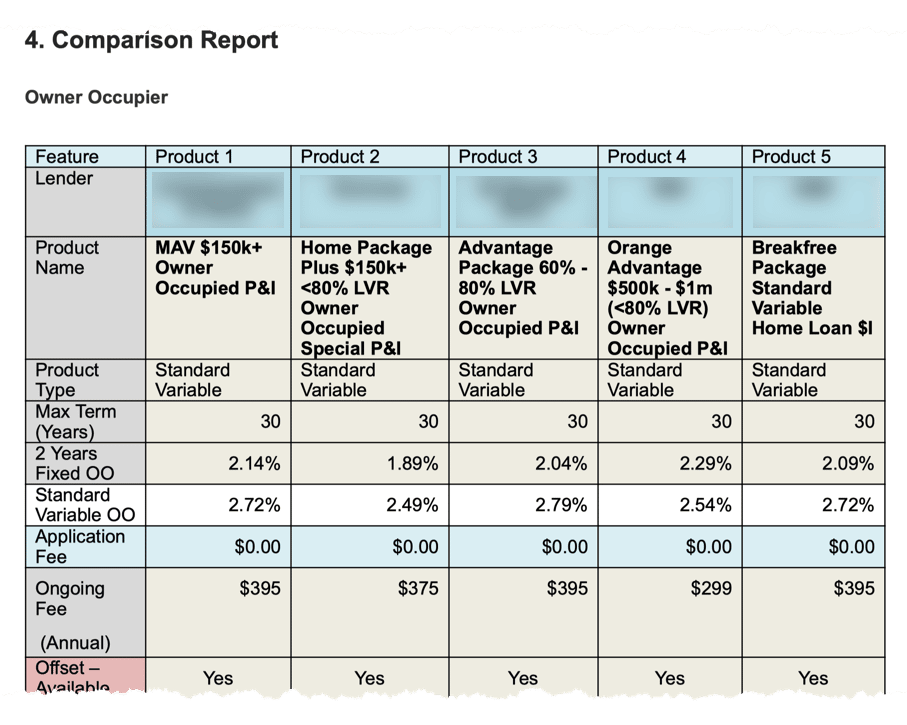

Part 4: Comparison Report

The Policy Table in Part 3 may eliminate certain lenders that don’t pass the policy filter. Now in Part 4, you display the remaining shortlisted lenders in a Comparison Report.

Again, you’re taking the prospect behind the scenes and showing them how you have arrived at your recommendation. By involving the prospect in the process, they tend to be highly invested in the solution.

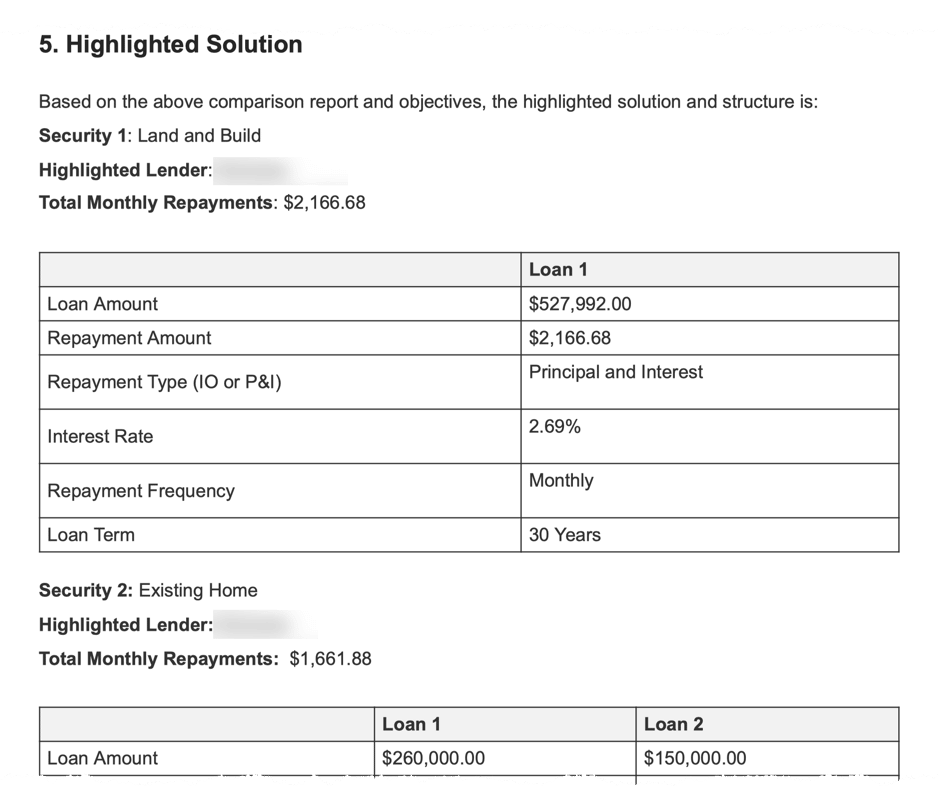

Part 5: Highlighted Solution (with Funding Diagram)

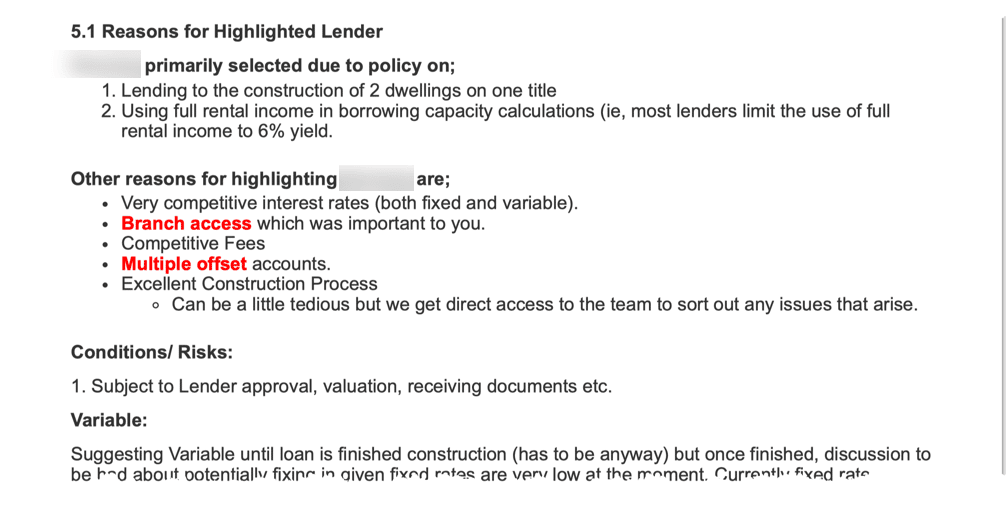

Now you’re ready to shift from analysis to advice mode, presenting your overall recommendation backed by supporting reasons. For example:

(Most of this text is pre-populated via BrokerEngine, then lightly edited as needed.)

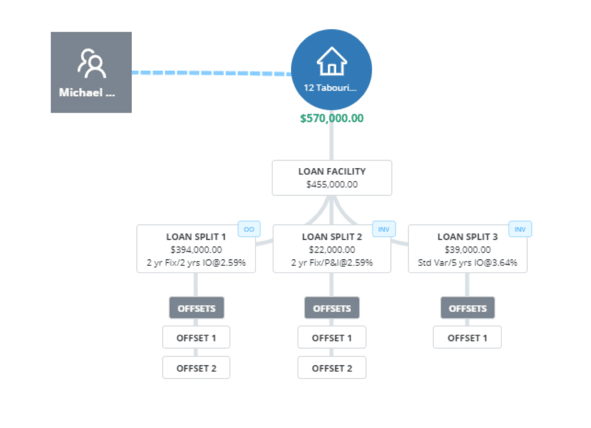

To put the icing on the cake, we include an auto-generated Funding Diagram to visualise the loan structure. This is the simplest way we’ve found to illustrate how a deal will be put together. For example:

Part 6: Supporting Information

As a client moves closer to making a decision, it’s natural for them to have questions or seek further information about what you’re proposing.

In Part 6, we provide additional information and education related to the features of the specific strategy you’re recommending. This prevents your deal from getting snagged by a client who has unresolved questions and “just needs to do a bit more research”.

Examples of Supporting Information include sections on:

- Offset Accounts

- Impact of extra repayments

- Tax deductibility

- Construction loan process

- First home buyer schemes

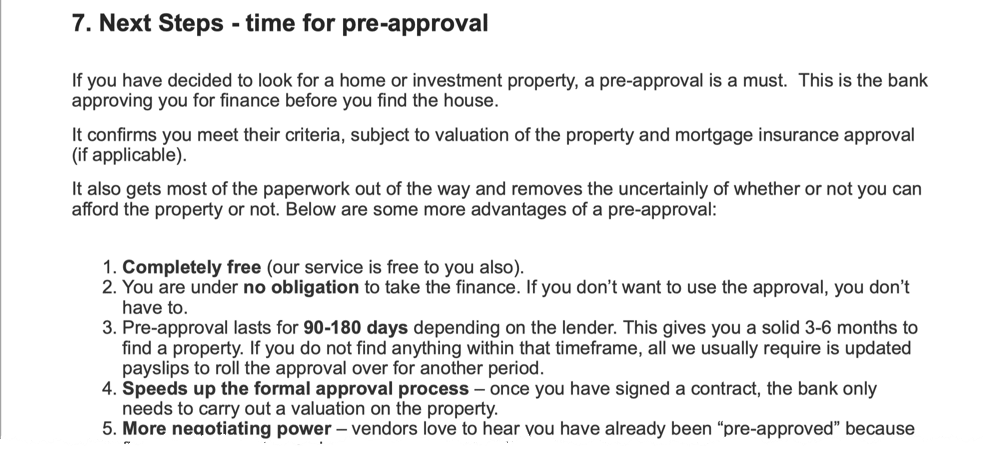

- Pre-approval process

- Etc.

Our Proposal tool will show/hide the relevant sections based on the specific deal.

Part 7: Next Steps

By now, you’ve demonstrated that you understand your client’s needs, helped them compare a shortlist of options, and provided a recommendation, supported by relevant reasons and education. Now it’s time to tell the client what you want them to do next.

Depending on the deal, this may be submitting the deal for pre-approval or formal approval. Here’s an example for pre-approval:

Part 8: Why Us?

Part 8 is added to cement your credibility and “dial the trust factor up to 11”. This section may include some or all of:

- Firm Profile: describe your firm (size, team, services etc.) and feature your value proposition explaining how you’re different to other practices.

- Broker Profile: Share your qualifications, experience, and a few personal details so clients can feel they know you.

- Reasons Why: Don’t wait for clients to work out why they should choose you as their broker – tell them. Talk about the things you do to give clients the best outcomes. See the excerpt below:

Part 9: Authority To Proceed

In Part 9, you ask your client to provide you with their Authority to Proceed with your proposed course of action. This is a series of statements, culminating in asking for an e-signature. Once the client e-signs this part, they’re not going anywhere else!

Part 10: Advisor Declaration

The final part in your mortgage proposal is a standard statement for compliance.

And you’re done!

Brokers have consistently found that this loan proposal template delivers confident, swift and decisive action from clients.

Conclusion and Next Steps

While this Proposal template may look super-detailed, when you consider that 90% of the document is auto-generated, it’s actually a great tool for delivering loan advice in a compliant, compelling, consistent and efficient manner.

We invite you to give this approach a try. And if you’d like to go one step better and generate sophisticated documents like this automatically, please check out the latest demo of BrokerEngine software.

Custom Proposals are just one of dozens of tools inside BrokerEngine that enable you to grow your settlements, while still getting home in time for dinner.