In an increasingly competitive landscape, mortgage brokers who are able to clearly communicate their value proposition are able to generate more leads, close more sales and drive more repeat and referral business.

But how do you go about articulating your unique value proposition?

This article provides a how-to guide for crafting a compelling Unique Value Proposition that positions you as an expert and helps you attract more ideal clients.

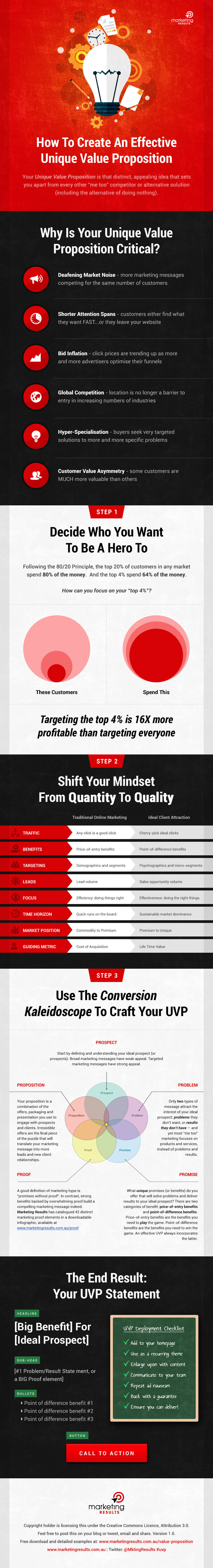

Introducing The Framework

We’re going to use this value proposition framework from Marketing Results to guide our discussion, before providing a specific worked example below.

Now that you have an overview of the broad framework, let’s talk about…

Winning UVP Approaches, Specifically For Mortgage Brokers

After helping dozens of mortgage brokers execute results-oriented marketing plans and lead generation campaigns since 2005, I’ve noticed that there are three broad UVP approaches that work well in the mortgage broking industry.

The common principle to all three approaches is SPECIALISATION. It’s much harder and more expensive to get traction as a generalist than it is as a specialist.

Here they are:

Successful Approach #1: Focusing on a specific target CUSTOMER

Focusing on a specific type of target customer allows you to direct your marketing messages at solving specific problems in a unique way. Examples of viable target customer groups include:

- Property investors

- First home buyers

- Professionals

- Medical doctors

- Business owners

- Expats

- Retirees

- Non-residents etc.

While not recommended in urban centres, positioning your firm as “the go-to choice for locals” can be effective in regional areas, as firms like Geelong mortgage broking specialist Aussiewide Financial Services have found.

Successful Approach #2: Focusing on expertise in a specific PRODUCT category

For example:

- Building loans

- Bad credit loans

- SMSF loans

- Commercial property loans

- Property investment loans

Some loan products map directly to a single client persona (aka profile).

But in many cases, it’s ideal to map specific messaging to the target customer you’re trying to attract.

As the below table shows – different products can appeal to distinct client personas, but the key benefits would be different in each case.

| PRODUCT | CLIENT PERSONA |

|---|---|

| Investment Property Loans | First Time Investor |

| Investment Property Loans | Multiple-Property Investor |

| Investment Property Loans | Property Developer |

| Building Loans | Owner Builder |

| Building Loans | Investor |

| Building Loans | Rural Land Purchaser |

| Commercial Property Loans | SMSF Investor |

| Commercial Property Loans | Property Developer |

| Commercial Property Loans | Non-SMSF Investor |

(e.g. A property investment loan specialist wouldn’t speak the same way to a first time investor as they would to a property developer.)

Successful Approach #3: Focusing on expertise in a specific STRATEGY

Yet another approach is to present an integrated strategy to achieve a certain outcome. Examples of strategies include:

- Rapid mortgage reduction

- Investment property accumulation

- Income replacement

- Debt freedom

Again, there is potential overlap between loan products and client types. However, with the “strategy” approach, there are usually more moving parts that aren’t limited to just a loan product.

“It’s much better to own 80% of 1% of the market, than 0.0001% of 100% of the market”

A Worked Example In The Mortgage Broking Industry

Now let’s look at how this UVP Formulation Framework applies to a specific mortgage broking practice.

The example we’ll look at is MAP Home Loans.

Let’s unpack each component of the value proposition, so you can see how the pieces fit together.

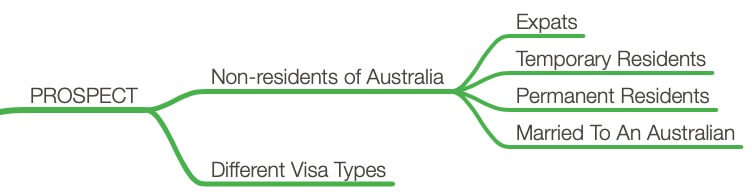

Lens 1: PROSPECT

The first step is to define a specific target prospect. Here’s what that looks like for MAP:

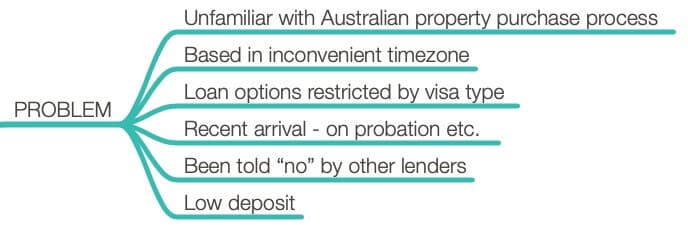

Lens 2: PROBLEM

The surface-level problem these prospects face is “I don’t have finance to buy a property and I want it”.

But that’s the same problem that ALL banks and brokers are trying to solve.

We need to dig deeper into the specific problems experienced by our specific prospect. For example:

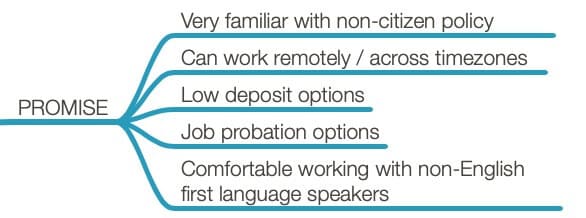

Lens 3: PROMISE

Now we know what the deeper problems are that the ideal prospect wishes to solve. Next, we need to communicate some unique promises that solve these problems better than other options. For example:

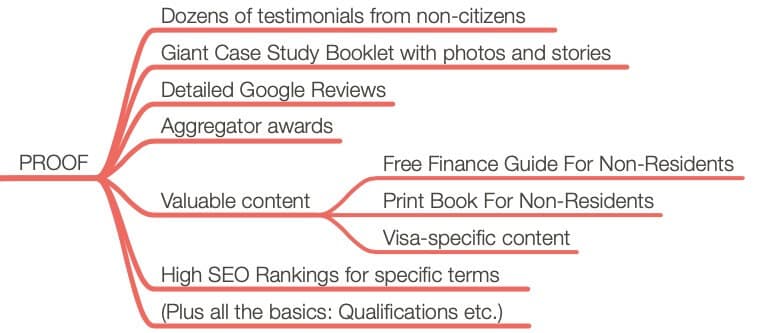

Lens 4: PROOF

“Claims without proof = hype.”

We now need to prove the promises expressed in the previous step.

(This infographic that documents 42 Types Of Marketing Proof Elements will give you all the ideas you need.)

It’s important to ensure your proof elements support the specific promises made in the previous step.

(For example, It’s no good to claim you’re a property investment specialist, if all your testimonials are from first home buyers).

Here’s how this looks for MAP:

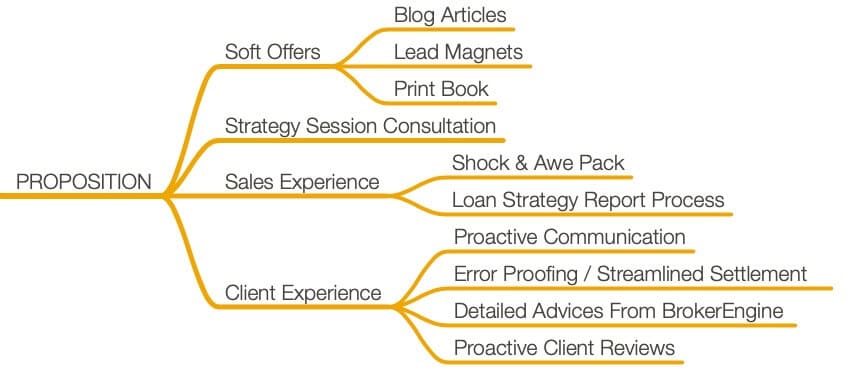

Lens 5: PROPOSITION

Your proposition is the combination of the offers, packaging and presentation you use to engage with clients.

For MAP, these elements include marketing offers, a best practice sales process and a streamlined client experience delivered by BrokerEngine software:

The Finished Product: The Unique Value Proposition Statement

All of the above is the raw material that can now be compressed into a top-line UVP Statement. This is what this looks like for MAP Home Loans.

Note that while a succinct UVP statement is important, it’s actually just the tip of the iceberg – there’s a lot of detail that lies below the surface.

This includes core messages, landing pages, emails, lead magnets and more.

But the net result is a rock-solid marketing foundation on which other strategies such as practice automation and SEO can sit.

Now It’s Your Turn

Now it’s your turn to enhance the desirability and distinctiveness of your firm in the eyes of your ideal client.

How does your Unique Value Proposition stack up?

I hope you’ll use this framework to refine your UVP and let us know how you get on.

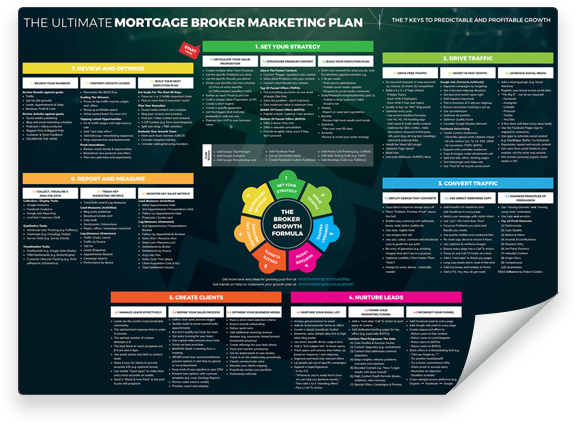

If you want to build on this framework to grow your overall marketing capability, be sure to download the Ultimate Mortgage Broker Marketing Plan here.