In this article, we’re going to explore why mortgage brokerages often struggle to grow and scale. We’ll look at the 4 Stages of Growth in a mortgage broking practice, and unpack the specific obstacles that stop brokers from moving from one phase to the next. Finally, we’ll highlight the specific focus areas that are required to solve the obstacles at each stage.

The Data Are In: Brokers Want Higher Income With Less Hours

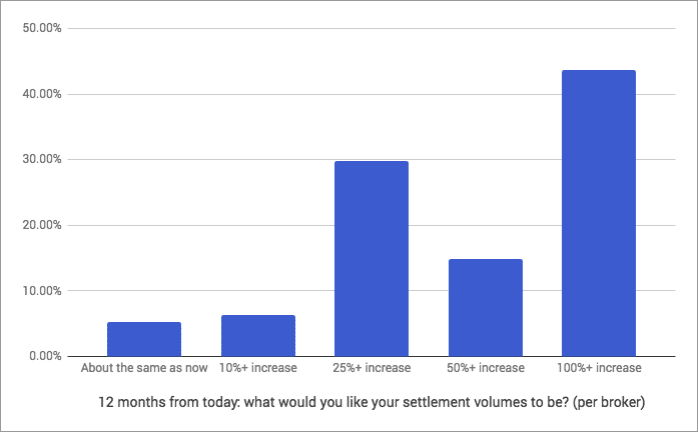

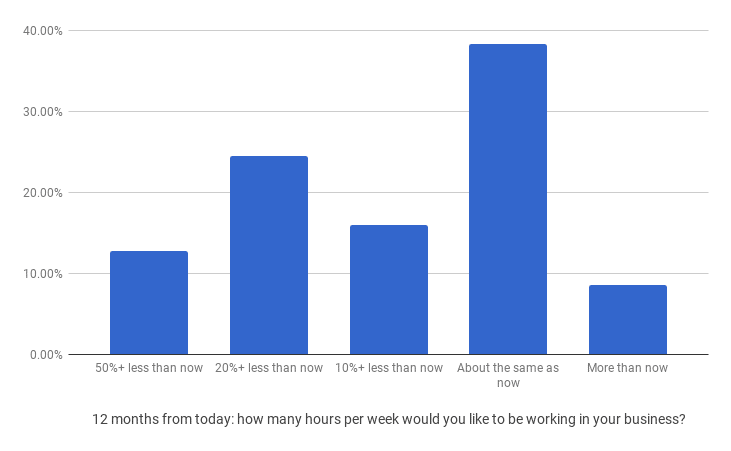

We’ve just finished collating data from 154 survey respondents, and the results are in: the typical mortgage broker is looking for revenue growth. More than 4 in 5 of the brokers surveyed aim to grow settlements by a minimum of 25% in the next 12 months:

Revenue growth is nice. But dollars and cents aren’t the only important measure. Brokers also overwhelmingly stated they want an improved lifestyle through greater productivity and/or reduced hours:

So the goal is clear: many mortgage brokers are asking,

“How can I grow my practice, while working no more than I do now (and preferably a lot less?”

That’s a great question, and one that we’ll devote the rest of this article to answering.

The 4 Stages Of Mortgage Broker Practice Growth

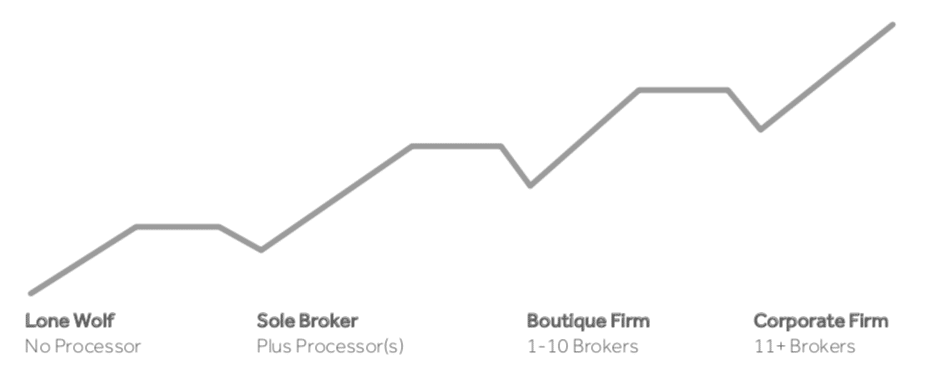

After being in the mortgage broking game myself for 10+ years, and observing hundreds of mortgage broking firms, I think about the mortgage broker growth journey in 4 distinct phases:

Phase 1: Lone Wolf – when a broker is operating independently, with no loan processing solution.

Phase 2: Sole Broker – when a broker is teamed up with at least one loan processor.

Phase 3: Boutique Firm – when multiple brokers and one or more loan processors are working together in a team.

Phase 4: Corporate Firm – where there are at least 11+ brokers in a firm.

Important: I am NOT suggesting that everyone has to aspire to becoming a Corporate Firm (I’ve have not done that myself, and wouldn’t want to). What I am suggesting is to understand what you want your brokerage to look like, and then build toward that vision.

I call it, Business By Design.

For example, if you want a great income, reasonable work weeks, and plenty of holidays, then remaining a Sole Broker is generally not a good business model – there isn’t enough redundancy.

Alternatively, if you love broking and talking with clients, you relish hard work, and you don’t want to manage other brokers, then maybe being a Sole Broker is the right model for you. Some of the biggest writers in the country are in fact Sole Brokers (teamed up with support staff).

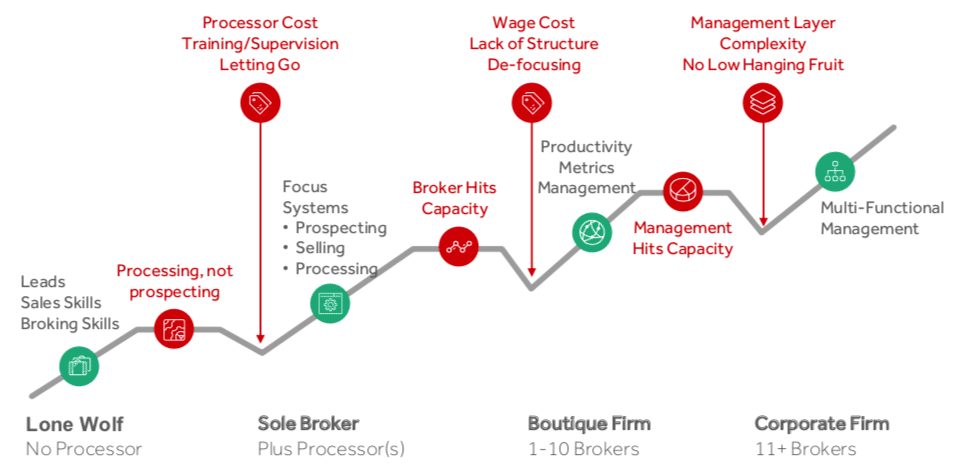

To understand the pros and cons of each phase of growth, this diagram will help:

- At the Lone Wolf stage, you get to learn the ropes and understand how everything works at the coalface. However, it’s hard to break $2M/mth in settlements consistently. And everything falls on you. There are lots of ways things can go wrong, and there’s only one person to fix them – YOU.

- At the Sole Broker stage, your income potential rises dramatically. You can choose to remain with one or two loan processors, or you can build an army of para-brokers, loan processors and customer service personnel to support you. The downside is the potential for single-point failure. Work/life balance may be a problem too. Long work weeks and short holidays are the norm here.

- At the Boutique Firm stage, there are more people in each role. There is more redundancy around processes, and specialists sitting in each seat. Here, the income and asset value creation potential is huge. But there is also a danger that the Broker Principal ends up spending more time on HR and less time on being a broker. There is potential to get distracted, and maybe even start longing for the “good old days” of being a Sole Broker!

- At the Corporate Firm stage, you’re now an established “brand”. In practice, larger firms are in practice often run as a “network” of brokers, or a loosely affiliated team of brokers that operate under the same banner. (That’s more like a band of sole brokers teaming up, as opposed to a true Corporate Firm.) In the Corporate Firm stage, the revenue potential is great, but there is an even greater need for structure. A broker who once enjoyed the client interaction and loan strategy side, may now find themselves a corporate manager at this stage of growth.

Growing Pains When Moving From One Stage To The Next

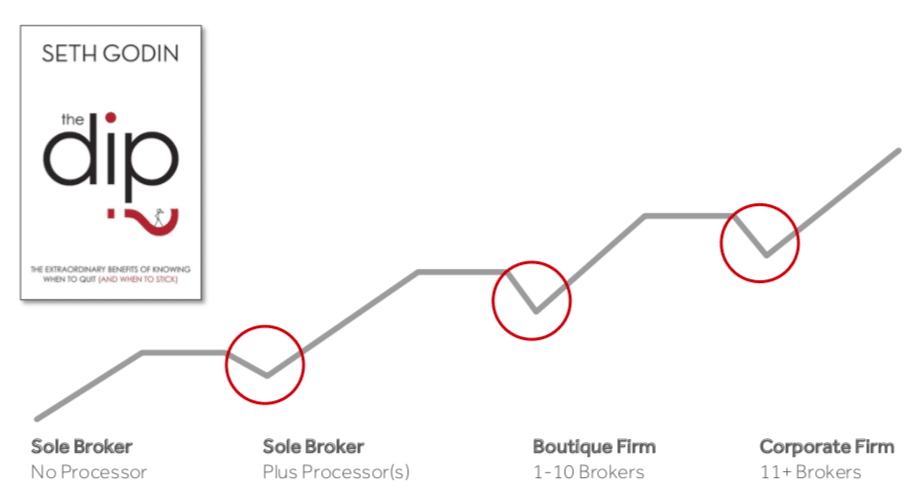

As Seth Godin wrote in his book of the same name, change and growth often involves navigating the Dip – a phase where things get worse before they get better.

This is particularly true of the mortgage broker growth journey: there are completely predictable Dips between each of the Growth Stages.

Once you know what each Dip looks like, what the root causes are, and what you need to focus on to fix them, you’re well on the way to a solution.

In the next image, I’ve summarised the Dip that lies between each growth phase, and the Areas of Focus that are required to move beyond the Dip.

Below, I unpack this in more detail.

At the Lone Wolf Stage:

- The Core Competencies required are sales prospecting, sales skills and fundamental broking skills. In other words, you need to be able to get some potential deals and translate those into settled loans.

- The Sticking Point is that as you get better, you find yourself processing, not prospecting. You get caught up doing the work, not getting the work and advising clients. This is why it is hard to consistently break $2M/mth in settlements while working a sensible number of hours.

- The Decision Point in order to move to the Sole Broker stage, is to hire a loan processor, or choose from a range of loan processing options.

- The Dip is when you start to think of the loan processing costs eating into your take-home income; once you hire a loan processor, you also need to train and supervise them. And you need to be able to let go. There’s no point hiring a loan processor, then ending up doing most of their work for them. (It happens!)

- The Solution is to first recognise that to scale, you must invest. Yes, a loan processor will cost money. There are a variety of loan processing solutions to choose from. My suggested approach is to mentally allocate a budget for this new initiative. For example:“I’m doing $2M per month now, and I want to get to $4M. I’m going to allocate $12K in budget to hire a full time loan processor offshore for 6 months, and some software to collaborate with them. That will save me at least 60 hours per month. With the 60 hours, I’ll do more networking, prospecting lead generation and marketing. That will result in at least 4 extra loans per month, which is how I’ll get to $4M. I have no expectation of ROI for 6 months.”Once the budget is mentally committed, you can focus on execution. Some brokers never really commit to growth. So in month 2 of their new plan, they start focusing on the loan processor cost, instead of focusing on what really matters: growth.The other important piece is DELEGATION and being able to let go. Your loan processor will need training, processes and oversight. (Shameless plug: the BrokerEngine software has pre-built processes built in, with “traintracks” for each deal, plus checklists to make sure everything is done right). Whether you use our software or not, you will need some way of collaborating with your loan processor to get value from them.

At the Sole Broker Stage:

- The Core Competencies required are:

- “FOCUS” itself. You need to transition from being a generalist and doing everything yourself, to focusing on your highest and best use at least 80% of the time. For most brokers, this means getting clients and advising clients on loan strategy and structure.

- Systemising your business. As a Lone Wolf, a lot of processes were probably in your head. Now you need to get things out of your head and decide on “one best way” for the practice to operate. The focus areas we recommend you start with first are marketing planning, lead generation, sales processes and loan processing.

- The Sticking Point in this phase is when the broker hits capacity. You physically can’t meet with any more clients.

- The Decision Point is to determine how you wish to scale:

- If you prefer to remain a sole broker, then you can add more people and processes around you to alleviate the constraint. On the people side, you could hire another Loan processor, or a Client Co-ordinator. On the process side, you could invest in online lead generation, digital or print newsletters, or more efficient sales processes including remote consultations.

- If you do decide to become a Boutique Firm, the Dip is the cost of new brokers (even commission-only brokers have costs associated); a lack of structure; and the risk of de-focusing from dollar-productive activities.I’ve seen this time and time again: a broker says, “I’m writing $5M/mth. I’ll hire 3 more brokers. They probably won’t do $5M/mth, but let’s be conservative and say they’ll do $2M/mth each. Then we’ll be doing $11M/mth as a group.”The reality is that without strong lead generation and sales systems, the new brokers write much less – say $500K/mth – and the Principal is drawn away from writing loans into managing and training brokers. Now the Principal only settles say $3M per month, while doing work they don’t enjoy as much as being a broker.Don’t get me wrong: brokers can and do make the leap to a Boutique Firm – but you must be intentional about it. You must get the strategy and execution right to make it a success.

- The Solution is to really focus on practice-wide systems for lead generation and sales processes prior to hiring new brokers. In addition, you need a way of measuring the Activity and Results of each new broker once they’re on board.(If you are already a Boutique Firm, but you don’t have these things in place yet, and are undergoing some pain, you can always retrofit them).

At the Boutique Firm Stage:

- The Core Competencies required are Productivity, Metrics and Management.

- Productivity is driven by well-documented systems, productivity tools, teamwork and culture. More team members and specialisation is good, but only if everything is well-coordinated. Think about a rowing eight: the boat can only go faster if all the rowers are rowing in time. If they’re out of sync, they’ll actually move slower than a single rower.

- Metrics are about tracking the Activity and Results of each team member. The most important Activity measure is initial client meetings held per week. And the most important Result metric is settlement volume per month.

- Management means helping every member of your team reach their full potential. The best method we’ve found for doing this in a systematic way (especially if you don’t think of yourself as a “natural manager”) is The 4 Disciplines of Execution from FranklinCovey.

- The Sticking Point as you move toward the threshold of becoming a Corporate Firm is where management hits capacity. There are too many moving parts to handle with just one key manager.

- The Dip is the need to hire a bigger, high-cost management layer, including functional specialists (Marketing Manager, Operations Manager, Sales Manager etc.). You’re becoming a corporate! The risk of de-focusing is even greater.

- The Decision is to decide if you actually want to become a Corporate Firm. I didn’t. Many brokerages choose to optimise at the Boutique Firm stage through better systems, technology and teamwork. But if you do want to go there, you’ll need to prepare by going all-in with your planning for what the future team will look like.

At The Corporate Firm Stage

Disclaimer: I’m entering uncharted territory here. I have not personally made the leap into becoming a Corporate Firm. It doesn’t appeal to me based on my skills and interests. However, for those who do want to go there, here are my thoughts:

- The Core Competency required is Multi-Functional Management. That means managing the managers who are managing their own teams through metrics and systems. You might also consider hiring a professional CEO.

- Once you make this leap, you’re in serious leadership, strategic planning and execution mode. Challenging stuff! But on the upside, at this level you have no doubt accumulated substantial value in your brand. Done right, you may find yourself on the BRW Rich List before too long!

Summary And Key Takeaways

- Growth is a Predictable Process. The same patterns emerge, time and time again. You can learn from others’ experience. It’s a lot cheaper than learning from your own!

- EXPECT “The Dip”. Some brokers seem surprised when their take-home profit goes down in the short term after they hire their first Loan Processor. Expect it, plan for it, and push past the short term Dip and into the next level.

- Focus on the Constraint. In other words, really focus on getting better at the core competencies required at each stage to grow. Don’t only focus on getting better at things you’re already good at.

- When you fix one constraint, another appears – expect it. “What?”, you say, “Do you mean I’ve only just finished putting in place loan processing processes, and now you’re telling me I have to be investing in lead generation??” Yup. Sorry. It’s a never-ending process.

- It’s about Enabling Teamwork. The right team members working together in harmony can do amazing things. There are limits to what you can do on your own.

- Enjoy the journey. Make every day great, despite the challenges and setbacks.

Our Mission: Powering Broker Growth

At BrokerEngine, our mission is Powering Broker Growth. We do this by providing the processes, automation and collaboration tools required to help broking teams work well together. We solve:

- Delegation and collaboration

- Loan tracking

- Delivering a better client experience

- Streamlining compliance and admin

- Increasing sales throughput

- Robust systems, out-of-the-box

- Checklists to ensure everything is done right

- And much more…

If you’d like to know more, sign up for a free demo. We’d love to help power your growth 🙂