You’re no doubt familiar with the phrase, “What gets measured gets managed”.

But are you actually measuring (and acting on) the key metrics you need to manage growth in your mortgage broking practice?

You probably have settlement goals and other growth targets you want to achieve.

Yet there may be times when you reach the end of the month and you’re disappointed because you (or one of your brokers) missed your target.

If so, here’s the exact system I’ve developed to guide growth by gathering and acting on the right metrics.

In this article, we’ll explore:

- what metrics to track

- how to track them

- and most importantly, how to convert your metrics into improved business results.

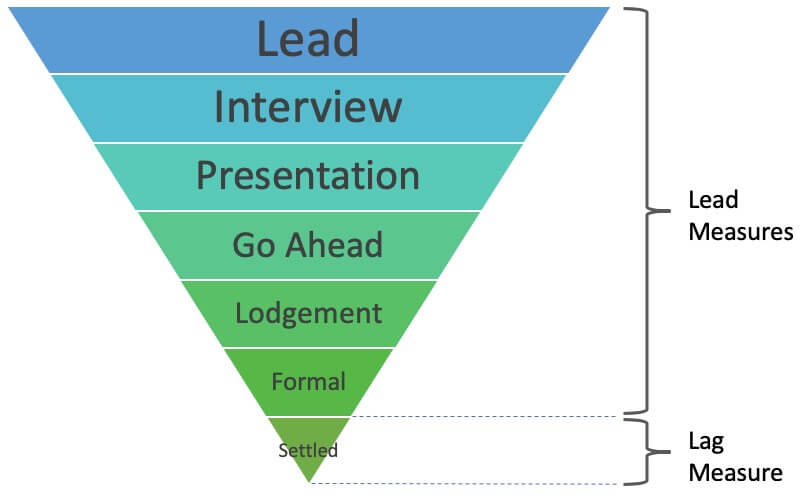

Two Types Of Metrics: Lead Measures and Lag Measures

Like most brokers, I always used to look at my settlement results every month.

When I reached my goals, I set my targets a little higher.

But when I missed, I told myself,

“<EXPLETIVE!!>. I’ll try harder next month!”

But what I didn’t have was a way to understand WHY I missed, and what specific actions I needed to perform to hit my goal next time.

Then I discovered a distinction in a great book called The 4 Disciplines Of Execution that cleared everything up.

That distinction is the difference between two types of metrics: Lead Measures and Lag Measures.

While a Lag Measure tells you if you have achieved your goal, a Lead Measure tells you if you are likely to achieve your goal.

Lag Measures are like looking in the rear-view mirror, and lead measures are like seeing the upcoming terrain with headlights.

Lag Measures = Results

Lag Measures track the success of your goals. For mortgage brokers, Monthly Settlement Volume is our big lag measure.

They’re called Lag Measures because by the time you see them, the performance that drove them is already passed. You can’t do anything to fix the result because it’s history.

Lead Measures = Activities

Lead Measures track the critical activities that drive the Lag Measure.

They predict the success of the lag measure and are influenceable by your team.

For mortgage brokers, the key Lead Measures that drive the Lag Measure of Settlements include:

- New Leads

- Initial Interviews Held

- Loan Presentations Held

- Deals Won (i.e. Verbal Yeses”)

- Lodgements

- Formal Approvals

The big insight here is:

You must perform enough activity (Lead Measures) to hit your goals (Lag Measures).

Let’s first calculate the precise amount of activity you need to perform to hit your goals, before discussing how to gather the metrics you need.

Calculating The Required Activity To Achieve Your Goals

To start with, we’re going to calculate how much activity you need to achieve your goals.

Click here to create your own copy of the Mortgage Broker Growth Calculator.

Watch the short video below for instructions on how to use it.

How To Gather The Data You Need

For many brokers, there is a challenge around actually getting your hands on the critical metrics you need.

Most aggregator software doesn’t provide this data, so you need some kind of third party system.

Some brokers use something like Excel or Google sheets.

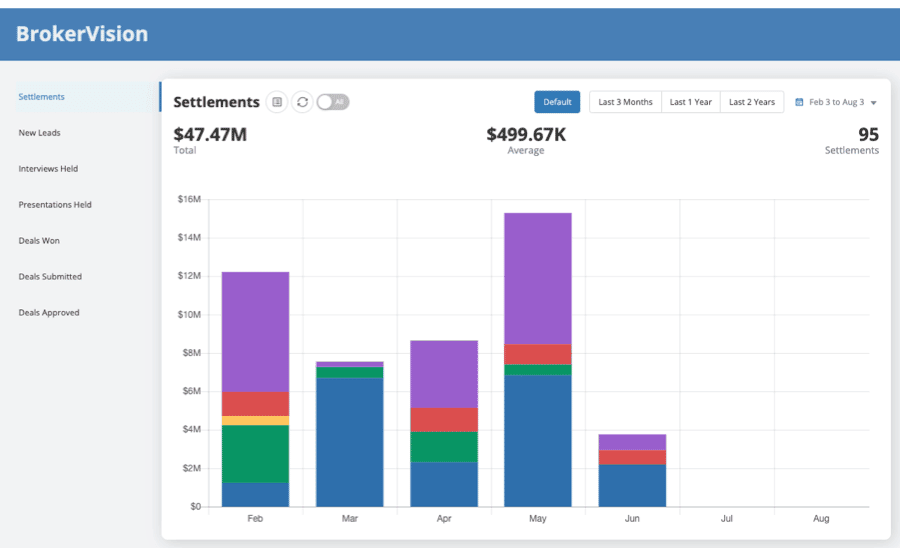

In our case, we use the BrokerVision metrics dashboard within the BrokerEngine software (take a free Demo here).

This automatically collates all the required metrics on a per-broker basis, in real time.

Regardless of the system you use, here are the specific views we recommend, and the types of decisions you can make as a result of analysing this data.

Graph 1: Settlements

Let’s start with settlements. Our recommended default view is actual settlements for the past 3 months, plus projected settlements for the next 3 months.

To look at longer trends (such as annual results), change the timeframe.

And individual broker results can also be isolated as needed. These insights are crucial if you manage multiple brokers.

Now let’s look at what the LEAD measures look like:

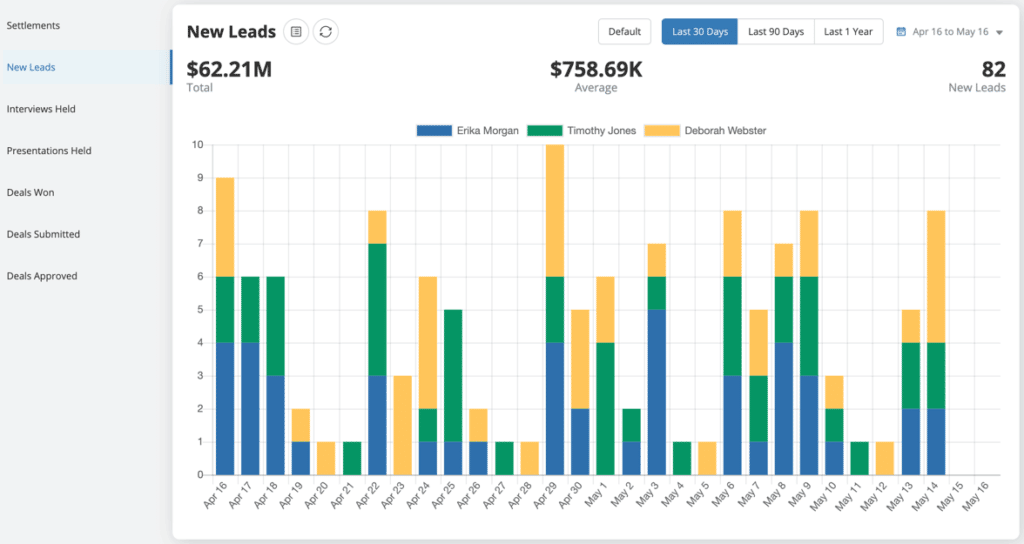

Graph 2: New Leads

New leads are the lifeblood of new clients.

This graph provides you with an easy snapshot of the current trend, but more importantly — it warns you if current lead volume is too low to achieve your goals.

That gives you a chance to pump lead generation activity NOW to fix the situation. You no longer have to wait for below-par settlement figures to come through before you act.

Potential remedial actions to drive more leads are:

- Activating paid traffic campaigns

- Increasing campaign budgets

- Emailing your database of warm leads

- Scouring your database for opportunities

- Running a batch of loan reviews

- Longer term, increasing the SEO rankings of your website

- And more…

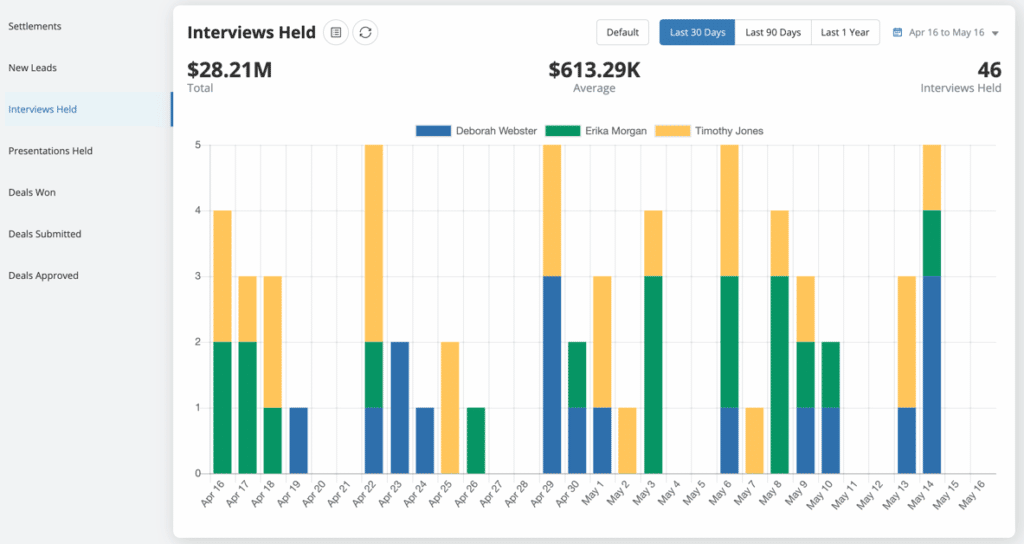

Graph 3: Initial Interviews Held

Next up is Initial Interviews Held.

Initial Interviews Held is arguably the most important Lead Measure in a broking business.

If you’re not getting in front of enough clients, it makes it very difficult to close a lot of new business.

What If You’re Not Holding Enough Initial Interviews?

If you find you’re not holding enough Initial Interviews, usually there are three root causes:

- You‘re not getting enough leads (see this post on lead generation ideas)

- Your sales process is too time-consuming and inefficient (see this article on the ideal mortgage broker sales process)

- Your loan processing is too time-consuming (see this post on the ideal loan processing process)

The important thing is to diagnose the problem, then take action to improve the bottleneck until your Lead Measures are where they need to be.

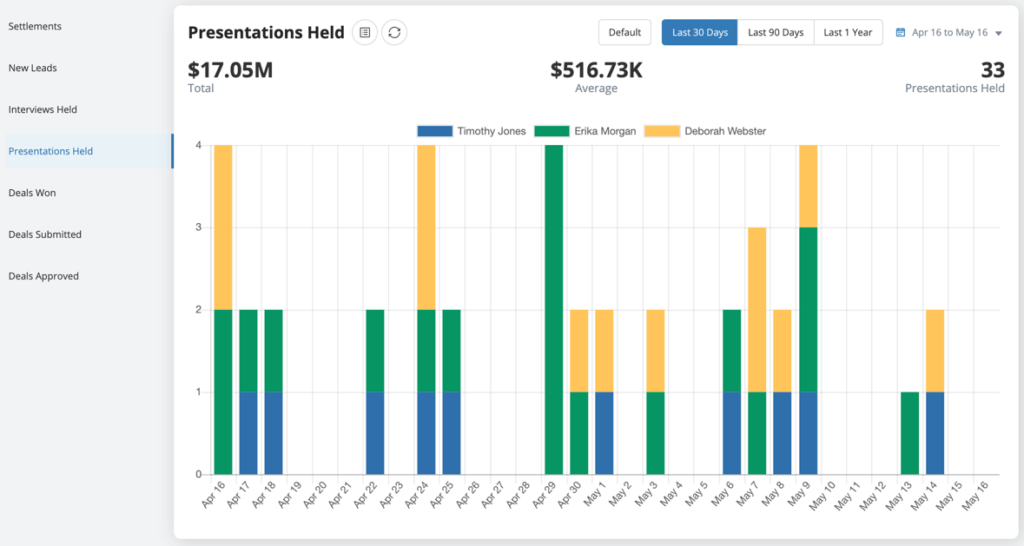

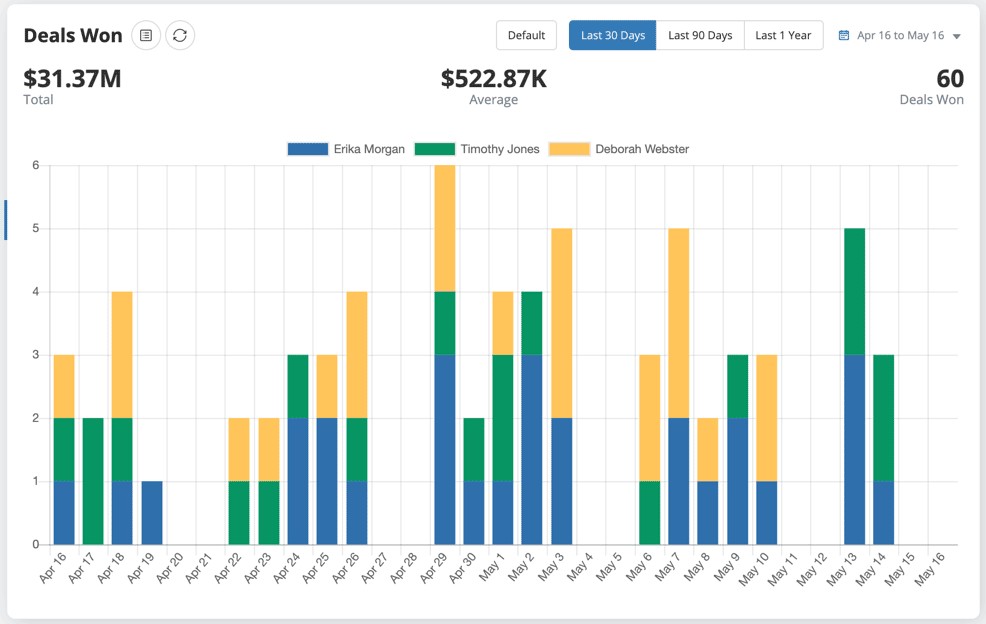

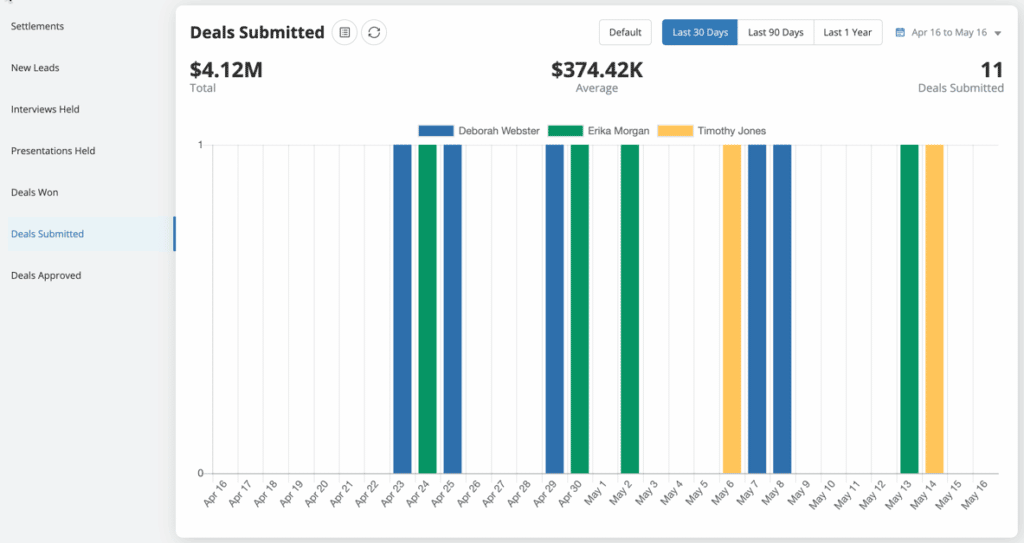

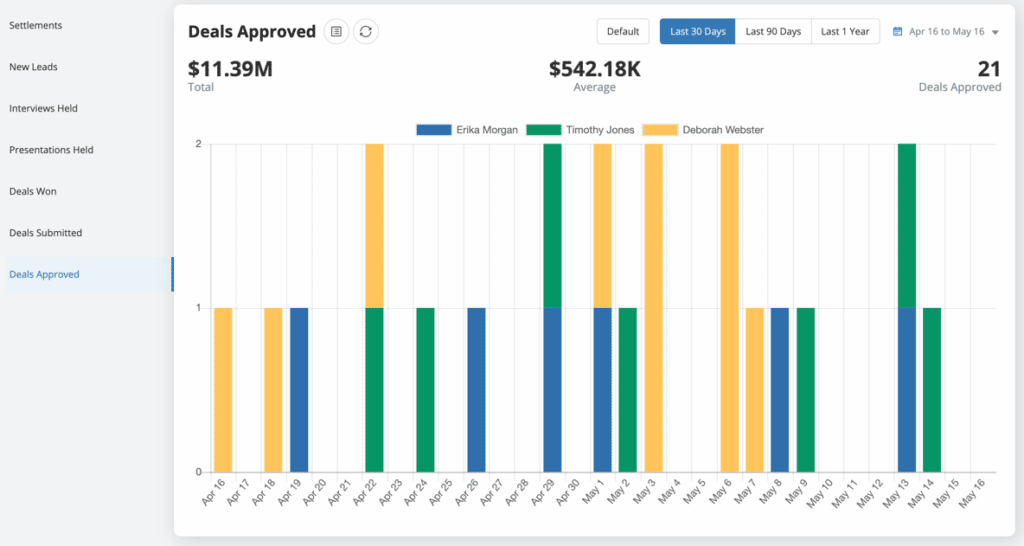

Graphs 4-7: Loan Presentations, Deals Won, Lodgements & Formal Approvals

Downstream of initial interviews, you have:

Loan Options Presentation Sessions Held:

Deals Won (aka Verbal Go-Aheads):

Deals Submitted:

Deals Unconditionally Approved:

Like the previous stages, if you detect a bottleneck, the steps are to:

- Analyse WHY the bottleneck exists.

- Take action to FIX the root cause.

- CHECK your results and re-align from there.

Key Takeaways And Next Steps

Having goals and keeping an eye on your progress is great.

But unless you have access to your critical lead measures in real time, you’re flying blind.

Once you take care of the Lead Measures, the Lag Measures will take care of themselves and practice growth becomes a certainty.

Want to grow your practice even faster? Be sure to check out the latest BrokerEngine software demo here.