Many mortgage brokers aspire to crossing the $100M mark in settled loans per annum. There’s something about this “nice round number” that seems to hold up a bright red target 🎯 for ambitious brokers.

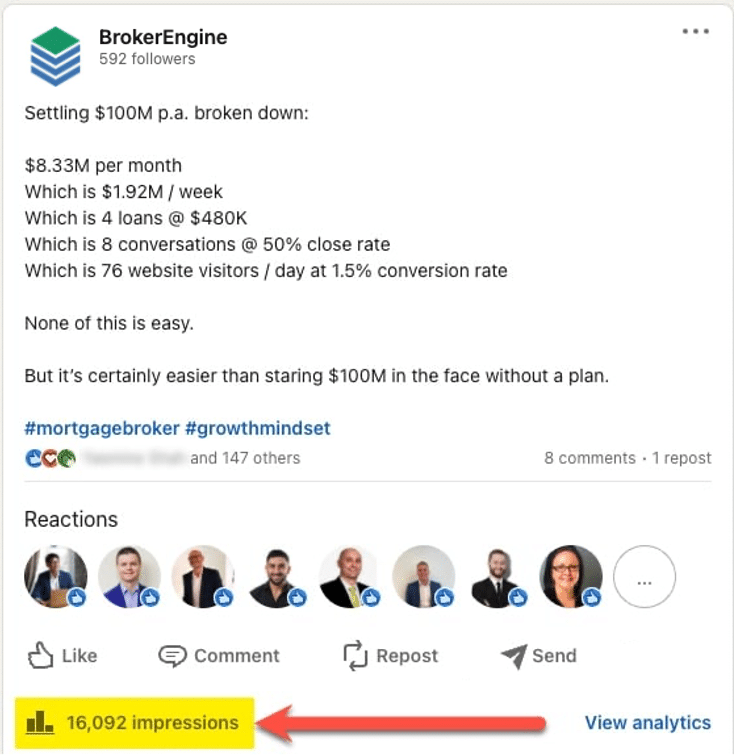

This point was driven home with a recent social media post:

Most of our social posts get 1,000 to 2,000 impressions. But this post drew 16,000+ impressions, which is pretty good for a niche audience of 19,000 mortgage brokers in Australia. So we figured a deeper dive may be of interest.

In this article, we’ll break down the process of settling $100M+ per annum with the aid of our recently upgraded Free Mortgage Broker Growth Calculator (click here to make your own copy), and introduce a systematic approach to analysing your numbers and taking decisive action.

Step 1: Model Your Current Metrics vs Goal Metrics

$100M in settlements seems daunting, but breaking it down makes it more digestible. Our original post breaks down the numbers into daily and weekly activity levels:

While this is useful, it’s also an over-simplification. Let’s dig deeper…

Grab your own copy of our upgraded Mortgage Broker Growth Calculator and punch in your own figures. Check out the following tutorial for instructions:

Step 2: Identify Focus Areas For Improvement

The purpose of the Growth Calculator is not just to spit out numbers, but to reveal focus areas for improvement.

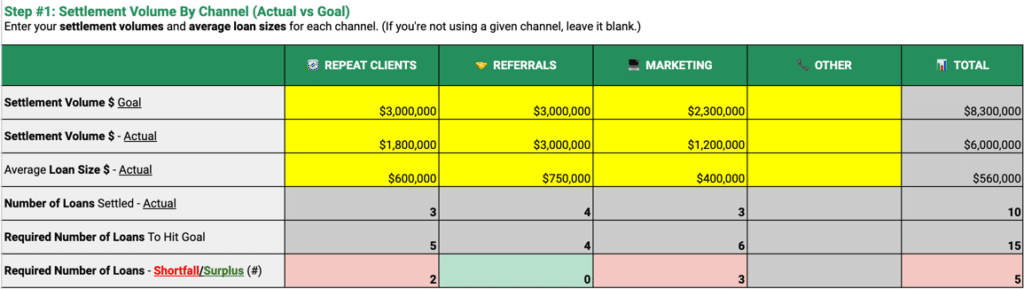

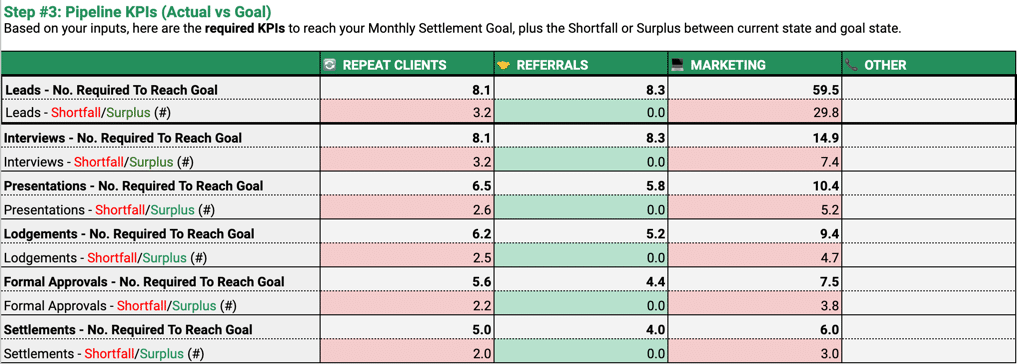

Here’s a worked example of a broker currently settling $72 million, wanting to hit the $100M run rate within the next 12 months.

- CURRENT STATE – this broker is currently settling about $6M per month from 3 major channels

- DESIRED GOAL STATE – the broker wishes to grow to $8.3M in monthly settlements.

- TAKEAWAYS – growth in Repeat Client and Marketing channels is required.

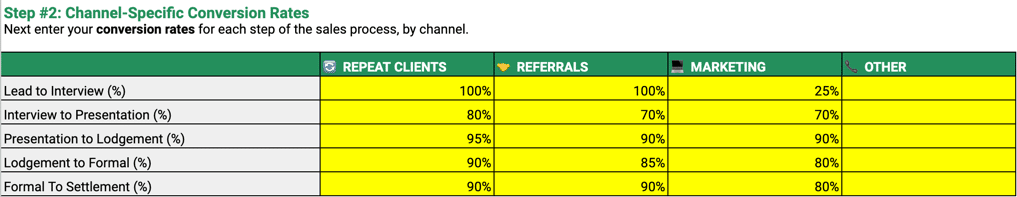

- TAKEAWAYS: different channels have different pipeline metrics. Mapping your pipeline conversion rates help determine how much activity is necessary per channel to hit your goals.

- TAKEAWAYS: more leads/opportunities are required in the Repeat Client and Marketing channels in order to hit desired goals.

While the details may vary, there are really only 3 reasons why a broker will fall short of their target:

- Ineffective Marketing = not enough prospects

- Ineffective Sales = low conversion rates and lengthy processes

- Ineffective Back Office = too much time spent on submission-to-settlement processes

By running the calculator, you’ll uncover where the major blockers exist for you, and pinpoint which area you need to focus on next.

Step 3: Focus On A Small Number Of Key Levers at A Time

In the previous sections, you’ve broken down your $100M plan into components, and identified areas for improvement.

It’s likely you may need to improve multiple areas to hit your overall target. However, you probably already know it’s not easy to focus on multiple improvement areas all at once.

We recommend focusing on one key lever per month (or even per Quarter for larger initiatives). Here are example Key Initiatives based on the common 3 blockers:

🎯 Improve Marketing Effectiveness

- Start a digital marketing strategy

- Increase digital marketing budgets

- Develop or nurture referrer relationships

🤝 Boost Sales Effectiveness

- Adopt a proven sales process

- Allocate more calendar slots per week to sales activity

- Apply division of labour to your sales process

⚙️ Ramp Up Back Office Effectiveness

- Adopt back-office automation

- Adopt a proven loan process flow

- Hire more back-office resources

Step 4: Rinse and Repeat

By focusing on one key area at a time, you’ll usually see solid improvement within the a calendar quarter. You may not always hit 100% of your goal, but that’s not a problem. Just keep chipping away at this quarterly rhythm and you’ll typically see dramatic improvement in the span of a year.

Conclusion and Next Steps

While settling $100 million per annum is undeniably challenging, when you break down your goal, it at least becomes “simple”, if not “easy”.

Hopefully this article has offered practical strategies to help you on your journey. And if you need some help alleviating some of the blockers described in this article, be sure to check out the latest demo of BrokerEngine software.