Henry Ford is famous as the inventor of the automotive production line. What you may not know, is that in addition to dramatically shortening production times, he was also able to double wages while slashing prices by 75%.

This is the power of “workflow”. Workflows are a sequence of tasks, activities, or processes that are systematically organised and carried out to achieve a specific business goal.

In my mortgage broking practice, I’ve been a strong advocate of workflows as a tool to drive growth, while simultaneously delivering a superior Customer Experience.

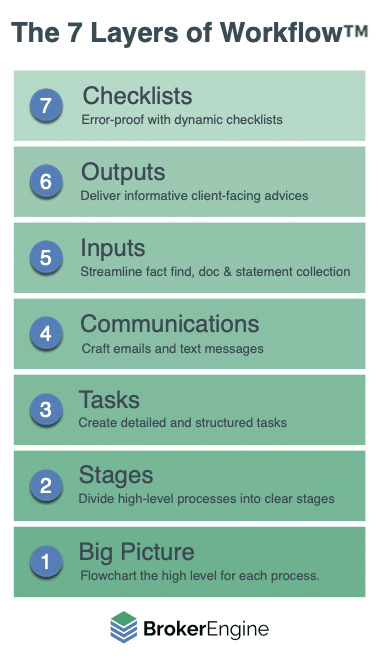

In this article, I share a methodology for building out your workflows called the 7 Layers of Workflow™. Let’s dive in…

Layer 1: Big Picture: Flowchart the high level for each process

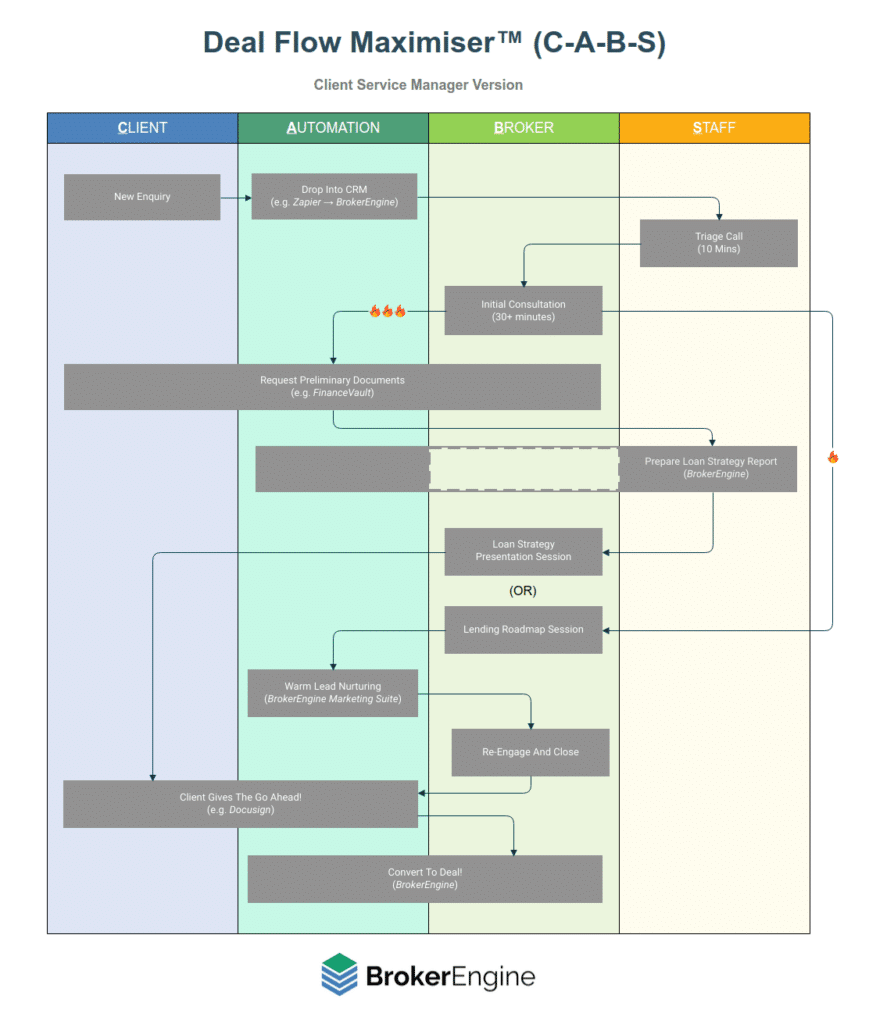

It’s helpful to start with a broad overview to provides context for how each major process works, and who in your firm is involved.

Big Picture processes to consider in a mortgage brokerage include:

- Lead generation

- Lead management

- Sales process

- Submission-to-formal

- Formal-to-settlement

- Loan maintenance

- Loan reviews

- Plus other general business functions such as recruiting, staff onboarding etc.

Schedule a whiteboard session and get your team to help map each of these functions. Use a flowchart to demonstrate the workflow from beginning to end. And allocate each step to a team member so somebody is accountable for each step.

Here’s an example for a Sales Process:

While you typically won’t capture everything in one session, know that you can come back in future to refine your thinking and improve your workflows over time.

Once you’ve got a high-level overview in place, you can start drilling down.

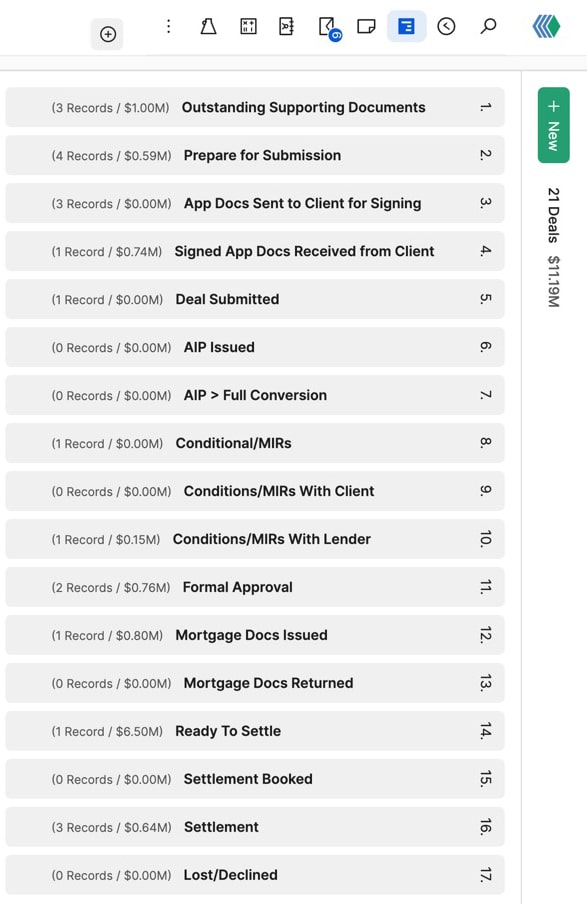

Layer 2: Stages: divide high-level processes into clear stages

At the next level down, you have process Stages, which need to be defined for each Big Picture function. Here’s an example of what our default Deal Stages look like for residential home loans:

We’re starting to get more granular. Next we need to put some meat on the bones by describing the specific Tasks that need to take place at each Stage.

Layer 3: Tasks: Create detailed and structured tasks

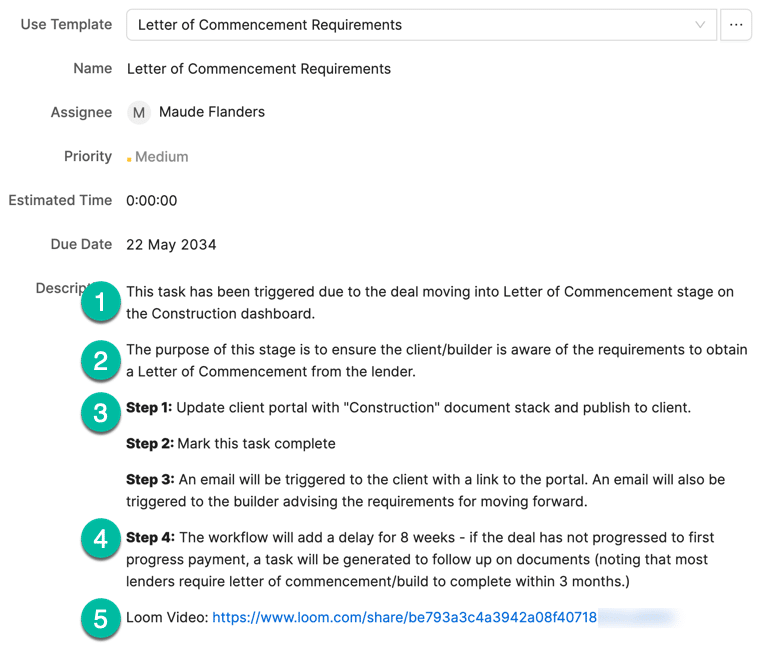

Because mortgage brokers are constantly executing variations on the same broad theme, most Tasks can be templated to a high level of detail. Here’s an example task template for obtaining a Letter of Commencement for a construction loan:

Note the task description includes details such as:

- Why the task been triggered

- The purpose of the task

- Steps to complete this task

- What happens after this task is completed

- Plus an explanatory video

While it might seem like overkill, this level of detail is required to fully “let go” and delegate Tasks to a team member.

With Tasks out of the way, we now need to consider the Communications that will be required to keep clients and stakeholders in the loop.

Layer 4: Communications: craft emails and text messages

Communications primarily refer to emails and text messages.

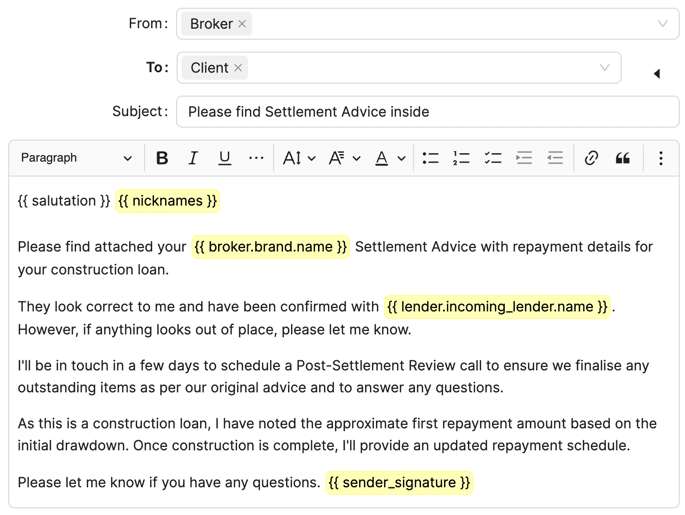

A vault of email templates is a huge time saver when you’re sending many similar emails on a regular basis. And it’s even better if those emails are automatically pre-populated with mail merge data so they can be fired out of your inbox instantly.

Creating effective communication templates is “simple but not easy”. Start by going through the emails and texts you’ve sent to clients in the past. Sort and store these as the basis for future communications so you never have to reinvent the wheel.

Here’s an example of a “Settlement Advice” email template which is part of the pre-built workflows in BrokerEngine:

Layer 5: Inputs: streamline fact find, document and bank statement collection

Document and fact find collection is a critical part of every loan application. Yet it can be tedious for both client and broker. As a result, deals can be delayed (or even jeopardised), and client experience suffers.

Gathering client data, bank statements, and documents via email leads to wasted time locating and storing files. Not to mention the ever-increasing risk of a security breach.

This is why it is important to consider how you collect information from your clients. Ideally, your information collection process should involve a secure client portal and be:

- Simple: One link for all uploads

- Easy: So clients respond quickly

- Accurate: Request and receive the right documents

- Organised: Everything in one place

- Up To Date: Track documents in real time

- Efficient: No double-handling

- Secure: Password protected

As an example, the FinanceVault feature which forms part of BrokerEngine software handles this function for our users.

One you’ve worked out how you’ll get information into your process, you need to consider how you’ll get information out and into the hands of your clients or stakeholders.

Layer 6: Outputs: deliver informative client-facing advices

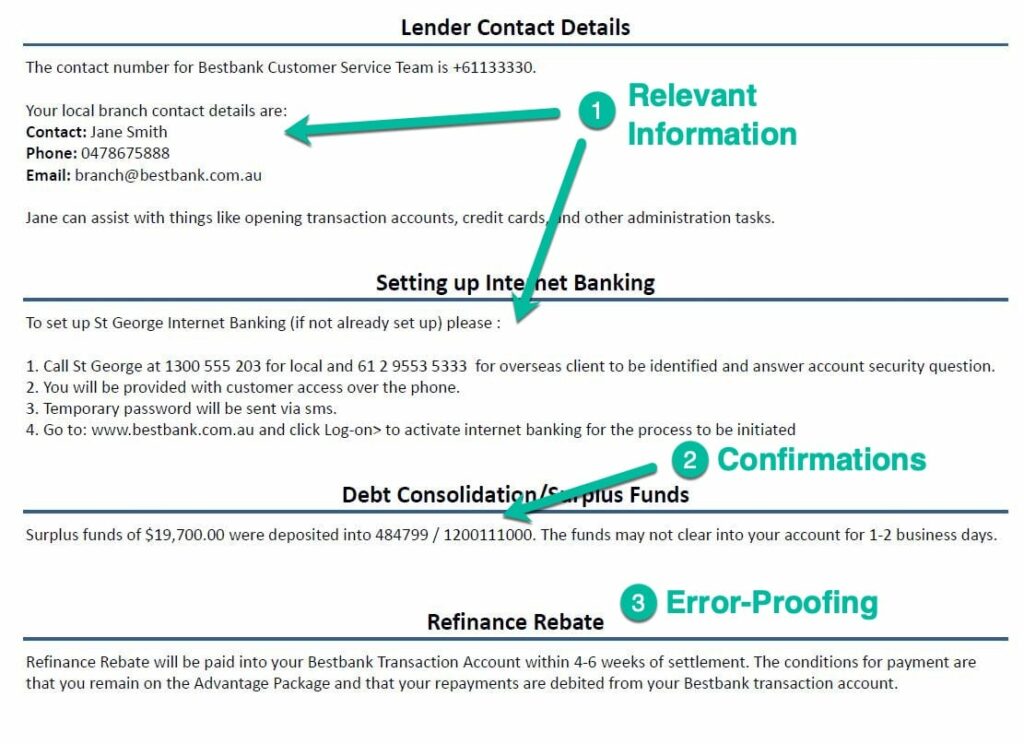

Key milestones in the mortgage approval process call for more than just emails and text messages. Structured Advice Documents deliver service, professionalism and efficiency in one package. Here’s an excerpt from our Settlement Advice document:

- Including relevant information about the loan saves you from fielding routine phone calls (“How do I set up Internet banking?”)

- Confirming completed actions sets the client’s mind at ease and prevents unnecessary phone calls (“It’s been 6 hours and I still don’t have the money!”)

- Error-proofing messages help to ensure the client doesn’t unwittingly make a mistake (“I didn’t know I had to remain on the Advantage Package to get my rebate!”)

Layer 7: Checklists: error-proof with dynamic checklists

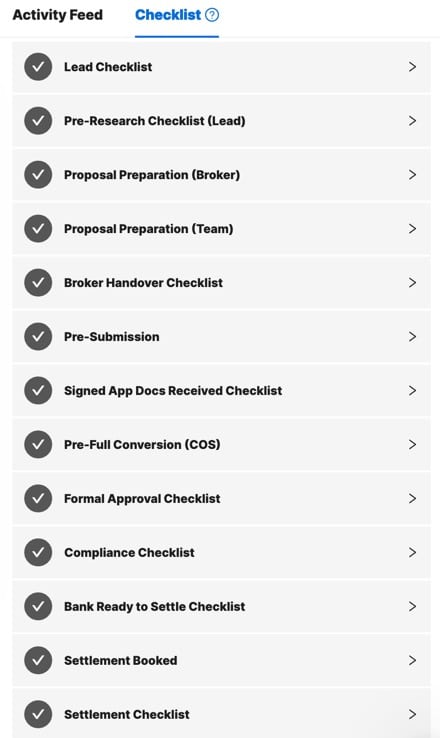

Checklists are the final, yet perhaps most critical step, in the 7 Layers of Workflow™. You can create the best workflows in the world, but if your team doesn’t follow them, mistakes will be made.

Checklists are used in high-stakes environments like surgical operating theatres and nuclear power stations. And they’re just as useful in a mortgage broking setting.

Here’s a list of some of the key Checklists included out of the box in BrokerEngine.

Conclusion And Next Steps

Workflows are one of the crucial tools for mortgage brokers who want to scale with efficiency, while also delivering an exceptional customer experience.

Every satisfied customer becomes a new referral source, and the more customers you serve, the more your practice grows… but only if you don’t make critical mistakes that cost you repeat business.

In this article we’ve reviewed the 7 Layers of Workflow™. While building workflows from scratch can be very time consuming, the benefit is a scaleable, profitable and efficient practice.

Or, if you prefer, you can leverage the done-for-you workflows that come our of the box in BrokerEngine and get you the same outcome with a fraction of the time, money and effort. If this is something you’d like to explore further, please check out the latest demo of BrokerEngine here.