Much has changed in the finance industry between 2021 and 2022, and mortgage brokers have to adapt accordingly.

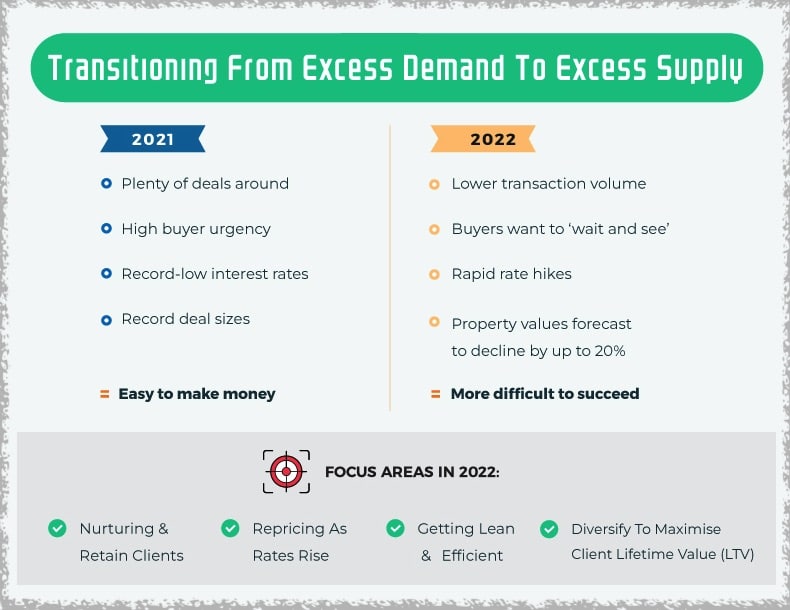

We’re witnessing a whipsaw from an “excess of demand” for mortgage broking services, to an “excess of supply”.

Fortunately, this isn’t the first time this has happened, and there are a number of mortgage broker strategies you can use to consolidate and thrive in the time ahead.

An Overview Of What’s Happening And How To Respond

Here’s a summary of the major shifts happening in the market, drawn from our Mortgage Broker Industry Trends analysis:

As a result of these shifts, here are the top priorities for mortgage broking firms in 2022 and beyond:

1: Nurturing & Retaining Clients

During the recent boom, it’s not surprising that many brokers shifted their focus to the front-end of the customer journey (i.e. writing new deals). The relative focus on different functions looked something like this:

Now that demand for new loans is dropping, the importance of the entire client journey increases:

While most mortgage brokers have always been interested in client retention, now there is a compelling reason to focus on that aspect of your business.

2: Proactive Loan Reviews

According to the AFR, as of September 2022, “Fixed-rate loans (including loans split between fixed and variable rates) worth more than $450 billion are due for renewal over the next 18 months“.

As fixed rates start to mature, lenders will be reaching out to clients to get them to re-fix. Savvy brokers will be several steps ahead. 😉

If your client Review process needs a tune up, check out this article on How To Conduct The Perfect Mortgage Client Review.

We also recommend starting to educate clients now via newsletters and social media, on how to cope with rising rates.

3: Repricing As Rates Rise

Part of your Client Review toolkit is to ensure your clients remain on the sharpest rates possible.

For a client coming off a fixed rate, it would be common to seek pricing from the current lender before looking at other options. There may also be ripe opportunities for refinance.

The best method we’ve found to engage a client in this discussion is a clear comparison of:

Current State

vs.

Option 1 (e.g. Better Pricing From Current Lender)

vs.

Option(s) 2+ (e.g. Refinance With Alternative Lenders)

We would present these Options to clients (along with accurate costs including the net effect of all rates, fees and offers) using the Scenarios feature in BrokerEngine software:

4: Getting Lean & Efficient

In boom times, when clients are beating down your doors, it’s common to simply throw resources at the problem, rather than get bogged down in process re-engineering.

But as times get leaner, efficiency becomes even more important. What may have worked in the past as a loose or unstructure process, can now be tightened up to drive efficiency and greater output per team member.

If business efficiency is a priority, check out these further resources for systemising and scaling your processes:

- The Ideal Mortgage Broker Sales Process

- Mortgage Broker Loan Processing: The Complete Guide

- How To Systemise Your Mortgage Broking Practice

5: Diversify Your Offerings

More and more brokers are moving beyond one service line such as residential mortgages and starting to explore other ways to diversify their offerings.

Finding new clients is relatively hard: increasing your “share of wallet” of existing clients with additional offerings such as asset or commercial finance can be somewhat easier.

6: Revving Your Marketing Engine

“What’s the point of marketing when I’ve already got more deals than I can handle?”

This sentiment made total sense in boom times… but now that times are changing, consistent marketing is more important than ever for differentiating your firm, attracting new leads and fencing your “herd”. Some resources that may help in this regard are:

- Executing the Ultimate Mortgage Broker Marketing Plan

- Leveraging A Book To Grow Your Mortgage Business

- Deploying The 3 Layers Of Mortgage Broker Marketing Automation

Conclusion

Brokers who have been in the industry for multiple business cycles will recognise the current period as just another turn of the wheel.

Being proactive – with your clients, your systems and your business – will help to ensure the next couple of years will be your best ever.

And if you can thrive in leaner times… imagine what you can achieve when the good times return.

If you’re looking for ways to make your practice more efficient, proactive and client-centric, I invite you to check out the latest BrokerEngine demo.