As a mortgage broker, you’re a trusted advisor who has the power to help your client realise their financial and lifestyle dreams. But nothing happens until a sale is made.

And the way you structure your sales process has a huge effect on your outcomes. There’s much more to selling loan advice than just a collection of “sales closing techniques”.

Instead, the ideal mortgage broker sales process is the overall positioning, packaging and presentation of your expertise in a way that makes it easy for prospects to say “yes”.

I used to suck at selling. But by using the strategies and processes I cover in this article, I managed to get my presentation success rate up to about 95%. In other words, by the time I reached the presentation stage, 95% of prospects would accept my recommendations and become my client.

So let me start with what I see as the unique challenges of mortgage broker sales, before giving you practical sales advice and tips that you can take to the bank.

Challenges With The Mortgage Broker Sales Process

Selling loan solutions isn’t like selling “widgets”. Consider some of the sales challenges that many mortgage brokers face:

- You want to be helpful, but you don’t want to chew up valuable time on prospects who aren’t serious or aren’t ready.

- Some clients are ready to go now… others may be ready to go in future… and still others may never be ready to go. You need a way to deal appropriately with the first two buckets, without getting distracted the by the third bucket.

- It’s easy to do a lot of work for a prospect, only to find that they’ve gone with another broker or lender at the last minute.

- It has become popular to say “if the prospect won’t fill in a full fact find up front, they’re not serious – move on!”. And yet if you operate this way, you may be sacrificing a third to a half of your potential new business.

- You have to find a way to combine your advice with the need for heavy data collection, compliance and other “red tape” that can frustrate even the most well-meaning client.

There may be other sales process frustrations you face, but these are a good start.

Before we look at the Ideal Sales Process I recommend in a moment, let’s take a moment to consider how most brokers try to navigate the sales process, and why these solutions are often sub-optimal:

Common Sales Process Approaches, And Their Shortcomings

While every sales process varies in the details, there tend to be two extremes that are most common:

Approach 1: The Stalker: “Chase like crazy, on the merest whiff of a deal”

This method is most often used by newer brokers, those writing low volumes, or those with weak lead flow. (No shame in that – we were all there once).

The potential problems of this approach are many. Here are a few for starters:

- Lack of mutual engagement: just like in dating, when one party is doing all the chasing and the other party isn’t engaged, it either begins to look like stalking, or one party takes advantage of the other.

- There may indeed not be a deal: if there is no chance of doing a deal, time spent chasing is wasted.

- Lack of efficiency: too many appointments can easily take place in the name of “customer service”

- Maybe you’re not the only one: if a potential client is giving you the run-around, how many other brokers are they doing this with?

Many brokers mistake activity for results.

They believe that if they work hard and run around obsessively, they’ll win the client’s business. Sadly, often the reverse turns out to be true.

If the “Stalker” Approach isn’t optimal, then the polar opposite isn’t great either. I call this…

Approach 2: Playing Hard-To-Get: “Make ‘em jump through hoops”

On the other end of the continuum, there is “playing hard-to-get”.

With this approach, the broker makes the prospect ”prove they’re serious” before they’ll lift a finger.

One common method is to insist the prospect fills in a full fact find before the broker will meet or talk with a new prospect. “If they won’t do it, they’re not serious”… right?

Maybe, maybe not.

- It’s possible the prospect is not ready yet, but they may be a great client 6 months down the track. Around one third of the new clients in my broker group come from leads who were initially “not ready”. I’m glad I don’t send them elsewhere!

- It’s also possible that a new prospect doesn’t want to share too much up front with a broker they’ve not spoken to before. Step 1 is to generate rapport.

I’m not suggesting that you shouldn’t request any information from potential prospects – just that it can be counter-productive to demand too much too soon.

So if neither of these two extremes are optimal, what is the best way to structure your sales process? That’s what we’ll address in this article.

What’s Changed In 2025?

The first edition of this article came out in 2018. Since then a few things have changed, and we’ve updated this article accordingly. So what’s changed?

- The introduction of Best Interests Duty – and the need to combine great advice with heavy compliance burdens.

- Larger team sizes, with more specialisation and division of labour, because loan processing is more complicated than ever.

- Greater desire on the part of the client for a seamless customer experience, especially where document collection and communication are concerned.

Goals Of The Ideal Mortgage Broker Sales Process

While no sales process is perfect, the process I use and recommend is one that allows a broker to:

- Spend less time with unqualified prospects (zero is the goal).

- Close new clients with no more than two appointments (almost always remote, in my case).

- Achieve a 95%+ percent close rate in the second appointment, even from cold (non-referred) prospects.

- Stop prospects from shopping around and going with someone else after you’ve given them all your great ideas.

- Scale a successful sales process amongst every member of your firm (instead of just 1 or 2 “stars”).

- Deal with significantly more clients in less time, leading to more settlements and a bigger trail book.

Do these things sound appealing? Good. Then let’s take a look at:

The Ideal Mortgage Broker Sales Process: An Overview

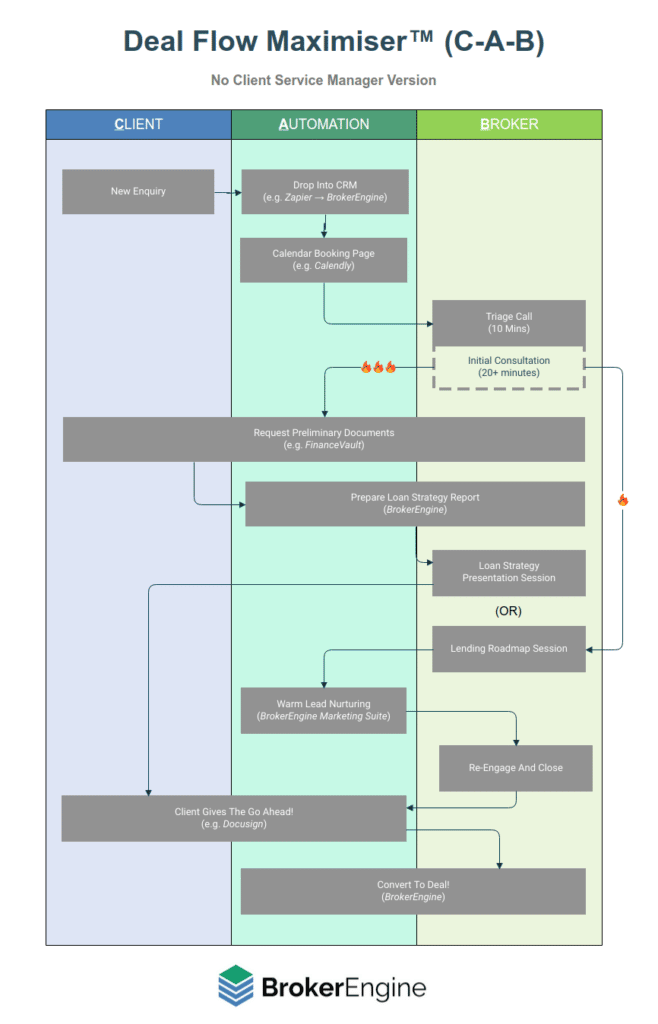

There are TWO Ideal Mortgage Broker Sales Process flowcharts I’d like to review. One where you don’t have a Client Service Manager (CSM) helping with the process, and the other where you do.

Sales Process Version 1: No Client Service Manager

In the first version below, the Client, Automation and Broker are involved in the sales process.

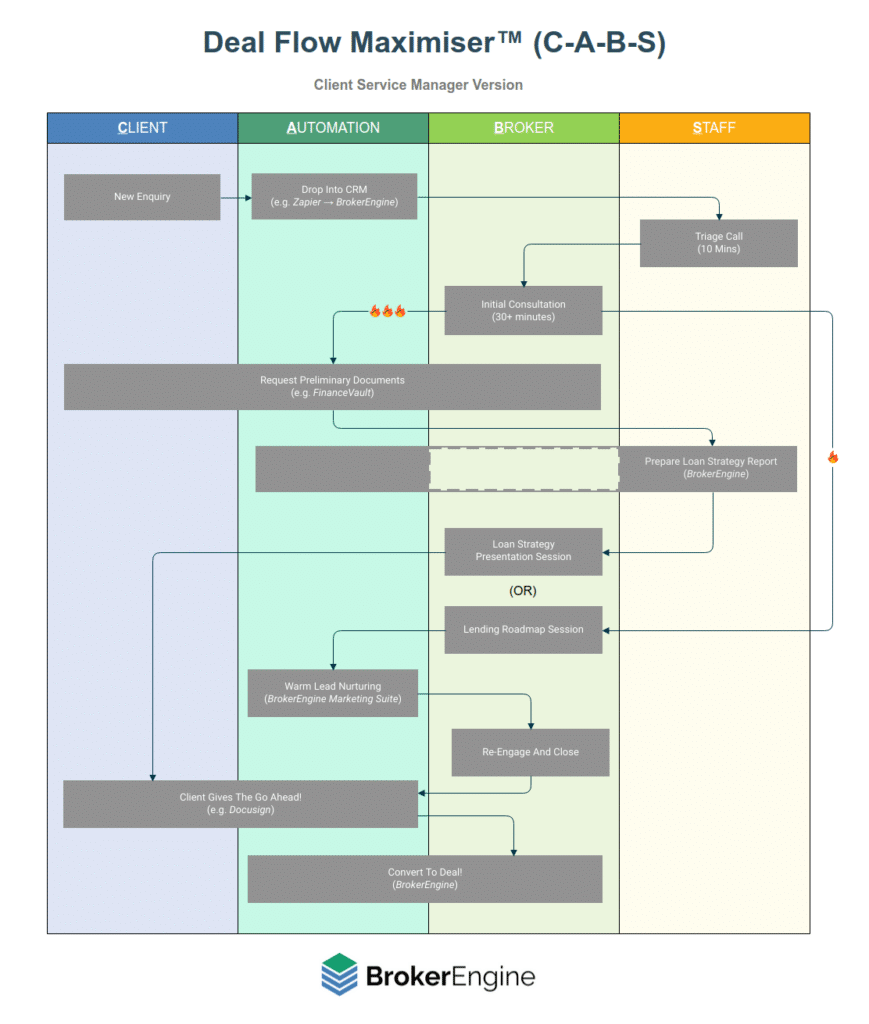

Sales Process Version 2: With Client Service Manager

In the second version, the Client, Automation and Broker combine with Staff to create a higher throughput sales process, where the broker is brought in exclusively for the sales and advice portions of the process.

The first thing you’ll notice is that, ideally, the broker doesn’t execute this process all on their own.

Instead, they leverage teamwork to deliver a faster and better outcome.

Here’s how the process unfolds – click on any of the links below to jump down to the relevant section:

- New Enquiry

- Lead Qualification

- Initial Consultation

- Loan Strategy Report™️ Preparation

- Loan Strategy Report™️ Presentation

- Client Gives The Go-Ahead

- Convert To Deal!

I use BrokerEngine as my Broker Management Platform, so some of the concepts in this article will be illustrated with examples that use BrokerEngine.

However, the process is broadly applicable to any broker. So let’s dive in and start with a…

1. New Enquiry

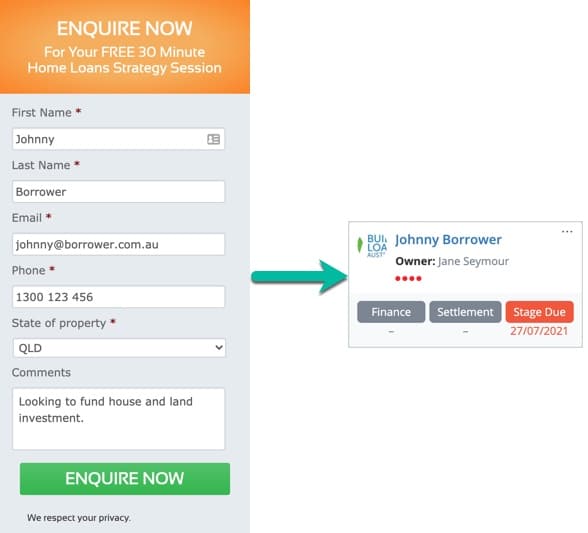

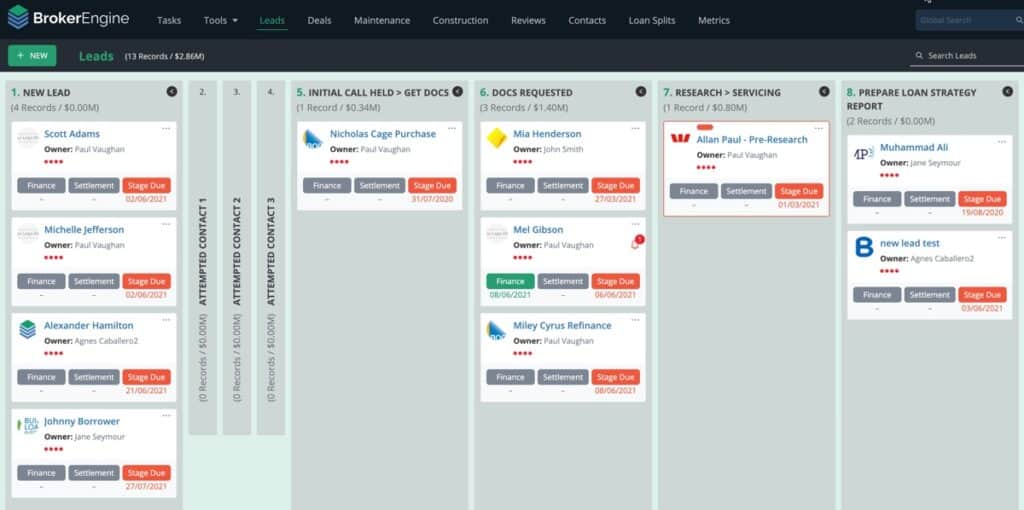

I execute my marketing according to this mortgage broker marketing plan. I also use a lot of different lead generation methods. New leads generated by my website(s) are dropped straight into BrokerEngine:

Sometimes leads might arrive via other methods (for example, a phone call from a referred client).

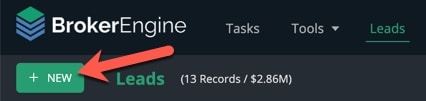

In that case, my assistant will simply hit the “New Lead” button on the BrokerEngine Leads dashboard, then proceed with the qualification script below.

2. Lead Qualification

When leads drop into our system, I have my Client Service Manager (CSM) attempt to contact the lead as soon as possible.

By “as soon as possible”, I mean VERY quickly. Research on lead management best practices suggests that the optimal timeframe for a lead callback is 5 MINUTES.

Anything slower and you start to lose business.

Advice For Sole Brokers Who Don’t Have An Assistant

What if you’re a sole broker and/or you don’t have an administrator who can contact leads on your behalf? Then you can do this initial callback yourself. Ideally, having an assistant do the call is better though, because if you follow our lead generation and loan processing advice, you’ll be sitting in front of clients all day and you won’t have time to call back!

On this initial call, the CSM will first establish rapport.

This is as simple as using a bright and positive tone, asking how the prospect’s day is going, and making a bit of “small talk” before leading into the qualification questions below.

Rather than go straight into these questions, the CSM should first ask permission:

“So I know the best person to put you in touch with at this end, do you mind if I ask you a few questions about where you’re currently at with your purchase?”

Having received permission, they continue with the following…

Mortgage Sales Qualification Questions

- What are you looking to do? Make a purchase? Refinance?

- What is the purchase price?

- What deposit do you have?

- What are your approximate income, expenses and liabilities? (to punch into a quick service calculator)

- What’s your occupation (and/or Visa Status, for migrant lending)

- Have you ever had any bad credit history or defaults?

You may wish to adapt the qualification questions for your situation. Not everyone will want to ask about visa status, for example. But the above should be a useful starting point.

The flow of questions may also change if the prospect is looking to refinance rather than purchase.

If appropriate responses are received to the qualification questions, the CSM books the prospect in for an Initial Consultation with me or one of my brokers.

In this way, we can efficiently filter out the leads into the following buckets:

- Looking to do something now

- Looking to do something later

- Not likely to be able to do anything

Buckets 1 and 2 go through to a broker. This ensures that the broker is not wasting time with leads who are unlikely to be able to transact, now or in the future.

OK, now that the prospect has been booked in for the Initial Discussion, we’re now ready to hold the…

3. Initial Appointment

I do all my Initial Appointments (and indeed my entire sales process) remotely via Phone, Skype or Zoom meeting.

This means I save a heap of traveling time and can be much more efficient in my sales process.

Some brokers believe they must be face to face in order to sell successfully – my experience has been that a remote process can work very well indeed.

If you do meet with clients in person, then the same broad structure below can be used with no problems.

3.1 Initial Sales Appointment Structure

The end goal of the Initial Appointment is to gain agreement to prepare loan recommendations in the form of a Loan Strategy Report™️.

To support this process, I open up the Proposals feature in BrokerEngine, which automates the process of producing the recommendation document itself.

Here’s an outline of the sales call structure I use:

- Rapport: start the call with small talk / breaking the ice. This is an important step to set a relaxed tone. If you miss this, the call tends to flow less smoothly.

- Set the frame: I explain the structure of the call and the value the prospect will get out of the call.

- Clarify Goals: I seek to understand what the prospect is trying to achieve, and importantly WHY they are trying to achieve it. Typical questions include:

- “What” Goals

- What are you looking to do?

- Investment or Owner Occupied?

- Where are you in the purchase process?

- What are your future investment goals?

- Fixed or variable?

- Rent in future?

- Who do you bank with?

- (Optional) Do you have a household budget? (if yes, implies prospect tends to be disciplined with money management)

- (Optional) What are your plans to pay your mortgage off? (accelerated or standard pace)

- (Optional) How long do you plan living in this home? Stepping stone or dream home?

- “Why” Goals – in my experience, understanding the WHY behind the prospect’s goals is the most important step in creating a real connection with the prospect, AND being well place to provide the right advice. Example questions include:

- “What’s your motivation to <XYZ>?”

- “What’s important about that?”

- E.g. property is a good asset, I don’t want to pay off someone else’s mortgage etc.

- Do you want to build a property portfolio? (e.g. could home be a future rental property?)

- “What” Goals

- Facts, figures and financials

- I use a transition phrase like, “Just to ensure I’m working with the right numbers, can I ask you a few questions about your current position… “

- Get income, expenses, assets, liabilities

- I punch these numbers into a servicing calculator

- Next Steps

- Assuming the prospect is likely to qualify for a loan, I say something like:

“From what you say, I understand you’re looking to <A, B and C> so you can <Rephrase Key Motivation>. As the next step, I’m going to go away and prepare your Loan Strategy Report™️. It’s going lay out the framework for your next purchase. We’ll go through the deposit required, what banks will lend to you based on policy, what rates and features may be most appropriate, and how to structure your loan(s) to be most flexible and cost effective.”

- Unless a Contract Of Sale is in place, I am happy for the prospect to wait a few days or so for the Loan Strategy Report™️ to be produced and delivered. I’ve found that a more considered approach is more effective than trying to quickly close a prospect based on incomplete or hastily-gathered information.

- Finally, I lock in a time and date for the Loan Strategy Presentation.

- Assuming the prospect is likely to qualify for a loan, I say something like:

At the same time as doing the above fact find, I’m making in within BrokerEngine.

After getting off the call, I usually take 10 to 15 minutes to generate the proposal document using BrokerEngine software. In other words, I:

- Tidy up my notes

- Build one or more Funding Positions within BrokerEngine based on the scenario(s) the prospect may be considering

- Select appropriate 1-Click Workflows (i.e. special features of the Deal such as FHOG, Guarantors, Visa Status, Borrower Living Overseas plus dozens of other options) which may impact my recommendations and affect the downstream automation and workflows within BrokerEngine.

- Select lenders and products to compare

- Finalise my loan recommendation

BrokerEngine then shoots off a brief to my support team, who start compiling the Loan Strategy Report™️ in a very specific format (which you’ll find below).

If the sales opportunity is high quality and “ready to go”, I also trigger one other very important step…

3.1 Dispatch A “Shock And Awe Pack”

Prior to delivering my Loan Strategy Recommendations in Step 5, we dispatch what we call a “Shock and Awe Pack” to the prospect’s mailing address.

This is a Big Folder of valuable information that arrives at the prospect’s doorstep before we convene for our next meeting.

My Shock and Awe Pack Contains:

- A big cover folder

- A copy of my mortgage broker book (which is also available to other brokers to “Private Label” and republish under your own name)

- A copy of my latest print newsletter (produced 6 times per year)

- A client Case Study booklet

- A copy of sample property contracts with helpful markup and notes

- A Fridge Magnet

- 2 x Business Cards

- A Greeting card in an envelope

- A Freddo frog

The purpose of this Pack is not only to educate and inform the prospect with valuable information, but to build authority and trust at the same time.

If the prospect is talking to a few brokers, how many other brokers do you think will send a pack like this?

That’s right: zero (unless they’ve read this blog post too 😉 )

Thanks to this process, I will almost always be the “front runner” by the time I present loan options to the client.

What if the prospect isn’t ready.. yet?

It may be the case that the prospect isn’t ready to go ahead yet. There are four scenarios that might apply. I categorise these as A, B, C and D prospects:

“A” Grade Prospects:

Definition: an “A” grade prospect is:

- Ready to go now

- Good fit

- Buying/refinancing now

- But hasn’t confirmed their interest in a Loan Strategy Presentation for whatever reason

For these prospects, I would:

- Send the full Shock and Awe pack EXPRESS POST

- Add them to my PRINT newsletter marketing list so they get my bi-monthly newsletter, and RBA updates

- Set a task to follow them up at an appropriate time

“B” Grade Prospects:

Definition: a “B” grade prospect is:

- Good fit

- I want to work with them

- But, they’re not ready to go for up to 6 months due to some OBVIOUS reason e.g. policy. Maybe they need to wait 3 months until off probation, or are 10K short on savings

For these prospects, I would:

- Send the full Shock and Awe pack regular post

- Add them to my PRINT newsletter marketing list so they get my bi-monthly newsletter, and RBA updates

- Set a task to follow them up at an appropriate time

“C” Grade Prospects:

Definition: a “C” grade prospect is:

- May or may not be a deal

- Doubtful whether a good fit for our brokerage

- Might qualify but would not be motivated to assist them

For these prospects, I would either close the opportunity, OR:

- Add them to my email RBA update list

“D” Grade Prospects:

Definition: a “D” grade prospect is:

- Unlikely to qualify or

- Clearly not a fit for our brokerage

For these prospects, I would simply close the opportunity.

When the prospect is ready to move forward with the process, the next step is…

4. Loan Strategy Report™️ Preparation

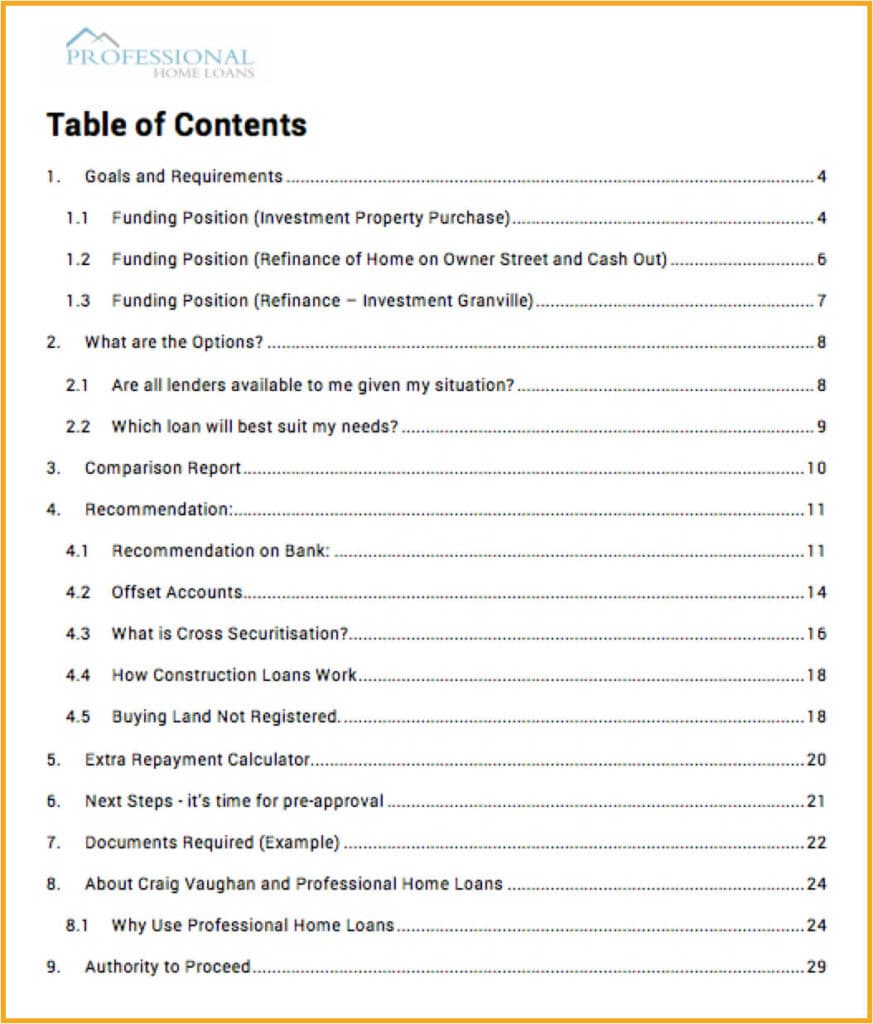

The Loan Strategy Report™️ (or LSR for short) is the “loan recommendation proposal document” that I walk through with prospects before they make a decision to go ahead.

The document itself is approximately 25-pages long, automatically generated by BrokerEngine software and support team.

Creating a very comprehensive document like this creates the illusion I’ve spent dozens of hours researching the prospect’s exact situation and drafting up a super-customised report.

In reality, all it takes is 15 minutes of my time, thanks to the custom loan proposal generator within BrokerEngine.

Here’s an example Table of Contents of what the Loan Strategy Report™️ covers. (NOTE: The exact contents will change based on the type of loan and/or features appropriate for each client.)

Once the LSR has been prepared behind the scenes, I’m ready for the next step:

5. Loan Strategy Report™️ Presentation

The Loan Strategy Report™️ Presentation stage is designed to walk the prospect through an analysis of their situation, an explanation of loan options, and an eventual recommendation.

Whether you use our Loan Strategy Report™️ structure, or your own loan advice document, the idea is to step the prospect through your thought process toward the logical conclusion: proceeding with your recommendations.

One of the key requirements of the Report is to restate to the client what they are trying to achieve (based on the information collected in the initial consultation).

Then, I want to seek confirmation that this is still accurate and nothing has been missed. The response you want from the client when you get to the end of the Goals and Requirements section is “that’s exactly what we want” (or words to that effect).

Then I respond:

“That’s good to hear. It’s important to capture this properly, because now I put myself into your shoes and think about what I would do if I were you…”

This allows the prospect’s overall situation and context to be brought to the forefront.

It also tends to take the focus off rate and allows me to position my service based on policy, features, structure etc.

As you can see from the Table of Contents above, the Loan Strategy Report™️ is broken down into a series of sections that flow easily into each other.

The aim isn’t to cover off every section of the Report in detail with the client right there on the call.

However, what I will do is cover off the options and recommendations and clarify any immediate questions that come up.

There’s nothing jarring. It all flows. And at the end, it’s much easier for the prospect to say “yes” than it is for them to do anything else.

Once I get to the end, I simply say:

“I’ll send this document through to you via email. Once you’ve happy to go ahead, simply e-sign the document and we’ll put this plan into action for you.”

Then I move the Deal Stage within BrokerEngine to trigger a copy of the Loan Strategy Report™️ to be sent to the client via Docusign.

6. Client Gives The Go-Ahead

Getting the customer to e-Sign the Loan Strategy Report™️ is an important step because it cements a level of commitment from the client.

Once the recommendation is e-signed, the client will stop shopping around for options (if they haven’t already done so).

You have now become “their broker”.

If for any reason the client doesn’t e-Sign the Loan Strategy Report™️ document, we send an email and SMS two days later to check in.

But generally, if everything has been done right up until this stage, the recommendation will be rubber stamped by the client on the spot.

Now, the deal is on!

7. Convert To Deal!

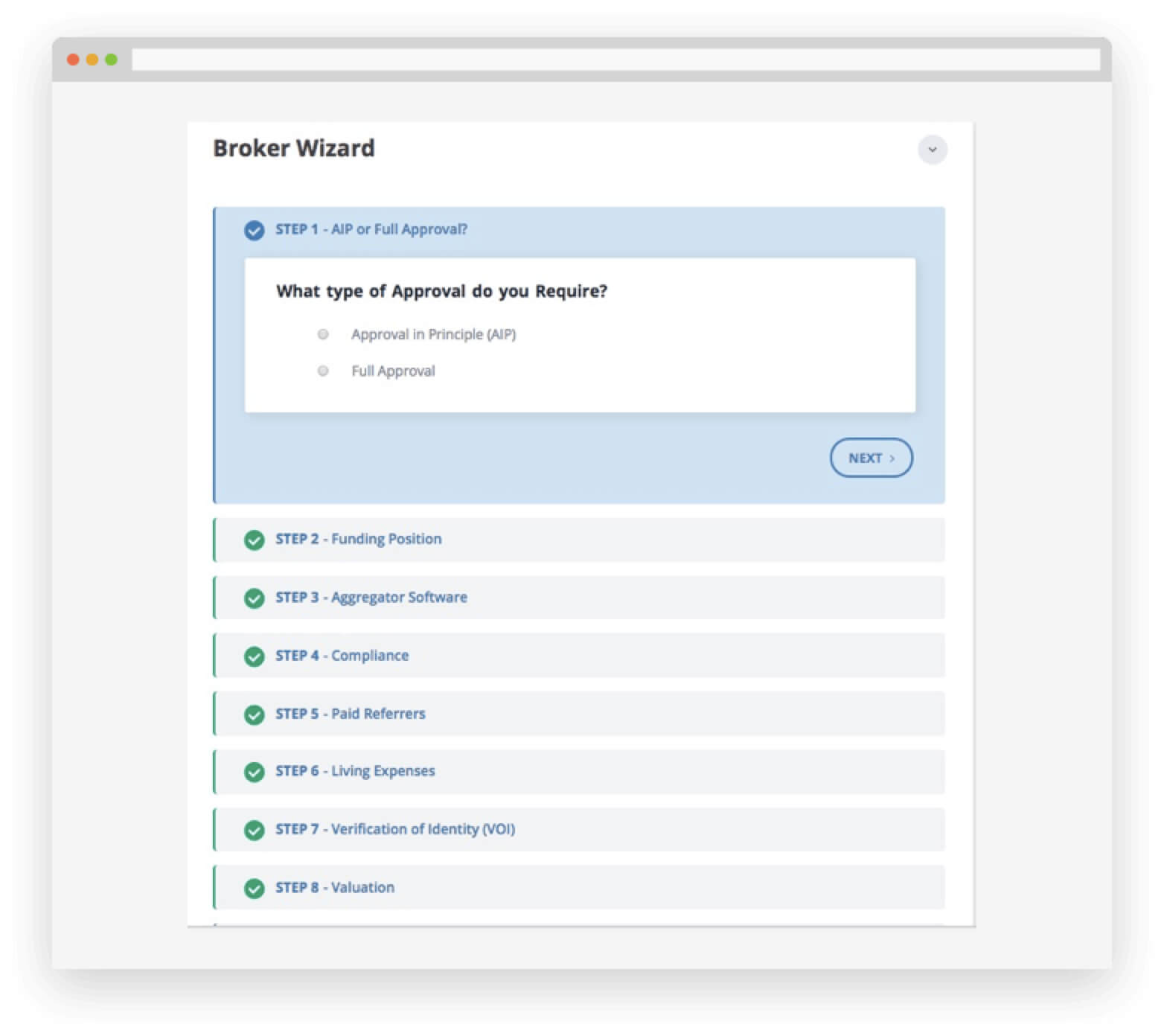

Much of the hard work has in fact been done already. Once the client gives their go-ahead, I click the “Convert To Deal” button within BrokerEngine and complete another automated workflow called the Broker Wizard.

The Broker Wizard provides everything else my back office team will require to proceed with loan processing, including application, submission, approval, tracking and settlement.

Delegating to my team via the Broker Wizard usually takes around 15 more minutes. Then the deal is in the hand of my team, and I’m off to write another deal.

In Conclusion

My own mortgage broking practice is now “referral and existing client only”. However, prior to that I used to sell to cold prospects using this sales method. The brokers in my broker group still use this exact approach with cold prospects.

My close rate using this process for cold prospects who book in for the Loan Strategy Presentation is at least 19 out of 20 (95%).

This is much higher than my close rate when I started out in broking. Now it means I’m able to write more loans in fewer hours.

I’ve also taught the same process to other brokers in my group (and in other broker groups), enabling them to get similar results.

And, by bringing a Client Service Manager in to assist, broker time can be further leveraged to focus only on sales, strategy and advice.

This is a critical point if you’re looking to scale your practice. It’s no good being a superstar broker if you don’t have good people around you to help leverage your time and skills.

I hope you’ll apply some of the concepts in this article to boost your sales and client acquisition results in your practice. And if you want to automate and streamline many of the processes we’ve covered in this article, make sure you check out the latest demo of BrokerEngine software.