I started in broking in 2007. By 2015 I was settling enough volume to be in the top handful of brokers in Queensland, while working very moderate hours as a broker. (You can read my full story here.)

The truth is, I should have hit this level a lot faster, but I didn’t know the first thing about standing out, attracting clients, or building a resilient, profitable practice.

A lot has changed since then, but what it takes to grow and succeed mostly hasn’t.

As a thought experiment, here’s how I’d structure a mortgage brokerage today, if I had to start again from scratch…

What I Would Set Out To Build

Success means different things to different people. First of all, I’d get really clear on the type of practice I wanted to build.

Maybe you’d like to be a solo lifestyle broker who travels the world and writes loans in your down time. Or perhaps you have ambitions to launch offices in every city. Or likely, it’s somewhere in between.

Personally, I’d shoot for a balance of…

- Healthy financial returns: If I’m going to put in the hard work, I want to be compensated.

- Simple team structure: I want a small group of A-players who get the job done, without headaches.

- Freedom & lifestyle: The business should not depend entirely on my individual efforts. I’d like the flexibility to take leave.

With that in mind, my goal would be to settle ~$150M/year in loans with a team of 5 people (1 broker + 1 Parabroker + 1 CSM + 2 loan processors) in the next three years.

Pre-empting Sticking Points (and Solving For Them)

Next, I’d list the common challenges faced by mortgage brokers. I’d seek to avoid these sticking points or, better yet, convert them into opportunities.

Here are some common challenges that I see brokers facing today:

- It’s hard to stand out in the marketplace.

- It’s hard to attract new clients.

- It’s hard to get potential clients to trust you.

- It’s hard to find and retain good people.

- Too much time is spent on admin and compliance.

- It’s hard managing and aligning teams (especially remote ones).

- Practices are highly key-person dependent.

Engineering For Success

Then I’d work through each of these 7 challenges and design my business model from the ground up to hopefully avoid as many pitfalls as possible.

1. How I’d stand out in the marketplace

In a digital-first world, brokers are effectively competing against every other broker with a website.

My solution? Choose an under-serviced niche that I can serve exceptionally well, and make it really clear why I’m the best choice for that specific audience by crafting a compelling Unique Value Proposition.

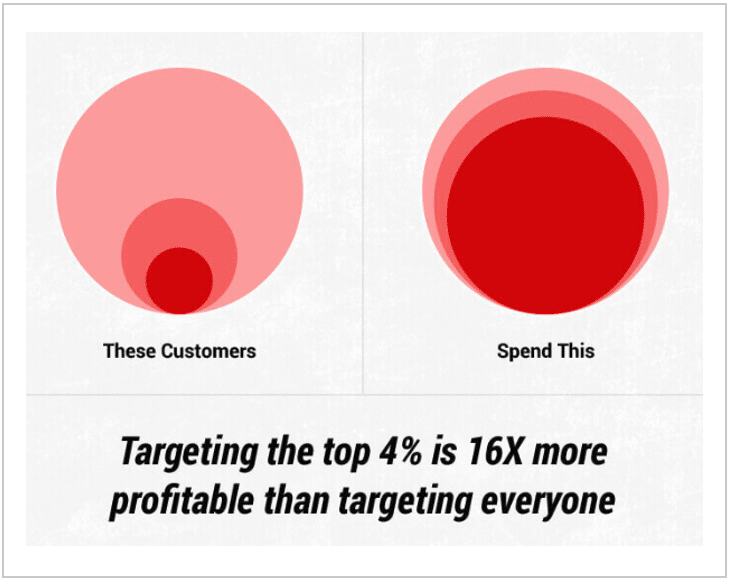

While focusing on a niche may seem limiting, remember that a small segment of the market often accounts for your most profitable clients. Targeting your “AA-grade” prospects can lead to greater success (and fewer headaches).

This approach served me well with my other brands: MAP Home Loans (for expats), Building Loans Australia (for home builders), and Professional Home Loans (for doctors and high-income professionals).

2. How I’d attract new clients

I feel for brokers who go out on their own without a plan for acquiring clients.

You quickly realise that prospects don’t just queue up at your door the moment you launch a website.

Our Mortgage Broker Marketing Plan outlines how I’d think about marketing strategy, traffic, conversion, nurturing and reporting. However, there are two key points I’d like to emphasise:

- Niche and value proposition determines 80% of your success

When you know exactly who your ideal customer is and how you uniquely help them, client acquisition becomes significantly easier.

For instance, when we ran Facebook Ads for MAP Home Loans, rather than trying to speak to anyone interested in a home loan, we only targeted expats living in Australia. That meant 100% of our budget was allocated to the small segment of the market we knew we could serve well. It also allowed us to use messaging that was far more compelling than a generalist. - Don’t discount the importance of simple initiatives

It’s easy to get caught up with fancy bells and whistles. But it’s the simple things that will move the needle from zero to one. Here are 7 simple tactics I’d use to get my first ten deals:- Tell everyone in my personal network what I’m doing and ask them if they need help.

- Launch a one-page website that clearly explains who I can help and why.

- Grow my newsletter list to 50 subscribers (start with friends, family and colleagues and LinkedIn posts).

- Start sending a monthly email newsletter (yes, even if it’s just an RBA update to begin with).

- Create a free Google Business Profile.

- Get 10 reviews on my Google Business Profile (again, I’d start by asking friends and family).

- Over-deliver and delight clients, then I’d ask for referrals and testimonials every time.

Once I had some initial traction, I’d look to build out a more sophisticated web presence with educational resources, landing pages and nurturing sequences.

I’d use Facebook/Instagram Ads as my initial go-to for driving traffic while laying the groundwork for a long-term SEO strategy aimed at securing “free” organic traffic.

Google Ads can be effective, but they tend to come with higher costs, so I’d experiment with this to see if the cost per lead was sustainable. And, when the time is right, I’d explore other platforms like YouTube, Microsoft Ads, and TikTok to diversify my traffic sources.

3. How I’d get potential clients to trust me

Establishing trust is more crucial and challenging than ever, particularly when first interactions are online.

Imagine you walk into a doctor’s clinic: everything signals trustworthiness. A pristine environment, a smooth check-in process, and the doctor’s professional attire and demeanour.

Similarly, my goal is to convey trust in every facet of what we do: our website, our phone greeting, our email signatures, our email invites, etc. Everything should convey trustworthiness.

This can be broken into four dimensions: Responsiveness, Expertise, Structure and Rapport:

| DIMENSION | Responsiveness | Expertise | Structure | Rapport |

|---|---|---|---|---|

| Lead Management | Contact new leads within 5 minutes. Persistent lead follow up. | Quickly disqualify prospects I can’t help. Seek to genuinely understand the client’s situation. Share how we’ve helped similar clients. | Lead flows directly into BrokerEngine. Client Service Manager (CSM) calls immediately. Defined process for new leads Professional meeting invite with clear agenda. | Follow the F.O.R.D. method when interacting with clients. |

| Sales Process | Show up on time, every time. Promptly reply to prospect queries (even if it’s just to acknowledge receipt). If you promise to get back to the client, do it promptly. | Ensure clients understand recommendations prior to proceeding. Present recommendations ina professional Loan Strategy Report. | Simple, structured document collection via FinanceVault. Every meeting with a clear desired outcome, agenda and schedule. Systematic follow up. Book a meeting from a meeting (BAMFAM). | Send “Shock ’n’ Awe” pack via post. Stay energised and excited. Actively listen for concerns. And address these as a trusted advisor. |

| Submission to Settlement | Pre-empt questions. Answer them before they’re asked. Don’t let response times slip before the finish line. | Pre-empt complications and get ahead of them. Set clear expectations. | Use checklists and processes to ensure all requirements are satisfied. Overcommunicate next steps and timelines. Never leave the client guessing. Don’t have to shoot the lights out, just don’t screw it up! | Send settlement gifts. Genuine excitement for the client’s outcome! |

| Post Settlement | Maintain service standards after the deal is done Keep clients informed about the status of their referrals. | Explain “what next”. Position yourself as an ongoing part of their finance and wealth journey. | Structured process for testimonial requests. NPS/Client Satisfaction surveys. Periodic loan / pricing reviews. | Ongoing communication e.g. newsletters. “Good news stories” e.g. repricing wins. |

4. How I’d find and retain good people

As an independent broker, attracting and retaining top talent can be difficult, especially when competing with larger firms that offer more visibility and seemingly more opportunities.

Having run a remote team well before it was fashionable, here are some of the mistakes I learnt the hard way (and what I’d do instead this time around):

| Hiring Mistake | What To Do Instead |

| Hiring the most complex roles first (e.g. parabroking) | Start delegating the least complex work first (e.g. data entry) |

| Throwing people at the problem, without having the processes in place to support them. | Get strong mortgage broking systems in place first so the team has a roadmap to follow. |

| Hiring specialists too quickly. | Hire generalists first and bake in redundancy |

| Not having the right performance metrics in place. | Monitor leading and lagging metrics for each team member every week. |

| Not setting aside time for training and feedback. | Establish a regular meeting rhythm to share feedback. |

If I were starting from scratch tomorrow, I’d build another remote team for a few reasons:

- It allows you to cast a wider net for finding A-players. Recruiting an exceptional Client Service Manager (CSM) is tough at the best of times, let alone if you’re not in a capital city and have a smaller candidate pool.

- Many prospective employees see remote work as an attractive benefit. Anything you can do to differentiate your role from other practices is a good thing.

- Physical offices require a large fixed cost that often doesn’t deliver a proportionate upside. Saving OpEx is especially important when starting from scratch.

Many practices expand their capacity by adding more brokers. I’d do the opposite. My priority would be to hire support staff and delegate the process-driven support work first.

Think about this in terms of building business units i.e. collections or people and processes that maximise the utilisation of our most expensive resources i.e. the broker.

While the following hiring plan would be a little larger than my goal, my recommended order of hiring goes something like this:

| Hire No. | Role | Cost | Capacity Added | Tasks Delegated |

|---|---|---|---|---|

| Hire #1 | Offshore Virtual Assistant (VA) #1 | ~$2K/mth | ~$2M/mth | Delegate lower hourly rate work |

| Hire #2 | Offshore VA #2 | ~$2K/mth | ~$1.5M/mth | Add redundancy |

| Hire #3 | Offshore VA #3 | ~$2K/mth | ~$1.5M/mth | More redundancy, capacity, and specialisation |

| Hire #4 | Onshore Customer Service Manager (CSM) | ~$6K/mth | ~$2M-$3M/mth | Some client facing tasks and general business management (lead generation, appointment setting, client updates/reviews, troubleshooting) |

| Hire #5 | Onshore Parabroker | ~$7K/mth | ~$3M/mth | Product selection and technical tasks including structuring |

| Hire #6 | Onshore Broker | ~$8K/mth (variable) | ~$3M/mth minimum | A new business unit |

5. How I’d spend less time on admin and compliance

When I first hit $20-$25 million a year back in 2010, I was putting in far too many hours, and following no system. My first 3 years in mortgage broking were almost a complete waste, because I didn’t have any method of keeping in touch with clients.

My stress levels were constantly red-lining. I was always fearful that something had been missed on a deal, or that it would go south at the last moment. And I hardly took any extended holidays, because I was afraid the wheels would fall off.

Needless to say, I’d do things differently this time around. Here’s how I’d think about admin and compliance:

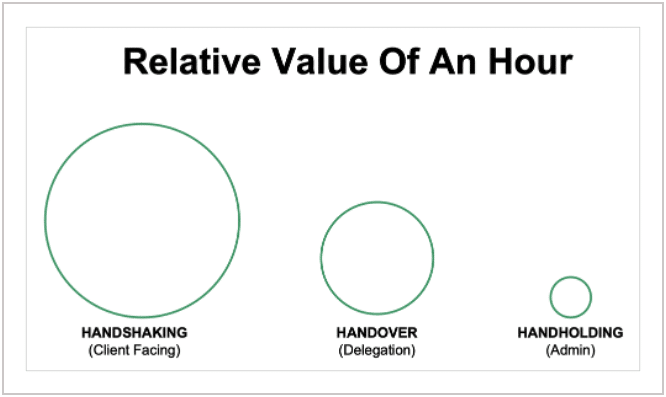

i. Every minute I spend on admin costs me money

My goal is to build a systems-led practice where I can focus on my highest and best use.

This is what led me to creating BrokerEngine software in the first place. Excuse the shameless plug, but yes, I would use BrokerEngine from day one. That way I could save myself the stress of managing everything with spreadsheets and whiteboards, and hoping nothing slipped through the cracks.

I’d approach admin and compliance with this hierarchy in mind:

- Eliminate anything that doesn’t add value.

- Automate what can be done without human intervention (See: 3 Layers of Mortgage Automation).

- Delegate what can be done by others.

- Templatise the commonalities between tasks.

- Do what remains.

I held on to a lot of unnecessary admin jobs back in the day. Now I see that for what it was: fear, self-importance and laziness. Today, I’d ruthlessly guard my time and challenge myself to find creative solutions to getting as much off my to-do list as possible, so I could focus on the bigger picture.

ii. Every minute I spend on selling or strategising earns me money

Your time is the most scarce and precious resource in your practice.

Spending time on admin is like Elon Musk sweeping the floors of the Tesla factory.

Time per hour when selling or strategising = $$$$

Time per hour when broking = $$$

Time per hour when doing admin = $

I’d employ systems like our Ideal Mortgage Broker Sales Process and Loan Processing Best Practices, so I could focus on my highest and best use (i.e. selling and strategising with clients).

iii. Every minute I spend on systems multiplies my earnings

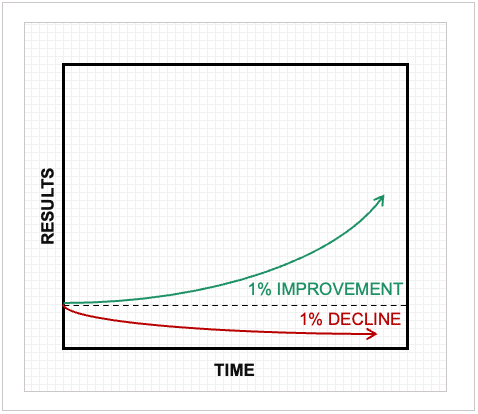

I’d build my practice around the principle of Kaizen: the Japanese practice of continual improvement or change for the better.

This philosophy suggests that enhancing productivity is an incremental and systematic journey that is owned by all members of an organisation.

As BrokerEngine users have demonstrated time and again, strong workflow logic can do the job of a $100K per year operations manager.

I’d hire team members who can demonstrate their ability to follow processes and enhance our workflows, rather than viewing every situation as special or unique.

Naturally, the book “Work The System” by Sam Carpenter would be required reading.

As we see in the chart above, a practice that adopts a systems mindset and a philosophy of continuous improvement, reaps exponential results.

6. How I’d manage my remote teams

The shift towards remote work has accelerated, and I’m all for it.

All of my broking brands have utilised remote models, so this isn’t new to me. But it does present some unique challenges in maintaining team cohesion, communication, and productivity.

For many brokers, remote work is great until it isn’t. Then it has the potential to collapse in spectacular fashion. Our job as business owners is to get ahead of these issues before they occur using:

- Clear Roles and Responsibilities:

Firstly, it’s essential to have clear job descriptions for all team members. This clarity helps in setting expectations right from the start and ensures that everyone knows their role and how it contributes to the broader objectives of the practice. - Collaboration and Visibility Tools:

Smooth collaboration and visibility across the team is crucial. BrokerEngine would be my real-time dashboard for monitoring tasks and progress, ensuring that everyone is aligned and accountable.

Other tools like Slack or Microsoft Teams for communication and Google Workspace for shared documents would also be critical. (For more, check out our Top 41 Mortgage Broker Productivity Tools.) - Regular Meeting Rhythm:

Regular check-ins are vital in a remote setting to ensure everyone is on the same page. I’d follow this cadence:- A Daily team Work-In-Progress (WIP) meeting, allows for quick updates, identifying any roadblocks, and fostering a sense of team unity. Held via Zoom/Teams or similar.

- A Weekly team meeting focused on key performance metrics, using a Precision Scorecard, would help in tracking progress towards goals and maintaining strategic focus.

- Monthly one-on-one meetings with team members to discuss KPIs, opportunities and challenges. Plus general rapport building, temperature check, etc..

- Quarterly team meetings to “zoom out” and monitor performance against strategic goals and organisational KPIs. Ideally held in person and offsite where possible.

- Annual meetings/team events to celebrate organisational wins – again, ideally held in person and offsite.

One of the biggest challenges with remote teams is maintaining a strong company culture and a sense of belonging.

Regular in-person catch-ups, as frequently as logistics and circumstances allow, help in building relationships and reinforcing the company’s mission, vision, and values.

For overseas teams, this might be once a year (or more frequently with other team members based in the same country), but for local teams, more frequent gatherings, like quarterly or monthly, would be beneficial.

7. How I’d ensure the business wasn’t key-person dependent

Many practices suffer from key-person dependency, where the absence of a single individual can disrupt operations, risking client satisfaction and business continuity.

I don’t know about you, but I’d like to take a holiday at some point. So I’d set out to create a practice where I could confidently take an extended break.

- Branding and Practice Positioning:

Understanding your long-term vision is crucial. Whether you’re passionate about the day-to-day brokering and wish to continue in that role indefinitely, or you aim to build a self-sustaining business, your branding should align with your end goal.

i.e if you call your business “Jane Doe Mortgage Broking”, you’re attaching your name to the business forever. Compare this with “ACME Brokers” — where your name is left out.

Your branding, be it “Jane Doe, Your Local Friendly Mortgage Broker” or “ACME Brokers, Your Team of Friendly Mortgage Brokers,” should reflect this vision.

I prefer the latter approach. - Systems and Processes:

When I started MAP Home Loans all those years ago, I was too stressed to take a holiday. I felt like if I took a break, everything would grind to a halt or fall apart. (And I was probably right.)

Essentially, I had built myself a job, not a business—a trap many fall into, as highlighted in “The E-Myth” by Michael E. Gerber.

Transitioning to a systems-led business not only alleviates this stress but also ensures continuity. This transition requires:- Dual Roles for Redundancy: As budget permits, aim to hire at least two people for each role (e.g., two VAs). This approach not only provides redundancy but also facilitates internal support and training, enhancing your team’s resilience.

- Cross-Training and Upskilling: Encourage and prioritise cross-training and upskilling within your team. For example, your Parabroker and Client Service Manager might be cross-trained in each other’s roles, so both can take a holiday occasionally!

- Continuous Recruitment: Adopt a mindset of always being in recruitment mode, not just when a vacancy arises. This is particularly crucial for sourcing A-players.

- Dual Roles for Redundancy: As budget permits, aim to hire at least two people for each role (e.g., two VAs). This approach not only provides redundancy but also facilitates internal support and training, enhancing your team’s resilience.

Conclusion and Next Steps

This post contains all the lessons from the past ~15 years in broking. I hope you’ll adopt some of these ideas and hopefully save yourself from many of the mistakes I made along the way!

Also please consider checking out the latest demo of BrokerEngine to see how it can systemise your operations, increase accountability, and support your growth ambitions.